Would you use inferior gas in an airplane? Of course not. You would never risk your family’s safety by fueling a plane with bargain-bin gas just to save a few pennies. Yet, many business owners do exactly this with their companies. Specifically, cutting corners on bookkeeping is the business equivalent of filling your tank with sludge and hoping the engine doesn’t stall at 30,000 feet. At Giesler-Tran Bookkeeping, we see the aftermath of these decisions constantly: messy ledgers, terrifying audit letters, and vanished profits. Therefore, this guide explores why cutting corners with your financials is a risk you simply cannot afford to take.

Would You Use Inferior Gas in An Airplane? Why Cutting Corners Crashes Businesses

Your business engine deserves premium fuel, not a discount mixture.

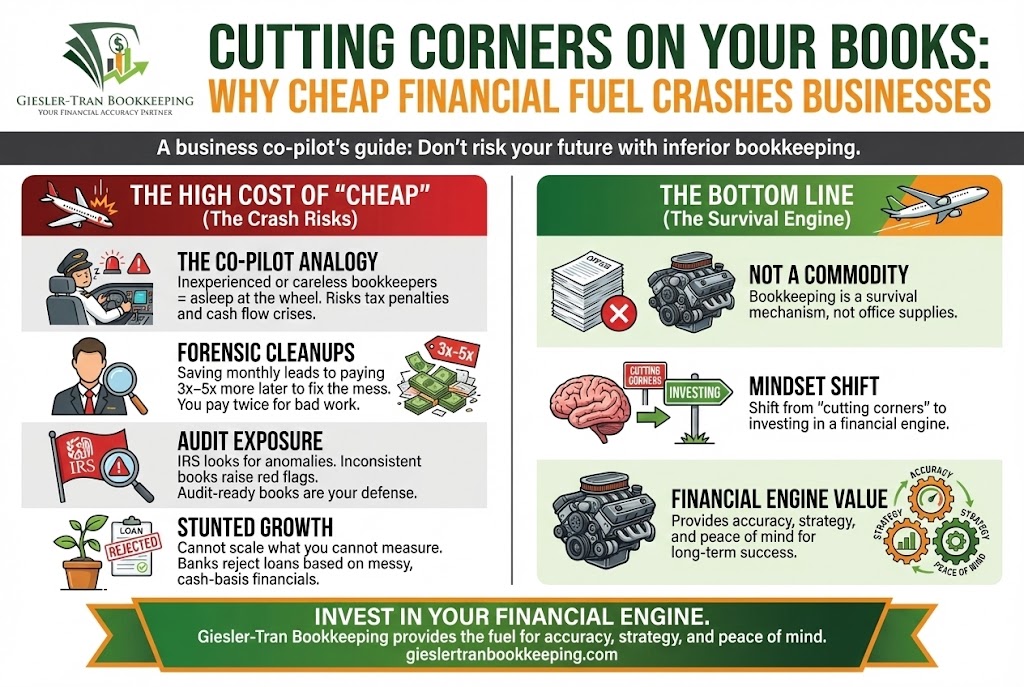

The Reality Check: Fundamentally, your bookkeeper is your business’s co-pilot. If you choose the cheapest option available, you aren’t saving money; you are buying risk. Cutting corners on professional oversight means missed deductions, inaccurate reporting, and a lack of strategy. Real safety comes from knowing your numbers are accurate, defensible, and ready for scrutiny.

Listen on The Deep Dive — where we reveal the hidden costs:

‘Why Cheap Bookkeeping Costs Five Times More’

The Hidden Dangers of Cutting Corners in Your Financials

First, we must address the mindset that drives owners to seek the lowest bidder. Often, entrepreneurs view bookkeeping as a commodity—something to be bought as cheaply as possible, like office paper. However, this perspective ignores the complexity of compliance. When you focus on cutting corners to save a few hundred dollars a month, you inevitably sacrifice accuracy.

Consequently, just like an airplane needs the right fuel mixture to fly efficiently, your business needs precise data to navigate the economy. Inaccurate books lead to blind decision-making. For instance, you might think you have the cash to hire a new employee, only to realize too late that your liability accounts were unreconciled. Ultimately, this isn’t a commodity decision; it is a survival decision.

Why Your Bookkeeper is Your Business’s Co-Pilot

Furthermore, consider the role of a co-pilot. You wouldn’t want a co-pilot who is asleep at the wheel or untrained in emergency procedures. Similarly, a certified bookkeeper spots trouble before it becomes a crash landing. By avoiding the temptation of cutting corners, you gain a partner who can see the storm clouds on the horizon.

