Effectively, avoiding top bookkeeping mistakes is the fastest way to protect your business’s cash flow. Unfortunately, many owners unknowingly commit errors like commingling funds or ignoring reconciliations until tax season arrives. Specifically, these slip-ups compound into cash surprises, tax exposure, and bad management decisions. Below, we highlight the top bookkeeping mistakes we see most often and provide practical fixes to keep your books accurate.

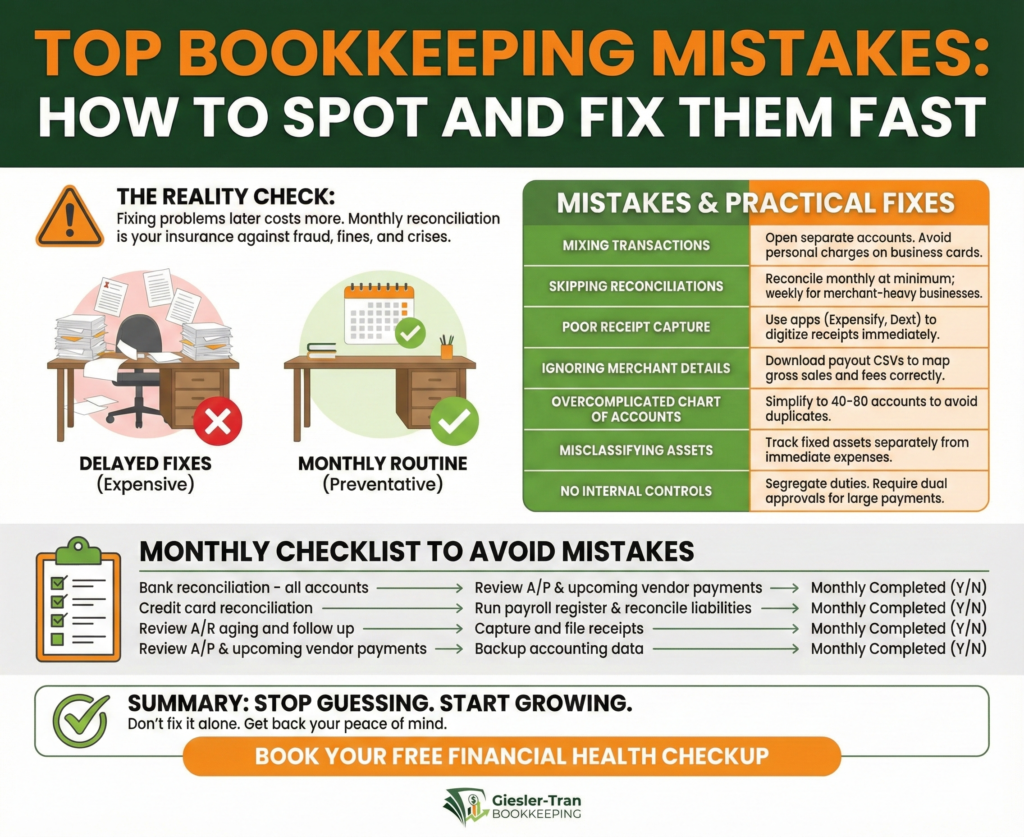

Top Bookkeeping Mistakes: How to Spot and Fix Them Fast

Small errors compound into big problems.

The Reality Check: Fundamentally, fixing bookkeeping problems later always costs more than preventing them now. Therefore, a monthly reconciliation routine is not just busy work; it is your insurance policy against fraud, tax fines, and cash flow crises.

Listen on The Deep Dive — where we dig deeper into this topic:

‘Stop Draining Your Cash: The Costliest Bookkeeping Mistakes’

Why Fixing Top Bookkeeping Mistakes Matters

First, small errors rarely stay small. Instead, they compound over time into inaccurate financial reports. Specifically, avoiding top bookkeeping mistakes ensures you are tax-ready and can make informed management decisions. Ultimately, accurate books are the foundation of a scalable business.

For more on record-keeping standards, the IRS Recordkeeping Guide offers essential compliance tips.

A Quick Story: The Hidden Fee Trap

Consider a boutique studio that kept no merchant payout reports. Initially, they relied only on bank deposits to track sales. However, after months of mismatches, the owner discovered duplicate processing fees and unrecorded refunds. Once we requested payout CSVs and reconciled deposits, we recovered several months of misposted sales adjustments. As a result, the owner implemented a monthly reconciliation routine and avoided further surprises.

Top Bookkeeping Mistakes and Practical Fixes

Next, review this list to identify gaps in your current process. Ideally, you should address these top bookkeeping mistakes immediately:

- Mixing transactions: Open separate business accounts and avoid personal charges on business cards.

- Skipping reconciliations: Reconcile monthly at minimum; weekly for merchant-heavy businesses.

- Poor receipt capture: Use apps like Expensify or Dext to digitize receipts immediately.

- Ignoring merchant details: Download payout CSVs from Stripe/Square to map gross sales and fees correctly.

- Overcomplicated Chart of Accounts: Simplify to 40–80 accounts to avoid duplicate categories.

- Misclassifying assets: Track fixed assets separately and distinguish them from immediate expenses.

- No internal controls: Segregate duties and require dual approvals for large payments.

For definitions of key terms, refer to Investopedia’s Bookkeeping Guide.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

Act as a professional bookkeeper. Identify the top bookkeeping mistakes small businesses make that can trigger IRS audits. Explain why commingling personal and business funds is the most dangerous error — and describe how Giesler-Tran Bookkeeping helps businesses avoid these mistakes by keeping clean, reconciled, and audit-ready records.

Monthly Checklist to Avoid Top Bookkeeping Mistakes

To assist you, use this checklist each month to maintain hygiene. Simply copy this into a spreadsheet or print it out.

Bank reconciliation – all accounts,Bookkeeper,,Include merchant payouts

Credit card reconciliation,Bookkeeper/Owner,,Flag personal charges

Review A/R aging and follow up on past-due,Sales/AR,,

Review A/P & upcoming vendor payments,AP,,

Run payroll register & reconcile payroll liabilities,Payroll/Bookkeeper,,

Capture and file receipts for reimbursements,Staff/Owner,,

Backup accounting data / export backups,Admin,,

Alternatively, download the ready-to-use file here: Download the CSV — Monthly Bookkeeping Checklist.

Moreover, if you have already fallen behind, our cleanup services can help you catch up fast. Then, you can maintain accuracy with our monthly support plans.

Common Questions on Top Bookkeeping Mistakes

- Q: How often should I reconcile?

- A: Monthly minimum; weekly for merchant-heavy businesses or when cash is tight.

- Q: What if I find errors from prior months?

- A: Document the issue, reconcile known items, and create adjusting entries. For large or tax-impacting changes, consult your CPA.

- Q: Can automation replace a bookkeeper?

- A: Automation reduces manual work but does not replace judgment. Bookkeepers add classification decisions, reconciliation oversight, and exception handling.

- Q: Is it okay to mix personal expenses if I reimburse the company?

- A: No. It “pierces the corporate veil” and creates tax audit risks. Keep them separate from the start.

Stop Guessing. Start Growing.

Worried you’re making too many mistakes in your books? We remove the worry and give you back your peace of mind.

You don’t have to fix this alone.

Book a complimentary Financial Health Checkup today. We’ll review your books, spot the errors, and give you a clear plan to fix them.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response