Small Business Financial Management: From Basic Books to Advanced Growth

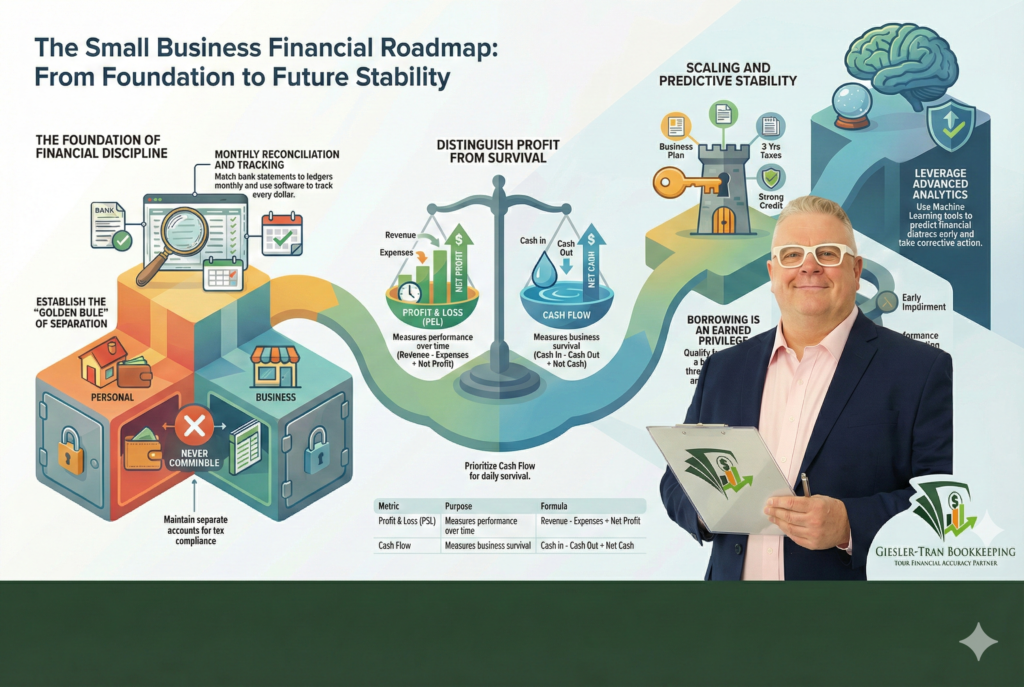

Small Business Financial Management is the absolute bedrock of stability in an increasingly volatile global economy. Specifically, business owners today face tightening capital requirements and fluctuating labor markets that make the margin for error slimmer than ever before. However, many entrepreneurs still treat their finances as an afterthought, focusing solely on product development while their […]

Reconciliation Services Camas: The First Line of Defense for Your Business

If you are a business owner searching for reconciliation services Camas, you likely already suspect that your books are not telling you the whole truth. Messy or unreconciled books aren’t just a minor administrative inconvenience; they are a significant liability. Consequently, bank reconciliation serves as the absolute foundation of trustworthy financials, yet it remains one […]

Hiring a Tax Professional: Filtering the Noise During Tax Season

Right now, your email inbox likely resembles a war zone. Specifically, between January and April, every CPA, franchise tax firm, and “instant refund” service comes out of the woodwork, flooding business owners with desperate marketing. Consequently, the process of hiring a tax professional feels less like a strategic decision and more like a game of […]

The Defensible Audit Trail: Why Spreadsheets Fail & How QBO Protects You

Effectively, creating a defensible audit trail is the single most important step you can take to protect your growing business from IRS scrutiny. However, many small business owners start with spreadsheets because they are flexible, familiar, and “free.” Unfortunately, what works for a hobbyist fails when revenue streams become complex. Specifically, spreadsheets lack the ability […]

Bookkeeping Cleanup: How to Fix a Year of Messy Books in 30 Days

Overwhelmingly, fixing a full year of bad accounting can feel like an impossible task, but the right bookkeeping cleanup process can turn chaos into clarity faster than most business owners realize. Often, one missed month quietly becomes three, three roll into twelve, and suddenly you’re staring at financial reports that don’t match reality. Consequently, ignoring […]

