Performing a comprehensive year-end catch-up is the single most effective way to prepare for tax season without the usual stress and anxiety. Recently, many clients have asked us how to navigate this process efficiently. Specifically, they want to know exactly what documents they must gather to get their books audit-ready before the filing deadline. Fortunately, getting your books caught up for a year-end catch-up doesn’t have to be a headache if you have the right roadmap. Below, we outline the exact checklist you need to provide so Giesler-Tran Bookkeeping (GTB) can make the process smooth, efficient, and painless.

What Do I Need to Provide for a Year-End Catch-Up?

Preparation prevents panic.

The Reality Check: Fundamentally, missing documents equals missed deductions. For example, if we don’t have the loan document, we can’t separate principal from interest. Therefore, providing a complete paper trail for your year-end catch-up isn’t just about compliance; it directly lowers your tax bill. Ultimately, the more information you give us, the more money we can help you save.

Listen on The Deep Dive — where we dig deeper into this topic:

‘The Ultimate Year-End Checklist’

Essential Documents for Your Year-End Catch-Up

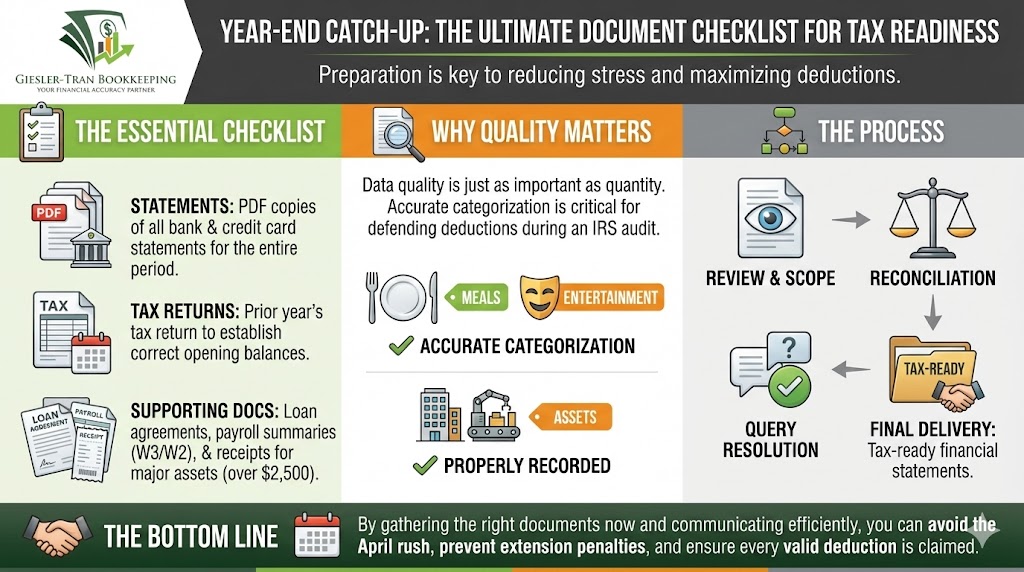

First, to ensure absolute accuracy, we need a complete picture of your finances. Specifically, please gather the following items for the year-end catch-up period. While this list may look extensive, each item plays a critical role in audit-proofing your business.

- Bank Statements: Provide PDF copies for all business accounts (checking, savings) covering the entire catch-up period. These serve as the “source of truth” for reconciling your ledger.

- Credit Card Statements: Include statements for every business card used. Often, business owners forget cards they rarely use, which creates reconciliation errors.

- Software Access: Grant us Accountant Access to your QuickBooks Online account (or current ledger).

- Prior Year Tax Return: Crucially, we use this to verify your opening balances. If this is your first clean-up with us, this document is non-negotiable.

- Loan Documents: Specifically, we need financing agreements to separate interest from principal payments. Remember, only the interest is tax-deductible!

- Payroll Records: Include summaries (W3/W2 data) if you have employees. We must match your payroll expenses to the cash leaving your bank.

