Every single December, as we approach the holidays, I hear the same dangerous phrase from business owners regarding their year-end bookkeeping. Specifically, they tell me: “I’m too busy right now. I’ll just clean up the books in January.”

Let’s be honest. That isn’t a strategy; it is a procrastination trap. Unfortunately, this mindset is likely costing you thousands of dollars. Waiting until tax season to address your year-end bookkeeping is exactly how missed deductions, massive tax surprises, and cash flow crises happen. When you rush the process in January, you aren’t strategizing—you are just trying to survive compliance.

Year-End Bookkeeping: Stop The “I’ll Do it Later” Trap

Procrastination is the enemy of profit.

The Reality Check: Fundamentally, messy books mean messy taxes. If you wait until the last minute, you will almost certainly miss deductions. Therefore, acting now on your year-end bookkeeping is the only way to guarantee you keep more of what you earned.

Listen on The Deep Dive — where we dig deeper into this topic:

‘The High Cost of Bookkeeping Procrastination’

Why Accurate Year-End Bookkeeping Matters

First, if you want to protect your profit, you need to perform critical checks right now. Specifically, ignoring these steps leaves you vulnerable to four major risks.

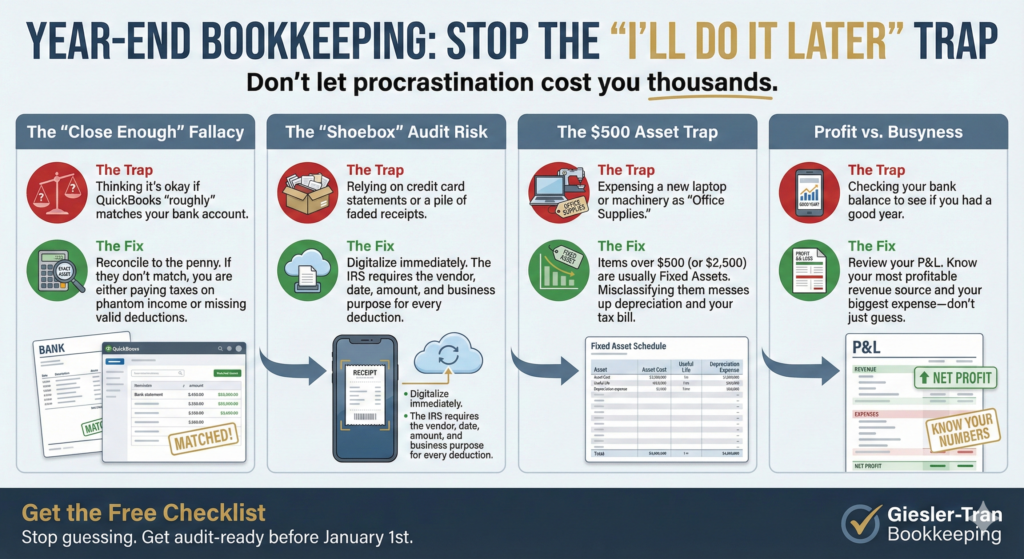

1. The “Close Enough” Fallacy

Crucially, your bank accounts must match your QuickBooks balance to the penny. Not “close enough,” and certainly not “it reconciled in June so it’s probably fine.” If your ending balance in QuickBooks does not match your actual bank statement, your Profit & Loss statement is effectively lying to you.

- The Risk: You are likely double-counting income (paying taxes on money you didn’t make) or missing expenses (paying taxes on money you spent).

- The Fix: Verify that your cleared dates, transfers, and ending balances align perfectly. If they don’t, stop everything and find the discrepancy immediately.

2. The “Shoebox” Audit Risk

Next, ask yourself: If the IRS audited you tomorrow, could you prove your expenses? Often, a credit card statement is not enough. If you rely on memory or a shoebox full of faded thermal paper, you are voluntarily donating money to the government.

- The Standard: For every deduction, you need to document the vendor, date, amount, and business purpose.

- The Fix: Digitalize everything. A photo of a receipt uploaded immediately is worth infinitely more than a pile of paper you “plan to sort later.”

3. The $500 Asset Trap in Year-End Bookkeeping

Furthermore, one of the most common mistakes we see during year-end bookkeeping cleanups is the misclassification of large purchases. Did you buy a new laptop, a piece of machinery, or office furniture this year? If you categorized that as a standard “Office Expense” or “Supplies,” you might be raising a red flag.

- The Rule: Generally, significant purchases (often over $500 or $2,500 depending on your capitalization policy) should be recorded as Fixed Assets, not immediate expenses.

- The Impact: This changes how your taxable income is calculated via depreciation or Section 179 deductions. Get this wrong, and you complicate your taxes significantly.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

Profit vs. Busyness: The Final Check

Finally, stop looking at your bank balance to determine if you had a good year. Instead, you need to look at your monthly reports to answer the hard questions:

- What was your actual top income source? (Not the one that kept you busiest, but the one that was most profitable).

- Where did your money actually go? (What is your biggest expense category?)

- Were you profitable, or were you just busy?

Stop Guessing. Use a System.

Ultimately, you cannot build a scalable business on messy data. If looking at your current set of books gives you anxiety, you need a structured way to clean them up before the ball drops on New Year’s Eve. To help, I have developed a Year-End Bookkeeping Checklist that I use to get my own clients tax-ready. It walks you through the entire process step-by-step:

- Reconciling bank accounts properly.

- Audit-proofing receipts.

- Correcting asset vs. expense categories.

- Generating the reports that actually matter.

In Summary: Get Clarity Now

I am making this checklist available for free to my network. If you want to enter the new year with clarity rather than chaos, drop a comment below or send me a DM, and I will send the checklist directly to your inbox. Additionally, we offer a Free Financial Health Evaluation to help you spot issues before tax season and go into January with clarity.

The Bottom Line

Don’t wait until January.

Your future self (and your bank account) will thank you.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.