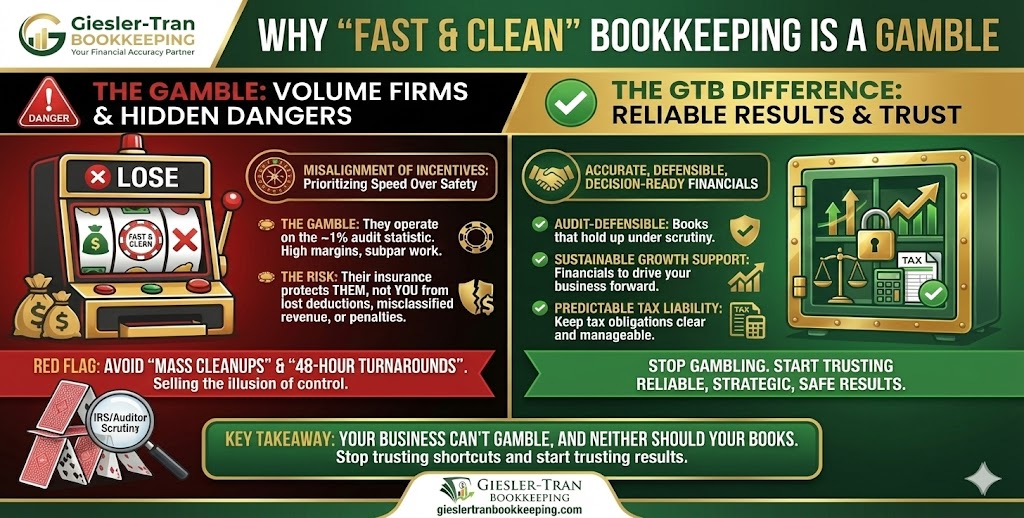

Many business owners, drowning in receipts and spreadsheets, are understandably tempted by the promise of fast & clean bookkeeping services. Initially, the idea of handing over a messy shoebox of data and receiving polished reports 48 hours later feels like a miracle. However, most business owners think bookkeeping is boring, while most volume-based firms think your books are simply a cash cow. Unfortunately, most of them are right. Because only about 1% of businesses ever get audited, these “churn-and-burn” firms can operate with massive margins, charge premium prices for subpar work, and even insure themselves against the inevitable mistakes. But here is the brutal truth: your business and financial stability are on the line, not theirs. Therefore, relying on fast & clean bookkeeping is not a strategy; it is a gamble with your livelihood.

Why “Fast & Clean” Bookkeeping Services Are Gambling With Your Business

Your business can’t gamble. Neither should your books.

The Reality Check: Fundamentally, when the IRS comes knocking—or when you need a bank loan, investor review, or litigation support—those “turnaround-in-48-hours” promises offered by fast & clean bookkeeping firms collapse instantly. Why? Because their insurance covers them; it does not cover your lost deductions, misclassified revenue, or inaccurate financials. Ultimately, speed without context is just efficient failure.

Listen on The Deep Dive — where we expose the industry secret:

‘The High Cost of Cheap Speed: Fast Bookkeeping Is Efficient Failure’

The Mathematical Gamble of Fast & Clean Bookkeeping

To understand why these services exist, you must understand the math behind their business model. Specifically, volume-based bookkeeping firms rely on a single statistic: the low audit rate. According to recent data from the IRS Data Book, audit rates for small businesses hover around 1% or lower. Consequently, a firm promising fast & clean bookkeeping can afford to be wrong 99% of the time because they won’t get caught.

However, for the business owner, the stakes are entirely different. If you fall into that 1%—or if you simply need to apply for an SBA loan—the “good enough” work falls apart. Suddenly, every misclassified transaction, duplicate income entry, or artificial “cleanup” shows up under scrutiny. Then, you realize the CPA or bookkeeper you trusted isn’t legally on your side. They were offering just enough to make you feel like you needed them, not enough to truly protect your business. This is not guidance; that is a bet against your own company.

Why Context Matters More Than Speed in Fast & Clean Bookkeeping

Undoubtedly, technology has made data entry faster. But bookkeeping is not just data entry; it is the interpretation of financial activity. When you opt for fast & clean bookkeeping, you often sacrifice the context that saves you money. For instance, an automated system might see a $2,000 payment to a vendor and classify it as an “Expense.”

