Ultimately, every growing business reaches a tipping point where basic data entry is no longer enough. When this happens, you need a professional who can handle the entire financial picture, not just the receipts. Enter the full-charge bookkeeper. Unlike an entry-level clerk who merely records data, a full-charge bookkeeper manages the full accounting cycle—from daily transactions to the complex month-end close. At Giesler-Tran Bookkeeping (GTB), we believe that understanding this role is the key to unlocking financial maturity. Therefore, this guide explores exactly what this role entails and why upgrading to a full-charge bookkeeper is the smartest investment for your peace of mind and profitability.

The Full-Charge Bookkeeper: Elevating Your Business Finances

Comprehensive Management from Transaction to Tax-Ready

The Reality Check: Fundamentally, a business cannot scale on messy data. While a standard bookkeeper might categorize expenses, a full-charge bookkeeper owns the result. They ensure that your Balance Sheet balances, your Profit & Loss makes sense, and your cash flow is predictable. If you are constantly waiting on your CPA to “fix” your books at the end of the year, you are operating blindly for 11 months out of 12.

Listen on The Deep Dive — where we break down financial roles:

‘From Clerk to Commander: The Full-Charge Bookkeeper Tipping Point’

Defining the Scope of a Full-Charge Bookkeeper

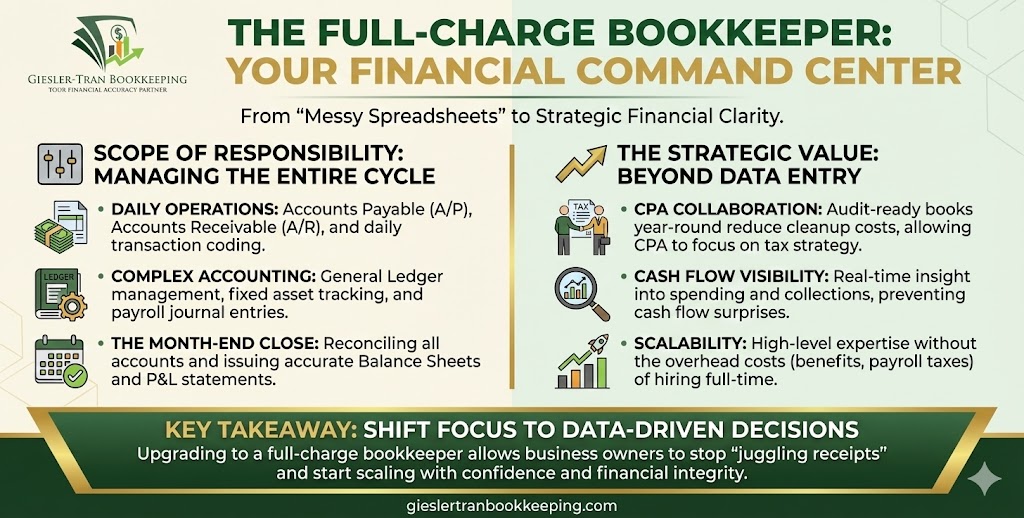

First, it is vital to understand the “full charge” distinction. Essentially, a full-charge bookkeeper assumes total responsibility for the accounting department’s daily and monthly operations. Unlike junior staff who may only handle Accounts Payable or data entry, this role encompasses the entire financial ecosystem.

Specifically, they manage the General Ledger, ensuring that every debit and credit lands in the correct account. Furthermore, they handle complex tasks such as bank reconciliations for multiple accounts, loan amortization schedules, and fixed asset tracking. By owning this entire process, the full-charge bookkeeper becomes your financial command center. Consequently, this ensures data integrity, cash flow awareness, and smooth communication between your operations team and your CPA. According to Investopedia, this role is often the highest level of non-CPA accounting professional.

