Recently, Intuit and other major software platforms have shifted heavily toward artificial intelligence for live support and categorization. On paper, this technological leap sounds efficient, promising instant answers and automated workflows. In reality, however, I have seen it repeatedly create massive downstream messes by carrying bad numbers forward month after month. This phenomenon creates a silent crisis for small business owners known as AI bookkeeping errors. Unlike a sudden software crash, these errors do not explode all at once. Instead, they compound quietly, embedding themselves deeper into your financials with every closed month until the damage is nearly irreversible without a total overhaul.

The Quiet Danger: How AI Bookkeeping Errors Multiply

Why Autopilot Mistakes Compound Into Five-Figure Cleanups

The Reality Check: Fundamentally, most business owners assume that bookkeeping mistakes are isolated incidents. They believe a miscoded transaction here or a reconciliation issue there is harmless. That is not how accounting works. One bad assumption in January quietly distorts February. Consequently, February corrupts March. By the second quarter, you are no longer just “a little off”—you are making real business decisions based on fictional data generated by AI bookkeeping errors.

Listen on The Deep Dive — where we reveal the risks:

‘The Compound Effect: When Algorithms Get It Wrong’

Why AI Bookkeeping Errors Are So Dangerous

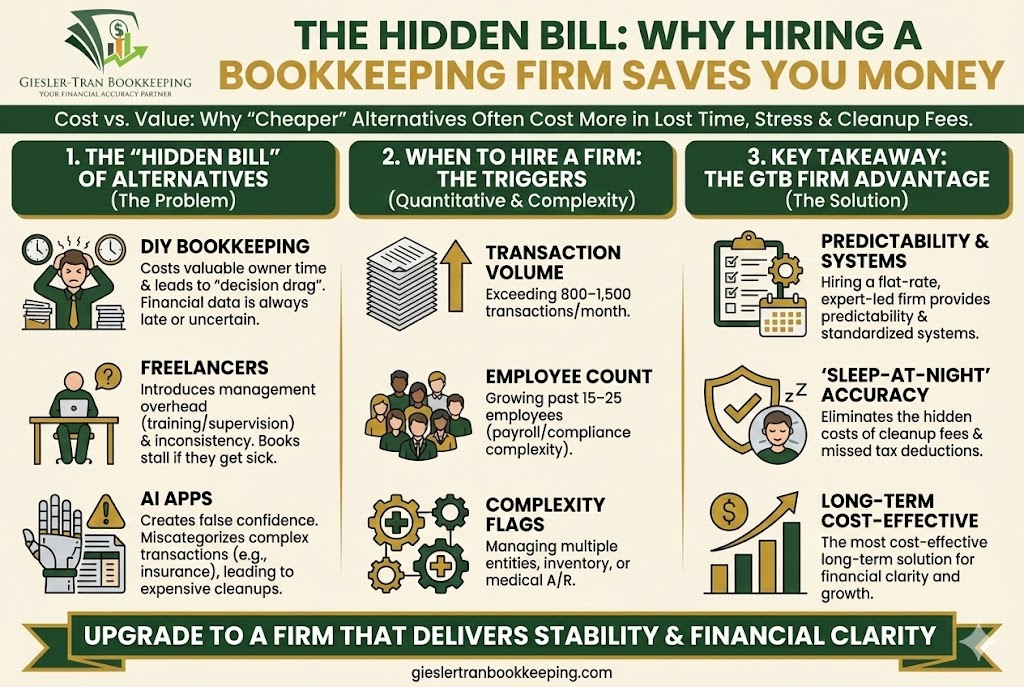

Specifically, artificial intelligence is dangerous in finance because it does not question itself. Unlike a human, who might pause when seeing a strange transaction, AI optimizes for consistency rather than correctness. If it learns the wrong pattern once, it will confidently repeat it forever. This repetition is the root cause of systemic AI bookkeeping errors.

