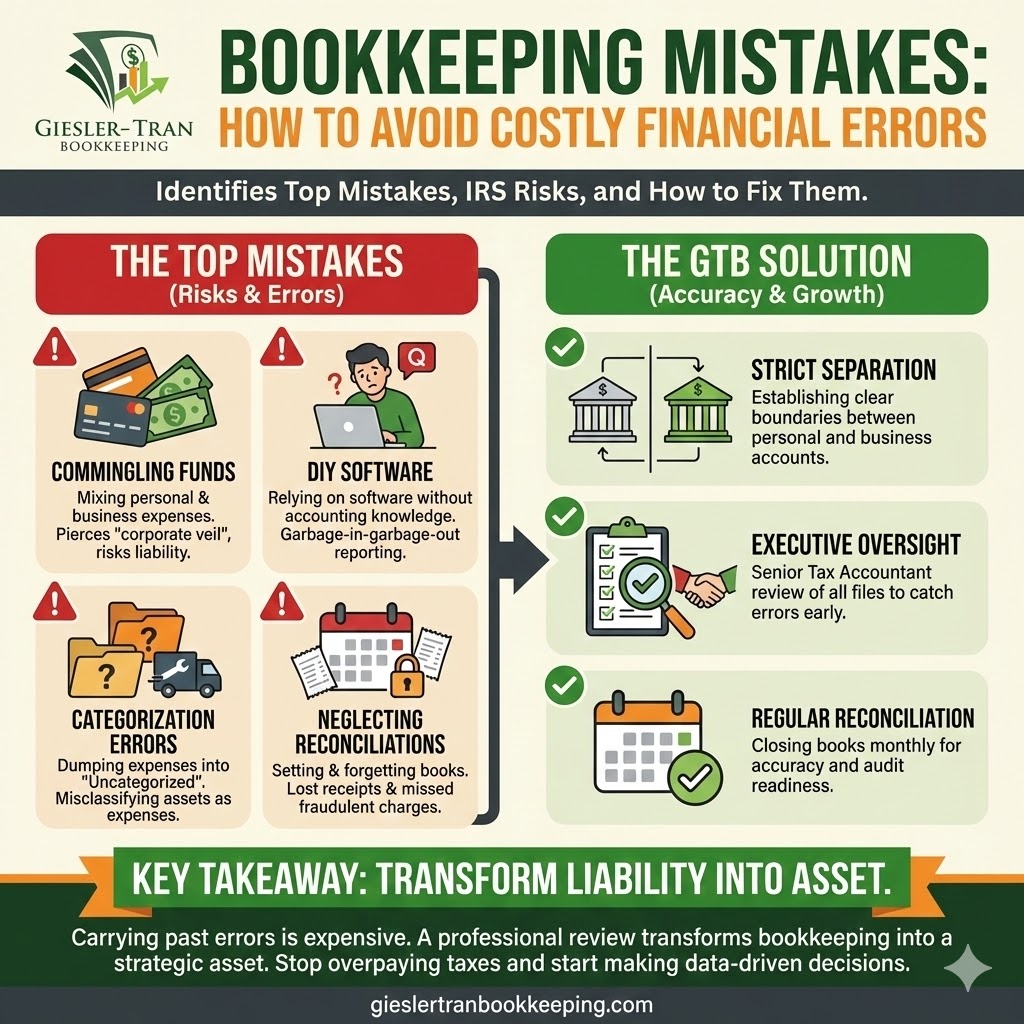

Commonly, small business owners believe that as long as money is coming in, everything is fine. However, hidden bookkeeping mistakes can silently erode your profits, trigger aggressive IRS audits, and stunt your company’s growth potential. At Giesler-Tran Bookkeeping (GTB), we have seen it all—from shoeboxes full of faded receipts to QuickBooks files that look like abstract art. Consequently, we know that identifying these errors early is critical for your financial survival. Therefore, this guide highlights the most frequent bookkeeping mistakes and explains how our expertise helps you avoid them permanently.

Top Bookkeeping Mistakes Small Businesses Make—And How We Fix Them

Why “Close Enough” is Never Good Enough in Accounting

The Reality Check: Fundamentally, most bookkeeping mistakes are not malicious; they are simply the result of busy entrepreneurs trying to wear too many hats. Unfortunately, the IRS does not care if you were “too busy” to separate your personal and business expenses. If your books are flawed, your tax return is a liability waiting to explode. Real peace of mind only comes from professional accuracy.

