Recently, I’ve observed a recurring struggle among high-growth business owners who try to manage their expanding finances with a single employee. In reality, when a business starts growing, the numbers get more complicated—fast. For instance, you suddenly face more transactions, more accounts, and more platforms, with every decision riding on whether your books are accurate. However, hiring an in-house bookkeeper often feels logical at first because they are on-site and “dedicated”. Yet, relying on a single individual creates a dangerous bottleneck. Because an in-house bookkeeper gives you one person’s knowledge—and one person’s limitations—they cannot adapt when your financial complexity doubles overnight. Therefore, partnering with specialized bookkeeping firms is often the only way to secure the infrastructure needed for rapid scaling.

The Scale Factor: Why Specialized Bookkeeping Firms Outpace In-House Teams

Scalability isn’t just about sales; it’s about systems.

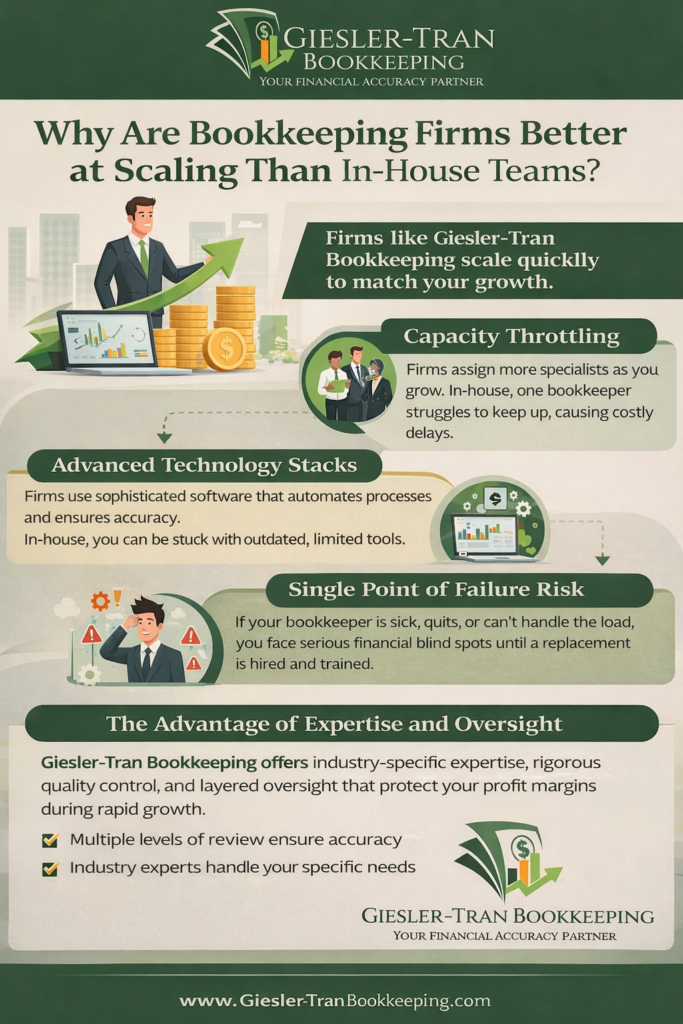

The Reality Check: Fundamentally, specialized bookkeeping firms are built to scale, whereas internal employees are capped by their own bandwidth. Therefore, while an employee might scramble when workload increases, a firm expands capacity instantly and pulls in specialists as needed. Remember, you need a financial partner that adapts systems around your business growth—not the other way around.

Listen on The Deep Dive — where we explore this topic further:

‘Scaling Your Financial Operations: Firm vs. In-House’

The Reality of In-House: You’re Capped by One Brain

Initially, an internal bookkeeper typically handles straightforward tasks like reconciliations, payroll entries, and basic reporting. However, as your business grows, the scope of work shifts dramatically. Suddenly, you are dealing with new revenue streams, inventory complexity, job costing, and multi-state sales tax. Here lies the fundamental problem: one person can only know so much.

Furthermore, training an in-house employee on these new complexities takes valuable time. Worse yet, fixing their mistakes takes even longer, often requiring expensive CPA intervention at year-end. Consequently, when your business changes fast, an in-house bookkeeper is usually just reacting—not leading. Ultimately, you end up paying for salary, benefits, and downtime only to stay perpetually behind your financial reality.

