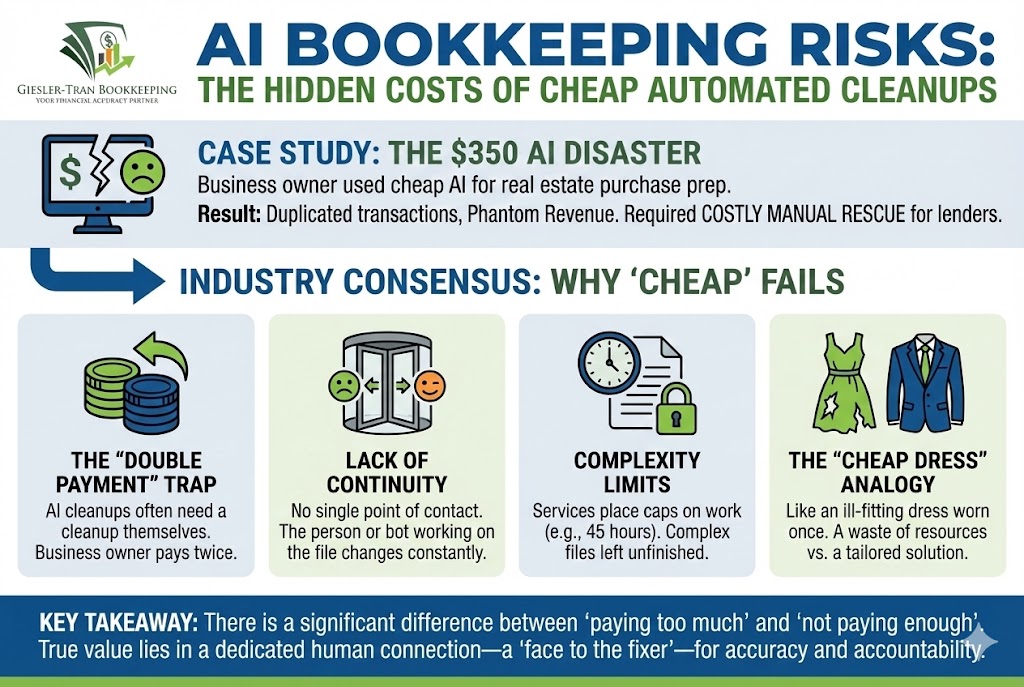

Recently, the promise of AI bookkeeping has flooded the market, offering business owners a tempting proposition: fully automated financial records for a fraction of the cost of a human professional. Initially, this sounds like a dream come true for entrepreneurs looking to cut overhead. However, at Giesler-Tran Bookkeeping (GTB), we have witnessed the fallout when these algorithms get it wrong. Specifically, we encountered a client who trusted an AI bookkeeping service to prepare for a major real estate purchase, only to find his financial records in shambles at the critical hour. Consequently, what started as a $350 shortcut spiraled into a multi-thousand dollar rescue mission. Therefore, this case study serves as a warning: automation without oversight is not an asset; it is a liability.

When AI Bookkeeping Goes Wrong: The Costly Lesson of Choosing Automation Over Expertise

A GTB True-to-Life Case Study for Business Owners

The Reality Check: Fundamentally, AI bookkeeping tools are designed to recognize patterns, not context. While they can match a vendor name to a category, they cannot discern if a transaction was a business expense, a personal draw, or a loan repayment. Consequently, without human oversight, an algorithm can confidently categorize thousands of errors in seconds. Remember, AI can process data, but only a human can understand your business story.

Listen on The Deep Dive — where we unpack this disaster:

‘The AI Trap: Why a $350 Shortcut Almost Cost a Client His Dream Property’

The Backstory: A Dream to Expand

Recently, a new client came to us after hitting a major roadblock. He was finally ready to purchase a new commercial property he had his eyes on—a space that would allow him to expand operations and take his business to the next level. However, before his lender could approve the financing, he needed clean, verified books for the last two years.

Instead of hiring a certified bookkeeper for a professional cleanup, he decided to save money and try Intuit Live—an AI bookkeeping service that promised quick, affordable results for just $350. The pitch was convincing: “Our AI will clean and organize your books automatically.” But as he soon learned, AI can automate—it just can’t account. Ultimately, the machine prioritized speed over accuracy, leaving him exposed.