Audit-Ready Books: Your Best Defense and Biggest Asset

Initially, most business owners view bookkeeping as a simple administrative chore. However, as the business grows, the stakes get higher. Suddenly, you aren’t just recording expenses; you are building a legal defense. At Giesler-Tran Bookkeeping (GTB), we deliver more than just accurate records; we build audit-ready books. This strategic approach helps you save money, reduce […]

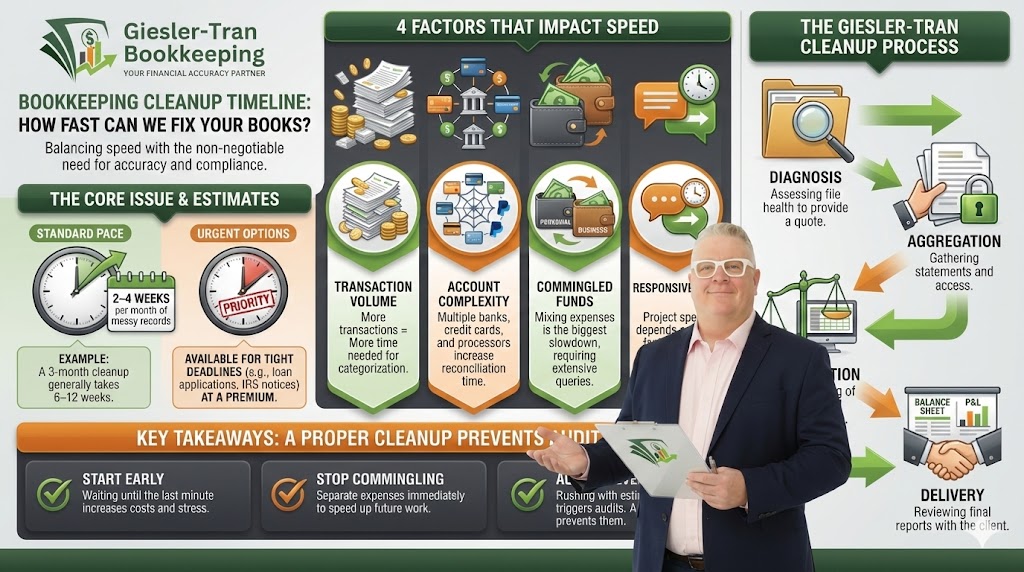

Bookkeeping Cleanup Timeline: How Long Does a Financial Reset Take?

Recently, new clients have come to us in a panic because tax deadlines are looming and their financial records are in disarray. Naturally, their first anxious question is often: “How fast can you get my books in order?” While we pride ourselves on efficiency at Giesler-Tran Bookkeeping, the honest answer depends on several specific variables […]

Cash vs Accrual Accounting: Which Method Fits Your Business?

Effectively, choosing between cash vs accrual accounting is one of the first and most critical financial decisions a business owner makes. However, many entrepreneurs simply default to whatever their software suggests without understanding the impact. Specifically, this choice determines when you pay taxes, how you view your profits, and whether you can secure a loan. […]

Top Bookkeeping Mistakes: How to Spot and Fix Them Fast

Effectively, avoiding top bookkeeping mistakes is the fastest way to protect your business’s cash flow. Unfortunately, many owners unknowingly commit errors like commingling funds or ignoring reconciliations until tax season arrives. Specifically, these slip-ups compound into cash surprises, tax exposure, and bad management decisions. Below, we highlight the top bookkeeping mistakes we see most often […]

Bookkeeping Cleanup Preparation: How To Lower Your Costs

Effectively, bookkeeping cleanup preparation is the single biggest factor in determining the final cost of your project. However, many business owners simply hand over a shoebox of receipts and hope for the best. Specifically, this disorganized approach leads to higher fees, longer turnaround times, and unnecessary questions. Below, we outline exactly how to gather 12–24 […]