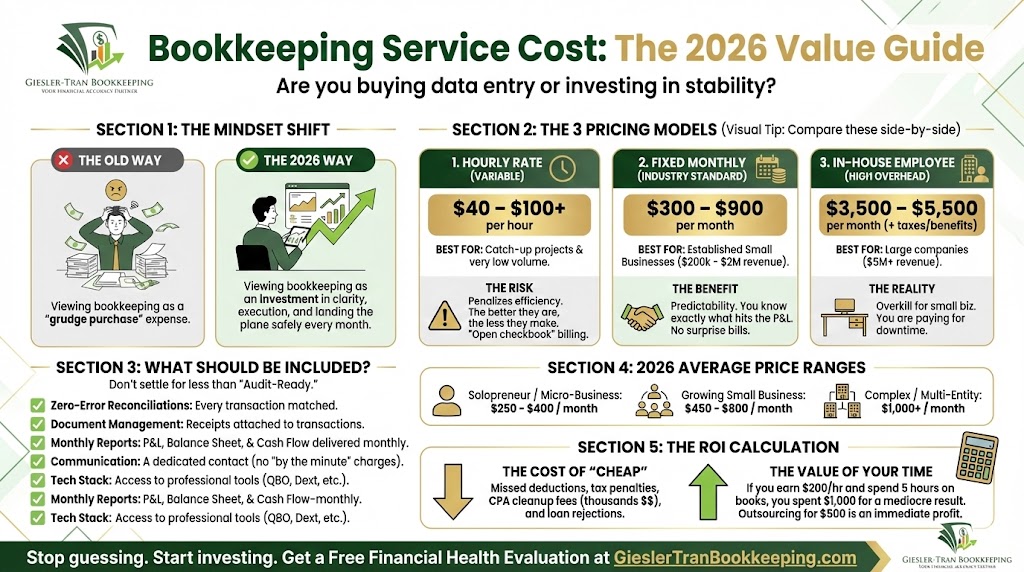

Recently, I told a potential client something I genuinely believe: I surround myself with people smarter than I am so we can accomplish our mission at the highest level. In fact, that is the exact mindset successful business owners use when they stop trying to DIY their finances and realize that the bookkeeping service cost is actually an investment in stability. Specifically, you want someone on your team whose ability to speak clearly about operations, process, and execution helps you land the plane safely every month.

Bookkeeping Service Cost: Average Prices, Inclusions & Best Value Guide

Invest in clarity, not just data entry.

However, once you’ve made that decision, the practical questions begin. For example, how much does a good bookkeeper actually cost? Furthermore, am I overpaying? Below, in this guide, we break down the real bookkeeping service cost in 2026, helping you distinguish between a cheap expense and a valuable investment.

The Reality Check: Fundamentally, bookkeeping isn’t one-size-fits-all. In 2026, most reputable firms have moved away from unpredictable hourly billing toward fixed-fee models that favor transparency. Consequently, understanding these models is the key to avoiding hidden fees.

Listen on The Deep Dive — where we dig deeper into this topic:

‘Is Your Bookkeeping Cost Justified?’

The Three Pricing Models Affecting Bookkeeping Service Cost

Typically, there are three primary ways you will be billed. Therefore, understanding the pros and cons of each is vital.

1. Hourly Rate: A Variable Bookkeeping Service Cost Model

- Average Cost: $40 – $100+ per hour.

- Best For: Specifically, this model suits catch-up projects, historical cleanups, or very low-volume freelance work.

- The Risk: Unfortunately, it creates an “open checkbook” scenario. For example, if your bookkeeper is slow or your software disconnects, you pay more. Thus, it penalizes efficiency—the better they are, the less they make.

2. Fixed Monthly Packages (The Industry Standard)

- Average Cost: $300 – $900 per month.

- Best For: Established small businesses (approx. $200k – $2M revenue).

- The Benefit: Primarily, the benefit is predictability. Because you know exactly what hits your P&L every month, budgeting becomes easier. Generally, these packages align with your transaction volume and complexity.

3. In-House Employee

- Average Cost: $3,500 – $5,500 per month (plus payroll taxes & benefits).

- Best For: Large companies ($5M+ revenue) requiring daily, on-site manual data entry.

- The Reality: For most small businesses, this is overkill. Essentially, you are paying for downtime.

What Does a “Good” Bookkeeper Include?

Crucially, when comparing quotes, you aren’t just comparing dollar amounts; you are comparing scopes of work. Often, a cheap $150/month quote leaves you with a mess at tax time. Instead, a professional Audit-Ready monthly fee should include:

- Reconciliations: Systematically checking every bank and credit card transaction against the statement to ensure zero errors.

- Document Management: Consistently attaching receipts and bills to transactions for audit proofing.

- Financial Reports: Regularly delivering a clean Balance Sheet, P&L, and Cash Flow Statement every month (not just once a year).

- Communication: Ideally, a dedicated point of contact who answers your questions without charging “by the minute.”

- Tech Stack: Often, access to professional tools (like QuickBooks Online, Dext, or specialized payroll apps) is included in the price.

Pro Tip: Always ask if “Cleanup” is included. Usually, reliable firms charge a separate one-time fee to fix historical messes before starting the monthly service.

How to Optimize Your Bookkeeping Service Cost for Value

If you want to maximize the ROI on your bookkeeping service cost, look for a partner who offers Financial Clarity, not just data entry.

1. Demand “Tax-Ready” Financials

Frequently, cheap bookkeepers dump unknown transactions into “Ask My Accountant” or “Office Expenses.” Although this saves them time, it costs you thousands in CPA fees at year-end to fix. Therefore, the best value comes from a bookkeeper who categorizes correctly all year round.

2. Look for Industry Expertise

Moreover, a generalist might not know that your medical practice needs to match EOBs to deposits, or that your construction firm needs job costing. In short, “surrounding yourself with people smarter than you” means hiring someone who knows your specific industry pitfalls.

3. Value Your Time

Finally, calculate your own hourly rate. For instance, if you earn $200/hour as a business owner and you spend 5 hours a month fighting with QuickBooks, you just “spent” $1,000 to do a mediocre job. Consequently, outsourcing for $500 is an immediate profit.

In Summary: The Real Cost of Peace of Mind

Ultimately, the cost of bookkeeping services is negligible compared to the cost of tax penalties, lost deductions, and the inability to get a loan because your books are messy.

Typical Ranges for 2026:

- Solopreneur / Micro-business: $250 – $400 / month

- Growing Small Business: $450 – $800 / month

- Complex / Multi-Entity: $1,000+ / month

The Bottom Line

Ready to surround yourself with experts who can execute at the highest level?

Stop guessing if you’re overpaying or under-protected.

Get Your Free Financial Health Evaluation

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

5 Responses