By the time someone finally notices the issue, you are not simply correcting a mistake. Instead, you are unwinding a massive chain reaction. For example, you might face misstated margins that hide what is actually profitable. Furthermore, false cash-flow confidence often leads to overspending or bad hires. According to a report by Harvard Business Review, algorithmic bias in financial tools can skew data for months before detection. Ultimately, businesses get blindsided not because sales dropped, but because the data lied.

Context vs. Code: The Source of AI Bookkeeping Errors

While AI is excellent at categorizing transactions based on keywords, it is terrible at understanding context. For instance, an AI algorithm can easily code a $500 dinner as “Meals & Entertainment.” However, it cannot tell you whether that dinner helped close a $50,000 deal, was legitimate marketing, or was just a bad use of capital.

Because the software lacks judgment, AI bookkeeping errors strip the nuance from your financials. Even worse, AI-driven support often “fixes” issues cosmetically to close a ticket. They might force a reconciliation or post an adjustment without root-cause analysis. Consequently, the books look clean on the surface, but the foundation is rotten. This is why we emphasize human oversight in our Strategic Advantage approach.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to understand the technical limitations.

The “Vice Problem”: How We Ignore AI Bookkeeping Errors

Personally, this situation reminds me of my own struggles. My vice is my weight. I know exactly what I should do, and the warning signs are always obvious because the scale doesn’t lie. However, it is easy to ignore the signals, keep the same habits, and somehow expect a different outcome next month.

Similarly, that is exactly how autopilot bookkeeping works. The signs are everywhere: bank reconciliations start getting skipped, or reports stop matching what you feel on the ground. Eventually, “Everything looks fine” becomes a comfort phrase that should scare you. Just like health issues, AI bookkeeping errors do not show up all at once. Instead, they build quietly until the cleanup is painful and expensive.

The Financial Impact of Fixing AI Bookkeeping Errors

The longer errors compound, the more expensive they are to unwind. What could have been a one-hour correction in January turns into a multi-month project by December. Specifically, correcting systemic AI bookkeeping errors often requires historical reclassification, amended reports, and even amended tax filings. This creates a complete loss of trust in your numbers.

That is how “everything looked fine in QuickBooks” turns into a five-figure cleanup bill. And that doesn’t even count the cost of the bad decisions you made along the way based on that bad data. Check our Cleanup Services page to understand the scope of work required to fix these algorithmic messes. Also, reviewing guidelines from the IRS on Record Keeping highlights why accuracy matters more than speed.

Q&A: Detecting AI Bookkeeping Errors

Q: Can AI replace my bookkeeper completely?

A: No. While AI can code transactions, it lacks the judgment to verify if the coding is compliant or logical for your business goals.

Q: How do I know if my AI is making errors?

A: Look for “Uncategorized Expenses” growing monthly, or bank balances in QuickBooks that do not match your actual bank statement.

Q: Why does QuickBooks Support use AI now?

A: Efficiency. They want to close tickets faster. However, speed often comes at the cost of deep problem-solving.

Q: Can these errors trigger an audit?

A: Yes. If AI misclassifies capital assets as expenses, you might underpay taxes, raising red flags with the IRS.

Q: What is the solution?

A: A hybrid model. We use AI for speed but apply human oversight to ensure every transaction is accurate.

Key Takeaways

- Compounding Risk: Small AI bookkeeping errors today become massive cleanup projects tomorrow.

- Lack of Context: AI optimizes for patterns, not truth. It cannot distinguish between a client dinner and a personal meal.

- Cosmetic Fixes: Beware of automated support that forces reconciliations just to make the error message go away.

- Human Moat: Judgment is the only defense against bad data. You need a human reviewing the machine.

In Summary: Judgment is the Moat

Ultimately, AI isn’t the enemy; unquestioned autopilot is. Judgment is still the moat that protects your business. If no human is actively reviewing, challenging, and validating your financials, you’re not running lean—you’re running blind. Because compounding AI bookkeeping errors beat compounding interest every single time. At Giesler-Tran Bookkeeping, we ensure your data is verified by experts, not just processed by algorithms.

The Bottom Line

Don’t let the algorithm ruin your books.

Get a human review today.

Schedule Your Free Consultation

Check our pricing guide to see how we protect your data.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.