- Asset Receipts: Include receipts for large asset purchases (over $2,500) or unusual transactions.

- Formation Documents: Provide EIN and LLC/Corp paperwork if we don’t already have them on file.

Why Precision Matters in a Year-End Catch-Up

Furthermore, simply dumping data isn’t enough; the quality of the data matters. When you undergo a year-end catch-up, we are essentially reconstructing the financial story of your year. If pieces of that story are missing, the ending (your tax return) will be incorrect.

For instance, accurately categorizing a “meal” vs. “entertainment” can change your deduction from 50% to 0%. Also, properly recording the purchase of a vehicle as a fixed asset rather than an expense impacts your depreciation schedule for years to come. According to the IRS Recordkeeping Guidelines, the burden of proof is always on the taxpayer. Thus, our thoroughness during the cleanup protects you during an audit.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below to verify our checklist.

Tips for a Faster Year-End Catch-Up

Moreover, you can speed up the process significantly by following a few best practices. Ideally, we want to minimize the back-and-forth so you can get your reports sooner. Here is how you can help us help you:

- Send documents electronically: PDFs, scanned images, or secure uploads via our portal work best. Avoid taking blurry photos of documents with your phone if possible.

- Be responsive: Quick replies to our information requests result in a quicker turnaround! Often, a project stalls simply because we are waiting on one statement.

- Flag personal expenses: Proactively let us know about any personal expenses mixed in with business accounts. This allows us to categorize them to “Owner’s Draw” immediately without asking.

- Communicate gaps: If you are missing a specific statement, don’t stress—just let us know. We can often help you track it down or find an alternative solution.

Additionally, consider utilizing bank feeds that connect directly to QuickBooks. For more tips on organizing financial data, check out NerdWallet’s guide to record keeping.

What Happens Next? The Process

Next, once you provide these items, our team goes to work. Generally, the year-end catch-up process flows through four distinct phases designed to ensure quality.

- Review & Scope: First, we review your uploaded documents and provide a clear project scope and timeline.

- Reconciliation: Then, we match every transaction to a bank record, ensuring no penny is unaccounted for.

- Queries: We compile a list of “unknown” transactions for you to identify. This keeps our communication efficient.

- Final Delivery: Finally, you receive a Balance Sheet and Profit & Loss statement that is fully ready for your CPA!

“Brian made it easy to get everything together for my year-end catch-up. The checklist was simple and I always knew what was next.”

Q&A: Catch-Up Logistics

Q: Can I send Excel or CSV files instead of PDFs?

A: Yes, for transaction lists. However, we still need the official PDF statements to verify the ending balances for the year-end catch-up.

Q: What if I lost a receipt for a large purchase?

A: Don’t panic. We can help you use bank records to reconstruct the expense, though having the receipt is always safer for audit protection.

Q: How long does a year-end catch-up take?

A: Typically, 2-4 weeks. However, this depends heavily on how quickly we receive the full document list.

Q: Do you file the taxes after the catch-up?

A: No. We prepare the books; your CPA files the return. We specialize in the accounting data to ensure your CPA has exactly what they need.

Q: Can you work directly with my CPA?

A: Absolutely. We love collaborating with tax professionals to ensure a seamless handoff.

Key Takeaways

- Complete Records: Providing all bank, loan, and credit card statements is the foundation of a successful year-end catch-up.

- Tax Returns Matter: We need your prior year’s return to establish accurate opening balances.

- Speed is Key: Sending documents electronically and responding to queries quickly ensures you beat the tax deadline.

- Audit Defense: Our thorough process ensures every deduction is documented and defensible.

In Summary: Get Organized Now

Ultimately, gathering these documents now saves you hours of stress later. By proactively managing your year-end catch-up, you avoid the April rush and potential extension penalties. Have questions about a specific situation or document? Just ask—our goal is to make your financial life as stress-free as possible! Let GTB turn your box of receipts into a clean, compliant set of books.

Beat the Tax Deadline

Ready to get started?

The sooner you provide your documents, the sooner you can relax!

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response