Virtual bookkeeping services are no longer just a futuristic option for tech startups; they have become the gold standard for main street businesses ranging from chiropractors to construction firms. Historically, business owners believed that financial data had to live in a filing cabinet down the hall to be secure. In reality, that outdated model often leads to data bottlenecks, lost receipts, and delayed reporting. However, modern commerce moves too fast for shoebox accounting. Consequently, utilizing professional virtual bookkeeping services allows you to access real-time financial clarity without the overhead of an in-house employee. Because we utilize bank-level encryption and cloud-first workflows, Giesler-Tran Bookkeeping delivers a level of precision and speed that traditional local firms simply cannot match.

Virtual Bookkeeping Services: The Modern Solution for Small Businesses

Secure. Scalable. Strategic.

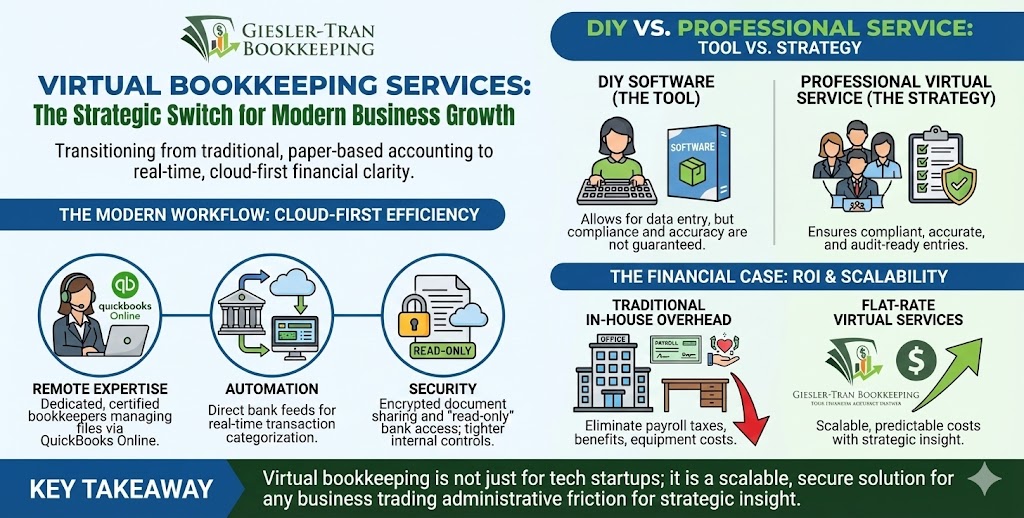

The Reality Check: Fundamentally, virtual bookkeeping services differ from simple data entry because they pair human expertise with automation. While software can download transactions, it cannot interpret them. Therefore, our service provides the strategic oversight needed to turn raw data into audit-ready financial statements. Remember, proximity does not equal accuracy; expertise does.

Listen on The Deep Dive — where we explore this topic further:

‘The Remote Advantage: Why Virtual Bookkeeping Services Are Safer and Faster’

Why Virtual Bookkeeping Services Are Replacing Traditional Firms

Initially, many clients come to us after years of frustration with local, paper-based accountants. Often, they describe the hassle of printing bank statements, driving across town to drop off documents, and waiting weeks for a reply. However, the landscape of financial management has shifted dramatically. Specifically, virtual bookkeeping services leverage the power of the cloud to eliminate these geographical friction points entirely.

Furthermore, the traditional model often relies on “after-the-fact” accounting, where you only see your numbers months after the year ends. In contrast, our virtual approach focuses on real-time data ingestion. By connecting your bank feeds directly to platforms like QuickBooks Online, we categorize transactions as they happen. Consequently, you make decisions based on today’s cash flow, not last year’s tax return. For a deeper look at how this impacts your strategy, read about our Strategic Advantage.

How Virtual Bookkeeping Services Actually Work

Undoubtedly, the idea of handing over financial data to a remote team can feel daunting to the uninitiated. To clarify, let’s break down the mechanics of how high-quality virtual bookkeeping services operate on a daily basis. Here is the workflow that keeps your books pristine:

- Remote Expertise: We assign a dedicated, certified bookkeeper to your account who manages your file using QuickBooks Online.

- Bank Feed Automation: You grant us read-only access to your bank accounts, allowing software to fetch transactions securely without us ever touching your money.

- Secure Document Sharing: Instead of mailing receipts, you simply snap a photo and upload it to our encrypted portal or forward digital invoices via email.

- Real-Time Access: You can log in 24/7 to view reports, check invoice status, and monitor cash flow from your phone or laptop.

- Monthly Close: We reconcile every account at month-end and deliver a comprehensive packet of financial statements.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see what an AI security analyst thinks about cloud accounting.

Security and Trust in Virtual Bookkeeping Services

Naturally, security is the top concern for any business owner considering a switch. However, reputable virtual bookkeeping services are often far more secure than keeping a ledger on a local hard drive. Specifically, Giesler-Tran Bookkeeping utilizes bank-level 256-bit encryption for all data transfers. Additionally, our use of “read-only” bank access means we can view and categorize your transactions, but we cannot move funds or sign checks. Ultimately, this creates a system of internal controls that protects your assets better than a generalist office manager with full bank access ever could.

Comparing Virtual Bookkeeping Services vs. DIY Software

Admittedly, software companies market their tools as “easy enough for anyone to use.” But there is a massive difference between buying a scalpel and knowing how to perform surgery. While DIY software allows you to record transactions, it does not tell you if you are recording them correctly. For instance, misclassifying an asset as an expense or failing to reconcile a credit card account can lead to disastrous tax consequences.

Therefore, hiring professional virtual bookkeeping services bridges the gap between the tool and the strategy. We don’t just click buttons; we apply accounting principles to ensure your Profit & Loss statement reflects reality. If you are currently struggling with DIY errors, our Bookkeeping Cleanup service is the first step toward clarity.

The Financial ROI of Virtual Bookkeeping Services

Crucially, evaluating the cost of outsourcing requires a comparison to the true cost of an in-house hire. When you hire a full-time bookkeeper, you pay salary, payroll taxes, benefits, vacation time, and equipment costs. Conversely, virtual bookkeeping services operate on a flat-rate monthly model. This means you get the expertise of a full accounting department for a fraction of the cost of a single employee. Moreover, our scalable solutions grow with you, ensuring you never pay for capacity you don’t need.

To verify the cost-benefit analysis of outsourcing, you can review industry standards from the U.S. Small Business Administration.

Q&A: Choosing Virtual Bookkeeping Services

Q: Will I have a dedicated person to talk to?

A: Yes. Unlike large call centers, we assign a specific, dedicated bookkeeper to your account. You will always know who is handling your confidential data.

Q: What software do you use for virtual bookkeeping services?

A: We specialize in QuickBooks Online and Xero. These platforms offer the best integration ecosystems for modern business owners.

Q: How do I get my physical receipts to you?

A: Simply use a mobile app to snap a picture. We utilize tools like Dext or Hubdoc to extract the data instantly, so you can throw the paper away.

Q: Are your services audit-ready?

A: Absolutely. Because we attach source documents to transactions digitally, your books are always prepared for IRS scrutiny or investor due diligence.

Q: Can you help with taxes too?

A: Yes. We have a Senior Tax Accountant on staff to ensure seamless integration between your monthly books and your year-end filings.

In Summary: The Future is Virtual

Ultimately, the shift to virtual bookkeeping services is about regaining control of your time. By partnering with Giesler-Tran Bookkeeping, you trade administrative headaches for strategic insight. If you are ready to modernize your financial operations, visit our Monthly Bookkeeping page to learn more.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.