Specifically, expert oversight provides peace of mind. You wouldn’t relax on a flight knowing the fuel was questionable. So why settle for uncertainty in your business’s financial foundation? Investing in quality support saves you from costly mistakes, tax penalties, and the sheer panic of an IRS inquiry. Expertise saves livelihoods.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see the data.

The True Cost of Cutting Corners: It’s Not Just Money

Moreover, the price of “cheap” service is often higher than you think. When you prioritize cutting corners, you inherit significant hidden costs. For example, inexperienced bookkeepers frequently overlook tax-saving opportunities that a pro would catch immediately.

Additionally, there is the cleanup factor. Messy books mean your CPA will charge a premium rate (often $200+ per hour) to fix them at tax time. In essence, you pay twice: once for the bad bookkeeping, and once to repair it. Cheap, inferior service may save a few bucks now, but it costs you dearly in the future through missed deductions, errors, and stress.

How Cutting Corners Leads to Audit Risk

Crucially, the IRS has systems to detect anomalies. If your books are inconsistent due to cutting corners, you raise red flags. Simple errors, like rounding numbers or misclassifying assets as expenses, attract scrutiny. Once an audit begins, the burden of proof is entirely on you.

Therefore, maintaining audit-ready books is your best defense. A quality bookkeeper ensures that every transaction is documented and categorized correctly according to IRS standards. Conversely, a budget provider often skips the receipt verification process, leaving you exposed. Don’t gamble with the engine that fuels your business.

Lost Opportunities and Stunted Growth

Beyond taxes, there is the issue of growth. Inaccurate books can prevent you from securing loans or attracting investors. Banks require clean, accrual-based financials to assess your creditworthiness. If you have been cutting corners, your Balance Sheet likely won’t balance, and your P&L won’t tell the true story.

Ultimately, you cannot scale what you cannot measure. To grow, you need data. You need to know your true margins, your labor costs, and your ROI on marketing. Cheap bookkeeping gives you data entry; quality bookkeeping gives you business intelligence.

Professional Oversight vs. Cutting Corners

Finally, let’s talk about standards. At Giesler-Tran Bookkeeping, we don’t just record history; we prepare you for the future. We understand that cheaper alternatives often cost more in the long run. Our approach focuses on precision, communication, and strategy.

In contrast, cutting corners implies doing the bare minimum. It means ignoring reconciliations and guessing at categories. Choose a partner who treats your business with the respect it deserves. Your financial health is too important to be left to the lowest bidder.

Q&A: Why Quality Matters

Q: Isn’t any bookkeeper better than none?

A: Not necessarily. If they make mistakes or miss deadlines, bad bookkeeping is often worse than no bookkeeping at all because it gives you false confidence.

Q: What is the biggest risk of going cheap?

A: The same as using bad gas—hidden dangers and potential disaster. Specifically, cutting corners leads to expensive surprises when you least expect them, like during an audit.

Q: How much does cleanup actually cost?

A: Cleanup work is forensic accounting. It typically costs 3x to 5x more than doing the work correctly the first time would have cost.

Q: What sets GTB apart from budget options?

A: We deliver certified expertise and transparent pricing. Our commitment is to your business’s long-term success, not just clearing a to-do list.

Q: Can I switch if I’m unhappy with my current provider?

A: Absolutely. We handle the transition seamlessly. We earn your trust every month with no long-term contracts, just quality service.

Key Takeaways

- Prioritize Accuracy: Just like a plane needs the right fuel, your business needs accurate books to fly safely.

- Avoid Risk: Cutting corners creates hidden liabilities that can surface years later as tax bills.

- Think Long-Term: Cheap service saves pennies now but costs dollars later in cleanups and missed growth.

- Hire Experts: Choose a bookkeeper who gives you confidence, not concerns.

In Summary: Don’t Crash Your Business

Ultimately, the choice is yours. You can gamble with the engine that fuels your business, or you can invest in its longevity. If you are still tempted by the lowest price, remember this mindset shift: cutting corners is risky. Don’t wait for a crash landing to realize the value of a good co-pilot. Start building a secure financial future today with Giesler-Tran Bookkeeping.

Stop Fueling With “Cheap” Gas

Your business engine deserves premium support.

See the difference expertise makes.

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.