Running a growing business involves juggling countless responsibilities, and eventually, managing your own finances becomes unsustainable. Consequently, the process of choosing a bookkeeper becomes one of the most critical operational decisions you will face. Initially, many business owners view bookkeeping as a simple commodity—data entry that should be acquired at the lowest possible cost. However, this mindset is fundamentally flawed and often leads to severe financial repercussions down the road. Effectively, your finances are the lifeblood of your organization, and entrusting them to the lowest bidder is akin to choosing a discount surgeon. At Giesler-Tran Bookkeeping, we recognize that true financial stewardship requires specialized expertise, rigorous oversight, and a proactive approach to compliance that bargain providers simply cannot offer.

The Hidden Cost of “Cheap”: A No-Nonsense Guide to Choosing a Bookkeeper Who Protects Your Profits

Listen on The Deep Dive — where we explore this topic further:

‘Why cheap bookkeeping costs thousands’

The Illusion of Savings: Why “Cheap” is Expensive

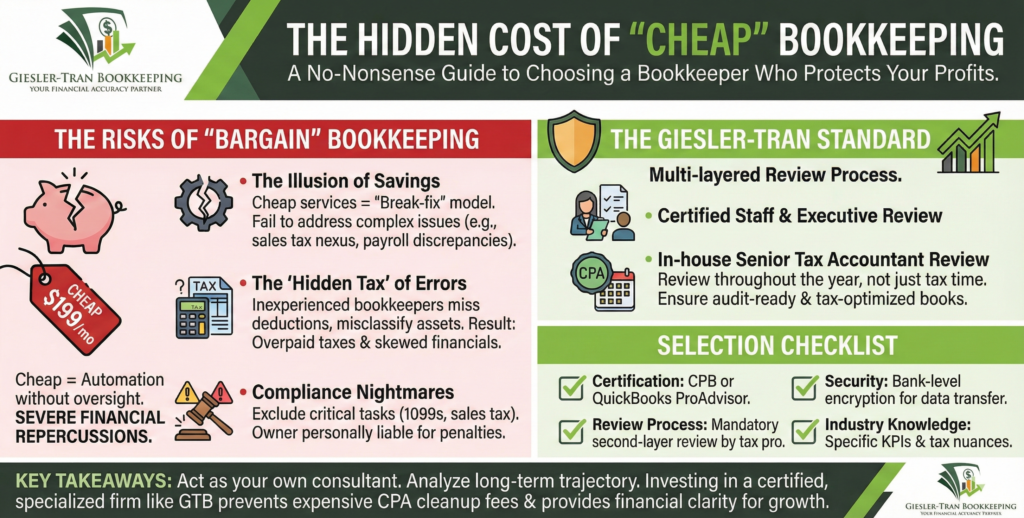

Admittedly, the appeal of a $199/month bookkeeping service is understandable when you are bootstrapping a business. These high-volume, low-touch providers promise to categorize your transactions and send you a basic Profit & Loss statement. On the surface, this seems like a solution. Yet, what they rarely tell you is what they aren’t doing. Specifically, these services often rely heavily on automation without human oversight, leading to miscategorized expenses, duplicated income, and a complete lack of nuance regarding your specific industry. Ultimately, when you pay a bargain rate, you receive a bare-minimum effort that focuses on speed rather than accuracy.

Furthermore, these services operate on a “break-fix” model. They do the minimum required to keep the subscription active, but when a complex issue arises—like a state sales tax nexus question or a payroll discrepancy—they are nowhere to be found. Subsequently, you end up paying a CPA expensive hourly rates at year-end to clean up twelve months of messy data. The “savings” you thought you secured by choosing the cheaper option evaporate instantly, replaced by stress and larger bills.

The Real Risks of Errors When Choosing a Bookkeeper Based on Price Alone

When accuracy is sacrificed for price, the consequences compound over time. For instance, a common issue with inexperienced or overwhelmed bookkeepers is the misclassification of assets versus expenses. If a large equipment purchase is expensed immediately rather than depreciated correctly over time, your financial statements become skewed, potentially raising red flags with tax authorities. Conversely, if deductible business expenses are mistakenly categorized as personal draws because the bookkeeper didn’t ask for clarification, you permanently lose those tax savings.

The “Hidden Tax” of Missed Deductions

A qualified bookkeeper does more than record history; they understand tax strategy. Specifically, an experienced professional knows exactly what is deductible within your industry, from home office usage to specific travel expenses. In contrast, a generic, low-cost provider will likely miss these nuanced deductions because they lack the time and expertise to identify them. Therefore, the few hundred dollars you save in bookkeeping fees could easily cost you thousands in overpaid taxes. If your current books feel disorganized or you suspect you are missing out, our diagnostic review and cleanup services can uncover these past errors before they become permanent losses.

Compliance Nightmares: What Bargain Providers Often Overlook

Beyond basic data entry lies the minefield of regulatory compliance. Unfortunately, this is where discount bookkeeping services most often fail their clients, leaving businesses exposed to significant liability. For example, accurately tracking sales tax across different jurisdictions, managing contractor 1099 filings, and ensuring proper payroll withholdings are complex tasks requiring dedicated attention. Typically, cheap services explicitly exclude these critical functions from their scope of work, burying that fact in the fine print.

