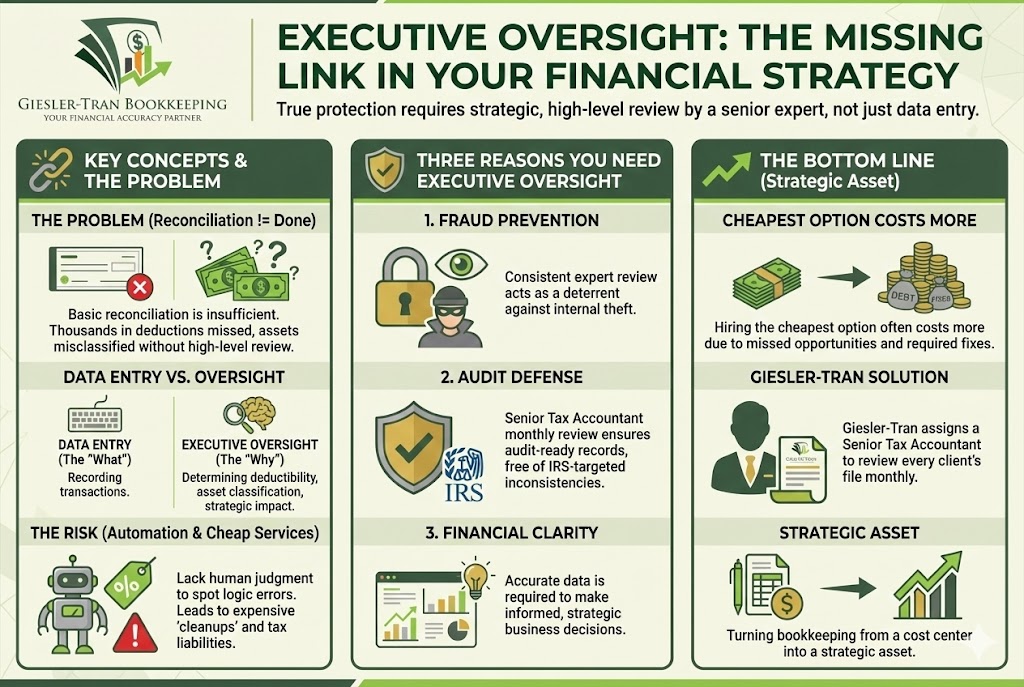

Recently, I reviewed a client’s file who believed their previous bookkeeper was doing a “great job” simply because they reconciled the bank account. However, upon deeper inspection, we found thousands of dollars in misclassified assets and missed deductions. In fact, this situation highlights a critical gap in many small businesses: the lack of executive oversight. Specifically, you need more than just a data entry clerk; you need a strategic partner who reviews your financials with a high-level perspective to ensure accuracy, compliance, and growth.

Executive Oversight: The Missing Link in Your Financial Strategy

Strategy monitors what data entry misses.

The Reality Check: Fundamentally, software automation cannot replace human judgment. Without professional executive oversight, small errors compound into massive tax liabilities. Therefore, having a Senior Tax Accountant review your monthly books isn’t a luxury; it serves as your primary defense against audits.

Listen on The Deep Dive — where we dig deeper into this topic:

‘Why You Need a Second Set of Eyes’

What is Executive Oversight in Bookkeeping?

To define it simply, executive oversight means applying a high-level review process to your daily financial transactions. While a junior bookkeeper enters the data, a senior expert analyzes that data for logic, tax compliance, and cash flow trends. Consequently, this process catches expensive mistakes before they become permanent records.

The difference between data entry and executive oversight

Typically, data entry focuses on the “what” (recording a receipt), whereas executive oversight focuses on the “why” (is this a deductible expense or an asset?). For example, without this level of review, you might miss key tax deductions that a seasoned eye would spot immediately.

Why Your Business Needs Executive Oversight

Furthermore, beyond basic compliance, strong oversight protects your assets. Specifically, here are three reasons why you should prioritize executive oversight in your financial strategy:

- Fraud Prevention: Unfortunately, small businesses face significant risk from internal fraud. However, consistent executive oversight deters theft because employees know an expert watches the books.

- Audit Defense: Crucially, the IRS looks for inconsistencies. By having a Senior Tax Accountant review your books monthly, you ensure your records remain audit-ready year-round.

- Financial Clarity: Ultimately, you cannot make good decisions with bad data. Thus, true executive oversight ensures your P&L accurately reflects your true performance.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight. Why is oversight critical?

The High Cost of Missing Executive Oversight

Frequently, business owners try to save money by hiring the cheapest option. Yet, the hidden cost of missing executive oversight far exceeds the monthly savings. For instance, we recently helped a client who paid a “cheap” bookkeeper for years, only to realize they had misclassified $50,000 in revenue. As a result, the cleanup cost and amended tax returns significantly impacted their cash flow.

Therefore, when you evaluate bookkeeping costs, remember that you pay for the expertise that protects your wealth, not just the time spent clicking buttons.

Common Questions About Executive Oversight

Q: Does my small business really need executive oversight?

A: Yes. Even small businesses face complex tax rules. In fact, smaller entities often face higher audit risks because they lack internal controls.

Q: How does Giesler-Tran provide this oversight?

A: Unlike generic firms, we assign a Senior Tax Accountant to review every client’s file monthly. This ensures we catch discrepancies immediately.

Q: Will this slow down my bookkeeping?

A: No. Actually, true executive oversight speeds up year-end processing because we solve problems in real-time rather than fixing a mess at tax time.

In Summary: Oversight is an Investment

Ultimately, executive oversight transforms your bookkeeping from a cost center into a strategic asset. Don’t leave your financial future to chance; ensure a qualified expert reviews your numbers every single month.

The Bottom Line

Ready to add a strategic partner to your team?

Get the executive oversight your business deserves.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.