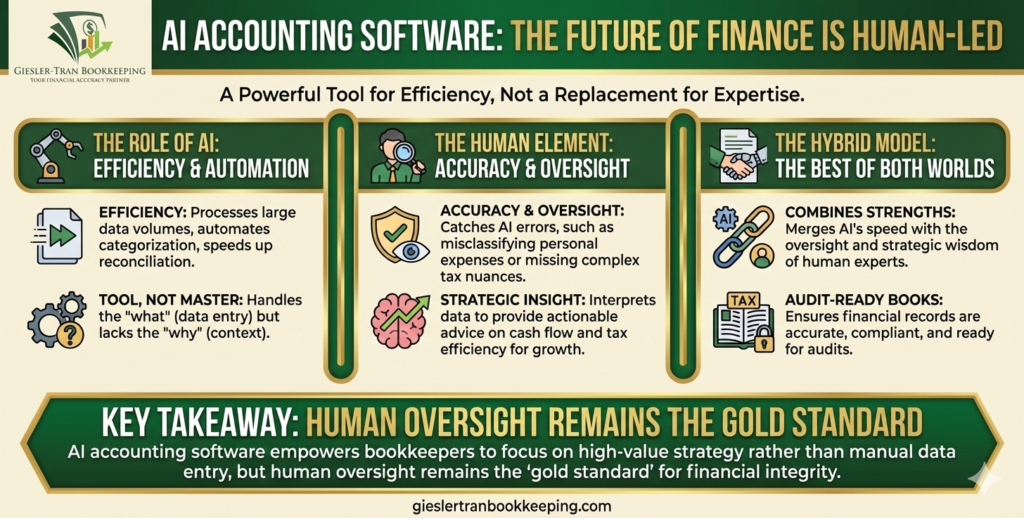

Unquestionably, AI accounting software has revolutionized the way we handle financial data, transforming industries from marketing to logistics. Consequently, business owners frequently ask a critical question: will bookkeeping be replaced by AI? The short answer is no, but the industry is evolving rapidly. While AI accounting software is reshaping how financial data is processed, it does not change why it is managed. Bookkeeping isn’t just about entering numbers; it is about understanding them, interpreting context, and making strategic financial decisions. Therefore, in this guide, we explore the capabilities of AI accounting software and why experienced professionals remain essential for your success.

AI Accounting Software: The Tool, Not the Master

Why Automation Needs Human Oversight to Succeed

The Reality Check: Fundamentally, AI accounting software is a powerful engine, but it is not a driver. If you let an algorithm run your books without supervision, it will make logical errors that a human would spot instantly. For instance, AI might classify a personal lunch as a business expense because it matches a pattern. Ultimately, the software handles the “what,” but only a skilled human understands the “why.”

Listen on The Deep Dive — where we unpack the tech:

‘The Algorithm Trap: Why AI Can’t Replace Your Bookkeeper’

How AI Accounting Software Functions as a Tool

First, we must clarify what we mean by AI accounting software. Essentially, these tools use machine learning to categorize transactions, detect anomalies, and even reconcile accounts automatically. However, treating it as a replacement for human judgment is dangerous. When your business has multiple income streams, vendor credits, merchant fees, and complex tax rules, the software often struggles.

Specifically, AI accounting software frequently misclassifies data or misses critical nuance. While AI handles data volume efficiently, bookkeepers handle judgment effectively. A skilled bookkeeper ensures every entry tells the truth of your business, not just what the algorithm ‘thinks’ it means. According to Forbes Finance Council, the human element remains the critical check against algorithmic bias and error.

Why Human Oversight Trumps AI Accounting Software

Automation saves time, but it cannot intrinsically spot why something is wrong. For example, duplicate transactions, misapplied payments, or bank feed errors can easily slip through the digital cracks. Unfortunately, these errors can cost you thousands if left unchecked. Therefore, human oversight is the safety net that protects your bottom line.

While AI accounting software makes bookkeeping faster, humans make it accurate. Bookkeepers review and reconcile every detail that the machine processes. If you rely solely on automation, you risk building your financial strategy on faulty data. This is why our Cleanup Services are often needed by clients who trusted “auto-add” features too much.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to understand the limitations of AI in finance.

Strategic Insight Requires More Than AI Accounting Software

Crucially, AI doesn’t understand your goals, cash flow needs, or business growth plans. It cannot adjust spending categories for tax efficiency or recognize when a purchase should be capitalized versus expensed. This is where professional oversight wins every time.

Your bookkeeper turns data into decisions—finding deductions, forecasting cash flow, and preparing your business for growth and audits alike. In contrast, AI accounting software merely records history; it does not plan for the future. If you want a partner who can interpret the story behind the numbers, you need a human expert. Check our Strategic Advantage page to see how we apply human insight to machine data.

How AI Accounting Software Enhances the Profession

Think of AI as the power tool in your financial toolbox—it speeds up the heavy lifting so your bookkeeper can focus on higher-value strategy. Instead of spending hours on manual entry, modern bookkeepers spend time analyzing, advising, and protecting your financial health. Consequently, AI accounting software enhances, rather than eliminates, bookkeeping jobs.

In other words, AI doesn’t replace bookkeepers; it empowers the best ones. At Giesler-Tran Bookkeeping, we leverage AI accounting software tools like QuickBooks Online automation and bank-feed integrations. However, every account is still reviewed by real professionals with senior tax oversight. This hybrid approach keeps our clients’ books audit-ready, compliant, and optimized—not just ‘processed.’ See how The Journal of Accountancy describes this evolution from data entry to data analysis.

Q&A: The Truth About AI Accounting Software

Q: Is AI accounting software safe to use?

A: Generally, yes, regarding security. However, relying on it for accuracy without review is unsafe for your financial health.

Q: Can AI replace my CPA?

A: Absolutely not. AI cannot defend you in an audit, understand complex tax law nuances, or provide strategic business advice.

Q: Does GTB use AI tools?

A: Yes. We use advanced technology to increase efficiency, but every transaction is verified by a certified human expert.

Q: Why did my AI software double-count my income?

A: Often, software confuses bank transfers for new income. A human bookkeeper spots this pattern immediately; AI often misses it.

Q: Will AI make bookkeeping cheaper?

A: It makes the process more efficient, which adds value. You get more strategic insight for your money rather than paying for manual typing.

Key Takeaways

- Tool vs. Replacement: AI accounting software handles data volume, while humans handle context and judgment.

- Accuracy Matters: Only human oversight prevents costly machine errors like duplicate entries or misclassifications.

- Strategy Wins: AI cannot forecast growth or plan for taxes; you need an expert for that.

- The Hybrid Model: The best approach combines the speed of AI with the wisdom of experienced bookkeepers.

In Summary: The Hybrid Future

Ultimately, AI accounting software is transforming bookkeeping—but it’s not replacing it. It is improving accuracy, saving time, and enabling experts to focus on strategy instead of data entry. The businesses that win are the ones who use both: AI for speed, and humans for strategy. At Giesler-Tran Bookkeeping, we merge the best of both worlds—automation that saves time and real expertise that saves money.

The Bottom Line

Smarter tools. Sharper minds.

Modernize your books with a human touch.

Check our pricing guide to see our hybrid approach.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response