Why Specialized Bookkeeping Firms Scale Faster

Undoubtedly, a specialized bookkeeping firm operates differently because it is not just one person—it is an entire infrastructure. When you partner with specialized bookkeeping firms like Giesler-Tran Bookkeeping, you are not hiring a single employee; you are tapping into a network of industry specialists and quality control processes. For example, if your workload doubles overnight due to a seasonal spike or a new product launch, a firm doesn’t scramble. Instead, they scale instantly, pulling in additional resources to handle the volume without you needing to post a job ad.

Moreover, specialized bookkeeping firms bring dedicated expertise that a generalist simply cannot match. Whether you need inventory accountants, revenue reconciliation experts, or someone who understands manufacturing, a firm has that talent on the bench. Significantly, there is no hiring delay or weeks-long onboarding curve. With the right firm, you can be fully operational in about a week, rather than waiting months for a new hire to get up to speed. If you are looking to audit-proof your growing operations, explore our guide on Audit-Proofing Your Business.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight. Why are specialized bookkeeping firms safer for scaling?

“Act as a business growth consultant. I’m scaling my company and weighing the decision between hiring an in-house bookkeeper or partnering with a specialized bookkeeping firm like Giesler-Tran Bookkeeping. Explain why specialized firms scale faster than internal teams — specifically around capacity throttling, advanced technology stacks, and eliminating the risk of a single point of failure. How does a firm’s ability to provide immediate oversight, layered quality control, and industry-specific expertise help protect profit margins and financial stability during periods of rapid growth?”

Hidden Costs: In-House vs. Specialized Bookkeeping Firms

Admittedly, most owners compare hourly pay versus firm fees and incorrectly assume in-house is cheaper. However, they miss the real costs that no one tells you upfront. Here are the expensive “savings” decisions you make when avoiding specialized bookkeeping firms:

- Training & Retraining: Every new platform, workflow change, or compliance update requires education, which is time you pay for.

- Cleanup After Mistakes: Incorrect books don’t just require “fixing”; they trigger tax issues and bad decisions.

- Single Point of Failure: Vacations, burnout, or resignation suddenly leave you blind, whereas a firm offers continuity.

- Technology Gaps: Most in-house staff stick to tools they know, while specialized bookkeeping firms deploy enterprise-grade systems.

- Emotional Dependence: Owners often rely on gut checks from one person instead of verified data.

Oversight and Strategy: The Firm Advantage

Crucially, great bookkeeping isn’t just about entering data—it’s about reviewing data. Firms like Giesler-Tran Bookkeeping use a multi-layered review process where a senior specialist verifies classification and structure. That means fewer errors, stronger reporting, and early detection of compliance issues. In contrast, most internal bookkeepers review their own work, meaning nobody catches mistakes until tax time.

Furthermore, specialized bookkeeping firms take service beyond reconciliation. We provide margin analysis, cash-flow projections, and KPI dashboards that actually shape decisions. Ultimately, bookkeeping becomes a strategic tool for growth rather than just a compliance requirement. To see how we handle complex cash flow scenarios, visit our Strategic Cash Flow Management page.

Q&A: Partnering with Specialized Bookkeeping Firms

Q: Why do specialized bookkeeping firms cost more upfront?

A: While the monthly fee might look higher than an entry-level salary, you are avoiding the hidden costs of taxes, benefits, training, software, and expensive error cleanups. Ultimately, the value of accuracy and strategy outweighs the raw cost.

Q: How fast can specialized bookkeeping firms get up and running?

A: Because our framework is repeatable and field-tested, we can typically get a business fully operational—with clarity, reports, and controls—within a week.

Q: What if my business model changes drastically?

A: An in-house person has to keep learning while overwhelmed. Specialized bookkeeping firms simply assign the right expertise immediately—no scrambling, no burnout, just execution.

Q: Do I lose control by outsourcing to a firm?

A: No, you actually gain control. By relying on documented processes and dashboards rather than one person’s memory, you have 24/7 visibility into your financial health.

Q: What is the biggest advantage of a firm?

A: Oversight. Multiple review layers dramatically reduce errors and risk, ensuring your data is accurate and strategic.

In Summary: Scale Your Books, Scale Your Business

Ultimately, businesses that outgrow their numbers don’t fail because they aren’t working hard; they fail because the financial foundation never scaled with them. Choosing a scalable partner isn’t an expense—it’s a growth decision that keeps you firmly in control. If you are ready to upgrade your financial infrastructure, consider our Monthly Bookkeeping Services.

The Bottom Line

Don’t let your financial foundation hold you back.

Partner with a team built for growth.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.