The importance of bookkeeping is often underestimated by enthusiastic entrepreneurs who prefer to focus on product development rather than spreadsheets. In reality, neglecting your financial records is akin to driving a car with a painted-over windshield; you might be moving, but you will eventually crash. For instance, a recent study suggested that 82% of business failures are due to poor cash flow management, a direct result of sloppy records. However, when you prioritize financial clarity, you gain the ability to navigate economic downturns with confidence. Therefore, understanding the true importance of bookkeeping—beyond just keeping the IRS happy—is the first step toward building a legacy that lasts. Because we believe that clarity equals control, Giesler-Tran Bookkeeping is dedicated to transforming your data into your most valuable strategic asset.

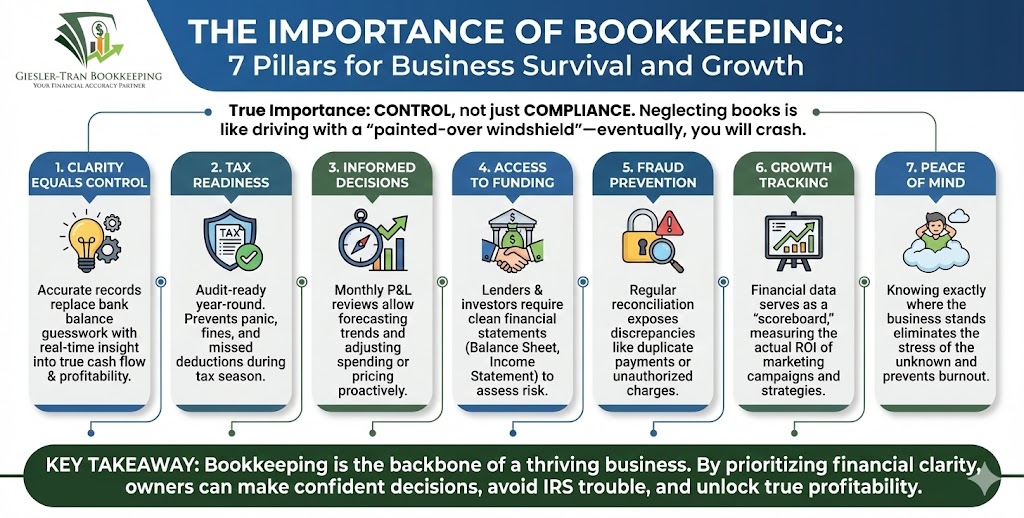

The Importance of Bookkeeping: 7 Pillars for Business Survival and Growth

Control your money, or it will control you.

The Reality Check: Fundamentally, the importance of bookkeeping comes down to one thing: control. When your records are accurate and current, you can track cash flow, make confident decisions, and stay tax-compliant. Conversely, disorganized books lead to missed deductions, IRS penalties, and sleepless nights. Remember, you cannot grow what you do not measure.

Listen on The Deep Dive — where we explore this topic further:

‘The 7 Pillars of Profitability: Bookkeeping Is Business Survival’

1. Clarity Equals Control

Initially, business owners often rely on their bank balance to judge their success. However, a bank balance is a liar; it does not account for uncleared checks, upcoming payroll, or accrued credit card debt. Accurate bookkeeping gives you real-time insight into your true cash flow, profits, and expenses.

Specifically, you will know exactly how much money is coming in, where it is going, and whether your pricing needs adjustment. Consequently, this clarity leads to confidence. When you understand your margins, you stop guessing and start executing strategies that actually work. For a deeper look at how clarity impacts strategy, read about our Strategic Advantage.

2. Tax Time Without the Panic

Undoubtedly, tax season is brutal if your books are a mess. Unfortunately, late filings, missed deductions, or calculation errors can cost you thousands in fines and overpayments. Furthermore, the IRS does not accept “I didn’t know” as a valid defense during an audit.

