Missing Receipts & The Cohan Rule: What the IRS Really Accepts

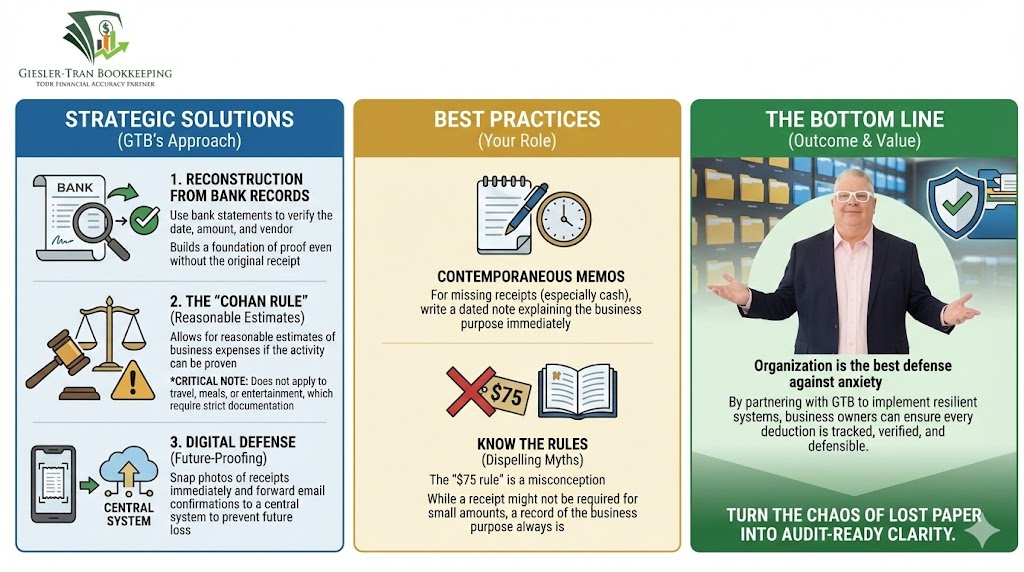

Recently, a business owner asked if they could simply “estimate” their travel expenses because they lost the paperwork. Technically, a legal precedent exists for this, but relying on it is dangerous. In reality, dealing with missing receipts isn’t just about showing you paid; you must prove the expense was ordinary, necessary, and business-related. Below, we […]

Missing Receipts? The Ultimate Guide to Audit-Proofing Your Business Expenses

Missing receipts can feel like a ticking time bomb for business owners juggling client acquisition and employee management. Consequently, in the whirlwind of daily operations, administrative tasks often fall to the bottom of the priority list, leading to gaps in essential documentation. Recently, a client panicked during our year-end review because they discovered a significant […]