In contrast, a human expert might recognize that payment as a deposit on a capital asset, which should be depreciated over time. Misclassifying this doesn’t just mess up your books; it distorts your Profit & Loss statement and your tax liability. Furthermore, speed-focused services rarely ask the necessary questions. They guess. And when they guess wrong, you pay the price in penalties and interest. To explore how we handle these complexities, read about our Strategic Advantage.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see why forensic accountants warn against speed-over-quality services.

The Illusion of Control in Fast & Clean Bookkeeping

Here is the red flag you can’t ignore: any firm selling mass cleanups, instant bookkeeping fixes, or “one-week turnaround” financials is likely selling a false reality. They are not building your business; they are commoditizing your trust. Essentially, they are not supporting profitability, stability, or sustainable growth—they are selling the illusion of control.

When you receive a polished PDF report, it feels like the job is done. However, if the underlying data is flawed, that report is dangerous. It might tell you that you are profitable when you are actually bleeding cash. Or, it might show you have tax liability when you actually have deductions. Therefore, trusting fast & clean bookkeeping is akin to navigating a ship with a broken compass; you might feel like you are moving, but you are likely heading for the rocks.

The True Cost of a Cleanup

Sadly, many clients come to Giesler-Tran Bookkeeping after using a “fast & clean” service. They arrive with books that are technically balanced but factually incorrect. Consequently, we have to perform a forensic cleanup to undo the damage. This means the business owner pays twice: once for the cheap, fast service, and again for the professional correction.

Moreover, the cost isn’t just financial. It is the lost time, the sleepless nights, and the missed opportunities while waiting for accurate numbers. If you are currently in this situation, our Bookkeeping Cleanup service is designed to restore integrity to your financial records. We do not offer instant fixes; we offer permanent solutions.

The GTB Difference: Reliable, Not Just Fast

At Giesler-Tran Bookkeeping, we don’t play odds with your business. We don’t chase volume. Instead, we build accurate, defensible, and decision-ready financials. Our books are designed to hold up under audit, support real growth, and keep your tax liability predictable.

Clean numbers aren’t always flashy or instant. They are reliable. They are strategic. And they are exactly what your business deserves. While we leverage technology for efficiency, we never sacrifice the human oversight required for accuracy. To see resources that help you maintain this standard, visit our Bookkeeping Tips & Resources page.

Q&A: The Truth About Bookkeeping Speed

Q: Is it impossible to have fast bookkeeping?

A: No, efficient bookkeeping is possible with regular maintenance. However, “instant” cleanups of years of neglected data are almost always inaccurate.

Q: Do these firms have insurance if they mess up?

A: Yes, but their insurance protects them from lawsuits, not you from IRS penalties. You are still responsible for the accuracy of your tax return.

Q: Why do banks reject “fast & clean” financials?

A: Banks look for consistency and logic. If your Balance Sheet shows negative cash or unclassified assets—common in automated cleanups—the loan officer will reject the application immediately.

Q: What is a reasonable turnaround time for a cleanup?

A: Depending on complexity, a thorough cleanup takes 2-4 weeks. This allows time for query resolution, reconciliation, and quality assurance reviews.

Q: How can I tell if my “fast & clean bookkeeping” is wrong?

A: Check for a large “Ask My Accountant” balance, negative asset accounts, or income that doesn’t match your bank deposits. These are hallmarks of rushed work.

Key Takeaways

- Speed Kills Accuracy: Promises of 48-hour turnarounds on complex files are a major red flag.

- You Bear the Risk: Service provider insurance does not cover your tax penalties or lost deductions.

- Context is King: Automation cannot replace human judgment when categorizing complex transactions.

- Trust Results: Focus on defensible, decision-ready books rather than flashy, instant reports.

In Summary: Stop Trusting Shortcuts

Ultimately, you must stop trusting shortcuts and start trusting results you can actually use. Your business can’t gamble. Neither should your books. By rejecting the allure of fast & clean bookkeeping, you choose stability and long-term success. If you are ready for a partner who takes your business as seriously as you do, Giesler-Tran Bookkeeping is here.

The Bottom Line

Don’t bet against your own business.

Get accurate, defensible books today.

Schedule Your Free Consultation

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.