Therefore, the importance of bookkeeping shines brightest in April. Proper record-keeping keeps you audit-ready year-round. So, when your CPA asks for reports, you already have clean, accurate data ready to go. If you are currently behind, our Bookkeeping Cleanup service can rescue you from the chaos.

3. Informed Financial Decisions

Crucially, from hiring a new employee to investing in expensive equipment, your books tell the story of what your business can afford. Without this data, every purchase is a gamble. Ideally, you should be checking your Profit and Loss statement monthly to spot trends.

With well-maintained records, you can forecast cash flow and make data-driven decisions that grow profit instead of shrinking it. For example, seeing a rise in “Cost of Goods Sold” might prompt you to renegotiate with suppliers immediately, rather than waiting until the end of the year when the damage is done.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see what an AI business analyst thinks about record-keeping.

4. Easier Access to Funding

Eventually, most businesses need capital to scale. However, lenders and investors want proof, not guesses. Specifically, they require clear Balance Sheets and Income Statements to assess risk. Clean books show your business is healthy, trustworthy, and well-managed.

Consequently, having organized financials makes it significantly easier to secure loans or attract investment when opportunity knocks. To verify what lenders look for, you can review the guidelines from the U.S. Small Business Administration (SBA).

5. Preventing Fraud and Costly Mistakes

Surprisingly, internal fraud is more common in small businesses than in large corporations. When transactions are recorded and reconciled regularly, discrepancies stand out fast. For instance, a duplicate payment to a vendor or an unauthorized credit card charge becomes obvious during the monthly reconciliation process.

Thus, good bookkeeping protects your business from internal fraud, overpayments, and missed invoices. It acts as your built-in safeguard for financial accuracy. Without this oversight, you are leaving your vault door wide open.

6. Tracking Growth Over Time

Ultimately, your financial data is your scoreboard. By comparing month-to-month or year-to-year reports, you identify patterns. You can see clearly what is working, what is not, and where to adjust your efforts.

Bookkeeping helps you measure progress with precision, not guesswork. If you see that marketing spend increased by 20% but revenue remained flat, you know immediately that your campaign failed. This feedback loop is essential for agile management.

7. Peace of Mind You Can’t Buy

Finally, the mental toll of financial chaos leads to burnout. When your books are up to date, you can focus on what really matters—serving clients and growing your brand. Bookkeeping removes the stress of the unknown.

You always know where your business stands. Instead of waking up at 3 AM worrying about cash flow, you sleep soundly knowing your Monthly Bookkeeping is handled by experts.

Q&A: The Importance of Bookkeeping

Q: Can I just do my own bookkeeping?

A: Yes, in the very early stages. However, as transaction volume grows, your time is better spent on sales. Additionally, DIY errors often cost more to fix than hiring a pro initially.

Q: What is the difference between bookkeeping and accounting?

A: Bookkeeping is the daily recording of transactions. Accounting is the high-level analysis and tax strategy based on that data. You need both to succeed.

Q: How often should my books be updated?

A: Ideally, weekly. At a minimum, you must reconcile monthly. Waiting until year-end guarantees missed deductions and high stress.

Q: Does bookkeeping help with audits?

A: Absolutely. The IRS requires proof for every deduction. Professional bookkeeping ensures digital receipts are attached to every transaction, making audits painless.

Q: Why is the “importance of bookkeeping” stressed for valuation?

A: Because buyers buy cash flow. If you cannot prove your profit history with clean books, your business is essentially worthless to an acquirer.

In Summary: The Backbone of Business

Ultimately, bookkeeping isn’t optional; it is the backbone of every thriving business. By embracing the importance of bookkeeping, you unlock the ability to make informed decisions and avoid IRS trouble. If you are ready to gain financial clarity, Giesler-Tran Bookkeeping is here to help.

The Bottom Line

Clean books. Confident decisions.

Unlock bigger profits today.

Book Your Free Financial Evaluation

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

2 Responses