Strategic bookkeeping Services for Vancouver–Portland Medical & service businesses

- Home

- Strategic Bookkeeping

Strategic bookkeeping services for Vancouver–Portland medical and service-based businesses—tax-ready, audit-ready financials with proactive guidance year-round.

Giesler-Tran Bookkeeping provides specialized financial management tailored to the needs of medical practices and service-oriented companies in the Vancouver-Portland area and across the country. Their approach, termed strategic bookkeeping services, moves beyond simple data entry by offering weekly reconciliations and audit-ready documentation that assists with year-round decision-making. By focusing on tax-aligned structures, the firm helps clients avoid common pitfalls like disorganized records and expensive year-end corrections. Business owners can choose between integrated tax preparation or seamless collaboration with their existing accountants to ensure financial accuracy. Every account benefits from senior-level oversight and flat-rate pricing, ensuring professional expertise without unexpected costs. Ultimately, the service aims to transform financial records into a reliable system that supports long-term growth and regulatory compliance.

The GTB Advantage

What “Strategic Bookkeeping Services” Means

Why Vancouver–Portland businesses choose GTB For Bookkeeping and Tax Services

Built for medical and service businesses that can’t afford sloppy books

We work best with businesses that:

Are tired of year-end chaos

Are sick of paying for “bookkeeping” that still leaves their CPA cleaning up

Want one team to handle bookkeeping + tax the right way (or collaborate cleanly with their CPA)

Who We Serve

We work best with businesses that are tired of year-end chaos and want one team to handle bookkeeping + tax the right way.

Niche Focus = Fewer Mistakes

1. Medical Offices Chiropractors • Dentists • Therapists • PT clinics • Wellness You deal with insurance reimbursements, EOBs, and provider compensation complexity. Most bookkeepers don’t understand that workflow. We do.

2. Service-Based Businesses Contractors • Trades • Consultants • Agencies • E-commerce You deal with job costs, subs, 1099s, and cash flow swings. We structure your books around how you actually earn and spend money.

Our Approach: The 3-Step System

1) Audit-Ready Clarity System™ Most firms reconcile “when they can.” We provide weekly reconciliations and an industry-specific chart of accounts. If the IRS or a lender asked for your books tomorrow, you’re ready.

2) Tax-Smart Bookkeeping We reduce “misc” buckets and year-end reclasses. We ensure owner, payroll, and contractor treatments are handled correctly so your books support your tax return cleanly.

Result:

No “your books are wrong” calls and no paying twice for the same work. (Want to keep your existing CPA? That’s fine too. We’ll give them clean books they’ll actually appreciate).

Want to keep your existing CPA? That’s fine too. We’ll give them clean, audit-ready books they’ll actually appreciate.

Deliverables & Pricing

Monthly bookkeeping with weekly accuracy standards.

Monthly bookkeeping with weekly accuracy standards.