Listen on The Deep Dive — where we identify the pitfalls:

‘The Cost of Chaos: Commingling Funds Pierces Your Corporate Veil’

The Danger of Commingling: A Top Bookkeeping Mistake

First, we must address the most common offense: mixing personal and business finances. Often, a business owner will use the company card to buy groceries or use a personal account to pay a vendor. While this seems harmless in the moment, it creates a nightmare for your accountant. Specifically, this is one of the bookkeeping mistakes that can pierce your “corporate veil,” making you personally liable for business lawsuits.

Furthermore, the IRS views commingling as a red flag for fraud. If you cannot clearly distinguish between a business expense and a personal treat, you risk having legitimate deductions disallowed. To avoid this, GTB helps you establish a strict boundary between your identities. See IRS guidance on business accounts to understand why separation is non-negotiable.

Why DIY Software Leads to Bookkeeping Mistakes

Next, many entrepreneurs believe that buying QuickBooks is the same as hiring a bookkeeper. However, software is merely a tool, not a solution. Without accounting knowledge, users often misclassify transactions or duplicate income. Consequently, these DIY bookkeeping mistakes result in reports that look professional but are mathematically largely fiction.

For example, recording a loan deposit as “income” artificially inflates your tax bill. Conversely, failing to record depreciation misses a valuable tax shield. Therefore, relying on automation without oversight is dangerous. Our team ensures that your software is set up correctly, preventing garbage-in-garbage-out scenarios. Check our Cleanup Guide if you fear you have already fallen into this trap.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to analyze the risks.

Categorization Errors: Subtle Bookkeeping Mistakes

Additionally, where you put a transaction matters just as much as the amount. One of the most frequent bookkeeping mistakes is dumping unknown expenses into “Uncategorized Expense” or “Ask My Accountant.” While this clears the bank feed, it creates a mess that must be cleaned up later at a high hourly rate.

Similarly, misclassifying an asset (like a new truck) as an expense (like gas) distorts your Profit & Loss statement. This leads to bad decision-making because you think you are less profitable than you actually are. At GTB, our Senior Tax Accountant reviews these categories monthly. This level of oversight ensures your reports are accurate and tax-compliant. Learn more about our process on our Resources Page.

The “Set and Forget” Mistake: Neglecting Reconciliations

Finally, procrastination is the enemy of accuracy. Many businesses fall into the trap of neglecting regular reconciliations, thinking they can do it all at year-end. However, trying to remember what a $45.67 charge was from 11 months ago is nearly impossible. These delayed bookkeeping mistakes result in lost documentation and missed deductions.

Moreover, failing to reconcile monthly means you might miss fraudulent charges on your credit card until it is too late to dispute them. Consistent, monthly closing of the books is the only way to ensure financial health. According to the SBA, regular financial review is a primary trait of successful businesses.

Q&A: Fixing Your Bookkeeping Mistakes

Q: Can I just fix these mistakes myself?

A: Technically, yes, but it is risky. Without forensic accounting knowledge, you might create new errors while trying to fix old ones.

Q: What if I lost old receipts?

A: We can help you reconstruct records using bank statements and affidavits. However, moving forward, we implement digital capture tools to prevent this.

Q: How far back can you fix my books?

A: We can go back several years if necessary. Our Cleanup team specializes in bringing historical data up to compliance.

Q: Will fixing these mistakes lower my taxes?

A: Often, yes. By finding missed deductions and properly categorizing expenses, we frequently reduce tax liability.

Q: How do you prevent future errors?

A: Through executive oversight. Every file at GTB is reviewed by senior leadership to ensure quality control.

Key Takeaways

- Stop Commingling: Keep business and personal funds entirely separate to protect your liability shield.

- Review Monthly: Waiting until tax season to reconcile guarantees errors and stress.

- Verify Automation: Software is not a replacement for a human expert; it requires oversight.

- GTB Solution: We provide the senior-level review needed to catch errors before the IRS does.

In Summary: Accuracy is an Asset

Ultimately, carrying the weight of past bookkeeping mistakes is exhausting and expensive. Don’t let avoidable errors hold you back. Start your journey toward financial clarity today. At Giesler-Tran Bookkeeping, we handle the complex details so you can focus on your vision. Get your books on track now.

The Bottom Line

Chaos is expensive. Clarity is priceless.

Start your rescue mission today.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response