Why Businesses Choose a Full-Charge Bookkeeper

Many small and mid-sized businesses eventually realize that basic bookkeeping isn’t enough. When invoices, payroll, and multiple accounts begin to stack up, having a dedicated professional who manages every detail can transform your financial clarity. A skilled full-charge bookkeeper becomes your go-to financial partner—someone who knows your business inside and out.

Moreover, they understand your cash flow cycles and ensure every transaction is properly categorized. With clean, accurate books, your accountant can focus on what they do best: strategic tax planning and financial forecasting. This division of labor not only reduces year-end cleanup costs but also protects you from costly compliance errors. In short, you get more control, more insight, and more confidence in your business decisions. Learn more about how we implement this via our Bookkeeping Cleanup Services.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see the ROI of this specific role.

Key Responsibilities of a Full-Charge Bookkeeper

While the specific duties may vary by industry, the core responsibilities remain consistent. Typically, a full-charge bookkeeper handles the following critical tasks:

- Daily Transaction Management: They code bank feeds daily, ensuring real-time visibility into spending.

- Accounts Payable & Receivable: They track vendor bills to avoid late fees and follow up on client invoices to improve collections.

- Payroll Journals: They ensure that payroll expenses and tax liabilities are recorded accurately in the General Ledger.

- Month-End Close: Crucially, they perform the rigorous process of closing the books, reconciling all accounts, and issuing financial statements.

- Compliance: They maintain internal controls to prevent fraud and ensure compliance with local tax laws.

By executing these tasks with precision, we ensure your business remains audit-ready. Check our Pricing Guide to see how we structure these comprehensive services.

When to Upgrade to a Full-Charge Bookkeeper

If your business has grown beyond simple spreadsheets, it is likely time to upgrade. Additionally, if your CPA spends hours cleaning up your records before filing taxes, you are wasting money on high hourly rates for work a full-charge bookkeeper should have done months ago.

Ideally, this role is perfect for companies with multiple revenue streams, growing vendor lists, or sophisticated payroll needs. Furthermore, if you have goals to implement tax strategy and forecasting, you need a solid data foundation first. By integrating modern accounting software like QuickBooks Online, a full-charge bookkeeper can automate repetitive tasks, reduce errors, and deliver real-time financial visibility from anywhere. See how the U.S. SBA recommends structuring financial management for growth.

Q&A: Everything You Need to Know About the Full-Charge Role

Q: Does a full-charge bookkeeper replace my CPA?

A: No. Think of them as a team. The bookkeeper prepares the data and reports, while the CPA uses that information for tax filing and high-level strategy.

Q: Is it cheaper to hire in-house?

A: Rarely. When you hire an employee, you pay for benefits, payroll taxes, and downtime. Outsourcing to GTB gives you expert service for a flat monthly fee.

Q: Do they handle payroll processing?

A: Yes. A full-charge bookkeeper typically manages the payroll process, ensuring staff gets paid and journals are entered correctly.

Q: What software do you use?

A: We specialize in QuickBooks Online. This cloud-based platform allows for seamless collaboration and real-time updates.

Q: How do I get started?

A: Simply schedule a consultation. We will assess your current volume and propose a plan that covers your full accounting cycle.

Key Takeaways

- Total Ownership: A full-charge bookkeeper manages the entire cycle, not just data entry.

- Better CPA Relations: Clean books mean lower tax prep fees and better strategic advice.

- Automation Wins: We implement smart workflows to eliminate manual errors and save time.

- Scalability: Outsourcing this role allows you to access high-level talent without the overhead of a full-time employee.

In Summary: Upgrade Your Financial Standard

Ultimately, your business deserves more than basic bookkeeping. It deserves financial clarity and confidence. By letting Giesler-Tran Bookkeeping take ownership of your accounting cycle as your full-charge bookkeeper, you gain the precision, consistency, and insight required to scale. Stop juggling spreadsheets and start making data-driven decisions today.

The Bottom Line

No Pressure. Only Clarity.

Let us own your accounting cycle.

Schedule Your Free Consultation

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.