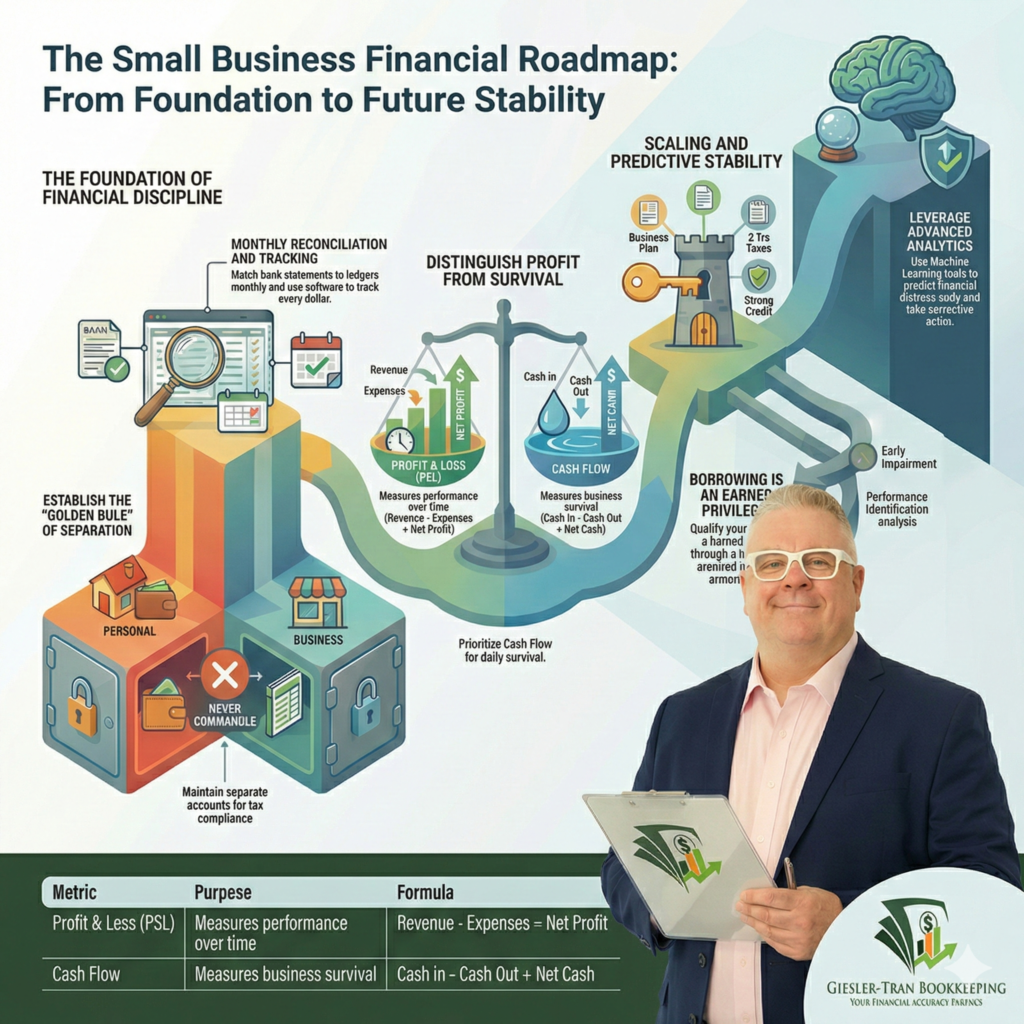

Financial statements (P&L, Balance Sheet) to help you make smarter decisions (aligned with SBA guidance).

Financial statements (P&L, Balance Sheet) to help you make smarter decisions (aligned with SBA guidance).

1099 and payroll reporting support.

1099 and payroll reporting support.

Senior-Level Oversight: You are not handed off to a junior. You get senior review on cleanups and direct access to experts.

Senior-Level Oversight: You are not handed off to a junior. You get senior review on cleanups and direct access to experts.

No surprise invoices or “we went over hours”.

No surprise invoices or “we went over hours”.

Flat monthly pricing based on complexity.

Flat monthly pricing based on complexity.

Optional tax filing quoted separately.

Optional tax filing quoted separately.

Senior-level oversight on every account

You’re not handed off to a junior bookkeeper who’s learning on your time.

At GTB, you get:

Senior review on cleanups and ongoing work

Direct access to someone who understands your niche

A Senior Tax Accountant involved in structure and year-end planning

That means fewer errors, faster answers, and better guidance.

Our Process

Step 1: Free Financial Health Evaluation

We review your current books to identify where you are leaking money and what it will take to get audit-ready.

Step 2: Personalized Onboarding & Cleanup

If your books are messy, we fix misclassifications, reconcile accounts, and rebuild your structure to fix current-year or multi-year issues.

Step 3: Monthly Vigilance

We reconcile and verify weekly to ensure accuracy.

Step 4: Ongoing Strategic Oversight

Includes Tax Accountant review to keep you consistent, transparent, and audit-ready.

Consistent, Transparent, Audit-Ready

Proven Results (Vancouver–Portland and Nationwide)

From Vancouver–Portland to clients nationwide, GTB helps medical and service businesses turn messy books into clean, audit-ready financials. We bring a documented system, senior oversight, and tax-smart structure—so your numbers stay reliable all year. Remote support available across all 50 states.

Strategic Bookkeeping Services — FAQs

What makes GTB different from a typical bookkeeping firm?

We combine niche-focused small business bookkeeping, tax-smart structure, and the option for in-house tax filing. We don’t just record transactions; we design your books for compliance, tax efficiency, and decision-making.

How long does it take to go from “messy” to “clean”?

For current-year issues only, many businesses reach an audit-ready state within 30–60 days. Multi-year cleanups take longer. We outline timeline and scope during your evaluation.

Do you only serve Vancouver–Portland?

No. We’re based in Camas/Vancouver, WA and serve the Portland metro, but we support clients across all 50 states with secure, remote-ready processes.

Can I keep my CPA?

Yes. We can collaborate with your CPA and provide audit-ready books and clean reporting—or you can use our in-house Senior Tax Accountant.

Start Winning Strategically

Books You Can Trust.

If you want clean, accurate books that protect profit and reduce tax surprises, GTB is your partner.