The AI “Cleanup”: Fast, Cheap… and Wrong

After a few weeks, the system had synced to his bank accounts and produced reports that looked clean—until the numbers didn’t match his lender’s expectations. That is when he came to GTB for help. Once we began our forensic review, what we uncovered was alarming. Specifically, the AI bookkeeping software had prioritized speed over logic, creating a minefield of errors.

Here is what our audit revealed:

- Massive Duplication: Over 4,000 transactions were incorrectly categorized or duplicated because the AI read bank transfers as new income.

- Phantom Revenue: Unidentifiable income was scattered across multiple reports, artificially inflating his profit.

- Systemic Errors: Revenue tracking was completely wrong, and the AI blindly carried the same mistake through every single month.

- Missing Documentation: There were zero receipts or audit trails attached to the transactions, leaving him defenseless against an IRS audit.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see what an AI developer thinks about the limitations of their own technology.

The Fallout: A $350 Shortcut That Cost Thousands

Regrettably, what should have been a simple cleanup turned into a full financial recovery project. Instead of saving money, the client had to pay for over 40 hours of manual forensic work. Our team had to rebuild two years of transactions from scratch to satisfy the lender. This involved correcting hundreds of misclassifications, reconciling every account line-by-line, and validating all revenue for compliance.

By the end, the cleanup bill had grown into a multiple-thousands-of-dollars mistake—all caused by trying to save a few hundred bucks. He almost missed the deadline to secure the property he’d been planning to buy for years. This experience proves that the only thing more expensive than good bookkeeping is cheap bookkeeping. If you suspect your books are in trouble, consider our Bookkeeping Cleanup services immediately.

The Lesson: Automation Without Oversight Is Dangerous

Undeniably, AI bookkeeping tools like Intuit Live and QuickBooks Assist offer convenience for micro-startups. However, for growing businesses, automation without human oversight is a significant liability. Why? Because AI lacks the ability to understand financial context or catch anomalies that a human would spot instantly.

For instance, AI cannot verify if revenue streams are missing entirely. It lacks compliance awareness and cannot produce audit-proof reporting. Most importantly, AI cannot interpret financial trends or provide strategy. At GTB, we use automation too—but always under human supervision. Our certified professionals ensure your data is accurate, compliant, and decision-ready.

The GTB Way: Cleanup, Confidence, and Clarity

Fortunately, this story has a happy ending. After our rigorous cleanup, the client’s books were fully audit-ready, tax-ready, and lender-approved. Within two weeks of submitting the corrected reports, the financing was approved, and he secured his new property.

His reflection after working with us was telling: “I thought I was saving money. I was actually gambling with my business.” To avoid this gamble, we offer:

- Certified Pros: QuickBooks-Certified professionals with Senior Tax Accountant oversight.

- Transparent Pricing: Flat-rate pricing with no hourly surprises.

- Monthly Insights: Financial summaries with actionable strategic advice.

- Scalability: Nationwide virtual support that grows with you.

Q&A: Navigating AI Bookkeeping Risks

Q: Is all AI bookkeeping bad?

A: No. AI is a powerful tool for data entry and categorization. However, it requires expert human review to ensure accuracy and context.

Q: Why did the AI duplicate transactions?

A: Often, AI software misinterprets bank transfers or payment processor deposits as new income. Without reconciliation, these errors compound quickly.

Q: Can I sue the software company for bad books?

A: Likely not. Terms of service usually state that the user is ultimately responsible for data accuracy. This is why hiring a professional is safer.

Q: How do I know if my books are wrong?

A: If your profit looks unusually high or low, or if your bank balance doesn’t match your software balance, you likely have errors. Forensic review is needed.

Q: Does GTB use AI?

A: Yes, but strategically. We use automation to fetch data, but our Certified Bookkeepers verify every single entry.

In Summary: Invest in Experts, Not Algorithms

Ultimately, the allure of AI bookkeeping is strong, but the risks are real. Cheap bookkeeping isn’t a savings—it’s a setup for future headaches. By choosing Giesler-Tran Bookkeeping, you ensure that your books are always ready when opportunity knocks. If you want to future-proof your business, schedule a consultation today.

The Bottom Line

Don’t gamble with your business.

Get audit-ready confidence today.

Schedule Your Free Consultation

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

3 Responses