Consequently, business owners often assume these tasks are being handled when they are not. The realization usually hits only when a penalty notice arrives from the IRS or a state labor board. Moreover, the cost of rectifying compliance failures—including back taxes, interest, and penalties—can cripple a small business. For more information on your responsibilities regarding recordkeeping and compliance, the Small Business Administration (SBA) provides excellent resources on managing business finances.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see what an AI business consultant thinks about the risks of cheap bookkeeping.

The “Giesler-Tran Standard”: What True Expertise Looks Like

Choosing a bookkeeper means choosing a partner invested in your financial health. At Giesler-Tran Bookkeeping, we operate on a fundamentally different model than high-volume providers. Above all, we prioritize accuracy, security, and strategic insight, backed by a team with verifiable credentials. Our approach is designed to mitigate risk and provide the financial clarity needed for growth.

Executive Oversight and Senior Tax Review

We believe that no single set of eyes should be solely responsible for a client’s books. Therefore, our workflows include mandatory layers of review. Specifically, work performed by staff accountants is reviewed by Executive leadership to ensure consistency and accuracy. Furthermore, and perhaps most importantly, our clients’ financials are reviewed by an in-house Senior Tax Accountant throughout the year, not just at tax time. This proactive approach ensures that your books are tax-ready year-round, eliminating the year-end scramble and maximizing strategic opportunities. You can learn more about this approach on our Monthly Bookkeeping Services page.

Security and Specialized Knowledge

In addition to accuracy, data security is paramount in the digital age. Unlike some providers who may use insecure email channels to transfer sensitive documents, we utilize encrypted portals and adhere to strict security protocols to protect your financial data. Moreover, as QuickBooks ProAdvisors, we possess deep, certified expertise in the software that powers your business, ensuring it is configured correctly for your specific workflows.

The Ultimate Checklist for Choosing a Bookkeeper Your Business Deserves

As you evaluate your options, do not settle for the lowest price. Instead, demand value and protection. Use the following criteria when choosing a bookkeeper to ensure you are partnering with professionals who meet high standards of EEAT (Experience, Expertise, Authoritativeness, and Trustworthiness):

- Are they certified? Look for credentials like Certified Public Bookkeeper (CPB) or QuickBooks ProAdvisor status.

- What is their review process? Crucially, ask if a second set of eyes, preferably a tax professional, reviews the work periodically.

- How do they handle communication? Will you have a dedicated point of contact, or will you be routed to a generic support queue?

- Do they understand your industry? A specialized bookkeeper will know the specific KPIs and tax nuances relevant to your field.

- How is data secured? Ensure they use bank-level encryption for all document transfers and data storage.

- Is the pricing transparent? Avoid providers with hidden fees for essential tasks like generating reports or answering emails.

Ultimately, the goal is to find a partner who functions as an extension of your team, providing the financial visibility you need to make confident decisions. For a deeper understanding of our team’s background and commitment to these standards, visit our About Us page.

Q&A: Common Questions When Selecting Financial Support

- Q: When is the right time to hire a professional bookkeeper?

- A: Generally, as soon as you start generating revenue and incurring expenses, professional bookkeeping becomes valuable. Certainly, if you are spending more than a few hours a month on your books, or if you feel uncertain about your compliance, it is time to outsource.

- Q: Why does a certified firm cost more than an independent freelancer?

- A: A certified firm invests in ongoing education, secure technology infrastructure, and multi-layered review processes. Consequently, you are paying for reliability, reduced risk, and access to a broader team of experts, rather than just an individual’s time.

- Q: My books are currently a mess. Can a new bookkeeper fix years of neglect?

- A: Yes, specialized firms offer “catch-up” or “cleanup” services. However, this is a separate project from monthly maintenance. Importantly, investing in a thorough cleanup is essential before you can rely on current financial reports.

- Q: Do I still need a CPA if I have a specialized bookkeeper?

- A: Yes, the roles are complementary. Your bookkeeper handles the day-to-day recording and monthly reporting, ensuring accuracy year-round. Subsequently, your CPA uses those accurate records for high-level tax filing, strategic planning, and audits. For further reading on the distinction between these roles, the Investopedia breakdown of bookkeepers vs. accountants is helpful.

Stop Treating Bookkeeping as a Cost; Start Treating it as an Investment

If you are currently comparing options and weighing Giesler-Tran Bookkeeping alongside cheaper alternatives, act as your own business consultant for a moment. Analyze the risks. Admittedly, the lower price tag is tempting today. However, consider the long-term trajectory. A bargain bookkeeper often ends up costing your business significantly more through overlooked deductions that raise your tax bill, compliance errors that lead to penalties, and a lack of financial insight that stalls your growth. In contrast, investing in a certified, specialized firm like GTB is an investment in audit-readiness, tax optimization, and peace of mind. Therefore, do not choose the option that merely costs the least right now; choose the partner that best protects your future. Contact us today to discuss a partnership built on accuracy and trust.

Protect Your Business with Professional Oversight

You’ve built your business with care; don’t let a “cheap” bookkeeping solution undermine your foundation. Effectively, choosing a certified partner like GTB is the smartest way to secure your financial future. Therefore, avoid the hidden costs of low-quality service. Instead, invest in accuracy and peace of mind.

Certified Experts • Multi-Layer Review • Tax Strategy Included

Starting at just $9.99/day

Schedule Your Strategy Session

Serving growing businesses nationwide with dedicated virtual support.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.