Is Your Business Bleeding Cash? The Critical Bookkeeping Health Check

Performing a comprehensive bookkeeping health check is the single most effective way to determine if your business is actually profitable or just moving money around. Most business owners erroneously believe their books are “fine” simply because their bank account balance remains positive. However, a positive bank balance often masks deep, systemic financial issues. Consequently, relying […]

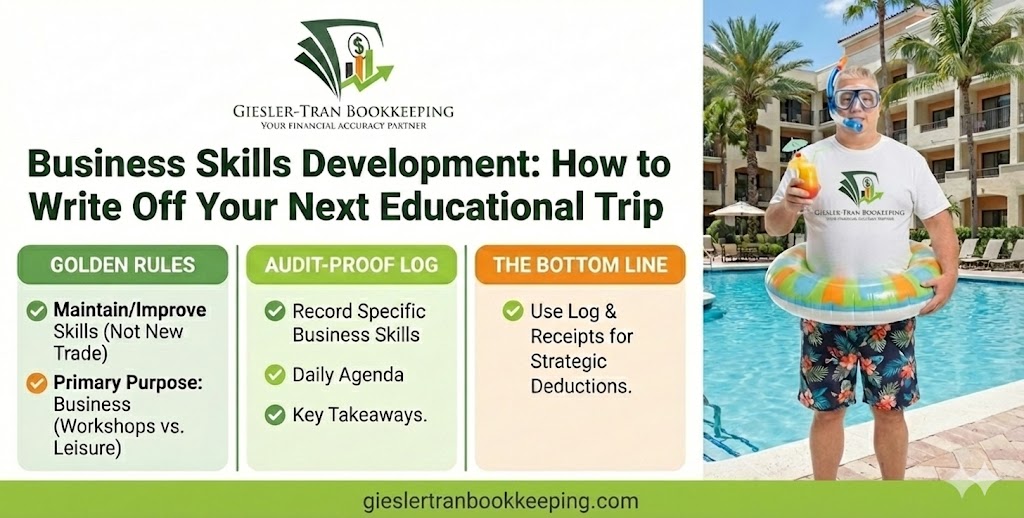

Business Skills Development: How to Write Off Your Next Educational Trip

Investing in yourself is the best investment you can make, but investing with pre-tax dollars is even better. For ambitious entrepreneurs, business skills development is not just a buzzword; it is a critical strategy for survival in a competitive market. However, many business owners hesitate to book that conference in Las Vegas or that workshop […]

Audit-Ready Books: Your Best Defense and Biggest Asset

Initially, most business owners view bookkeeping as a simple administrative chore. However, as the business grows, the stakes get higher. Suddenly, you aren’t just recording expenses; you are building a legal defense. At Giesler-Tran Bookkeeping (GTB), we deliver more than just accurate records; we build audit-ready books. This strategic approach helps you save money, reduce […]

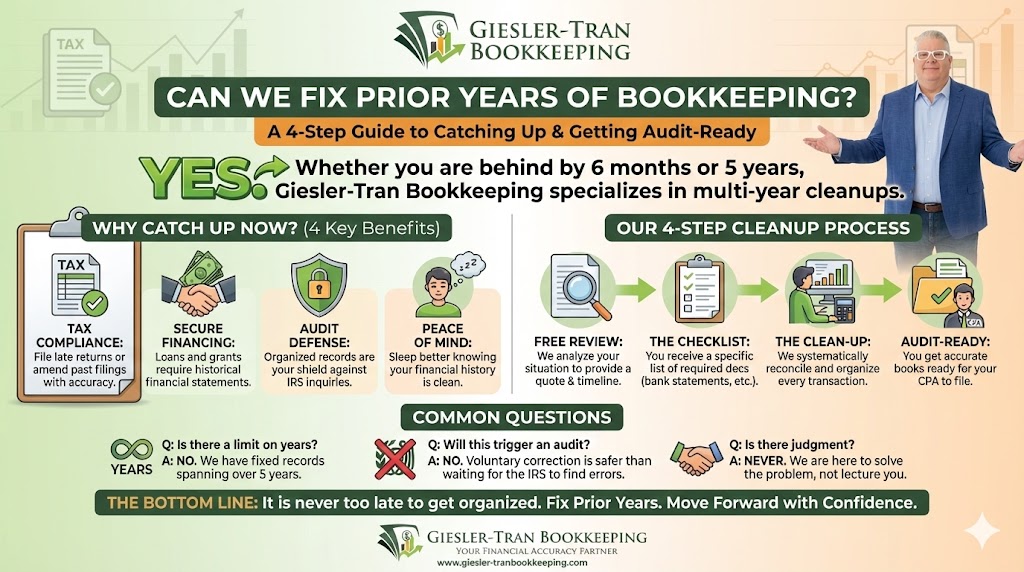

Can We Fix Prior Years of Bookkeeping? A Guide to Catching Up

The urgent need to fix prior years of financial records is the primary reason many business owners approach us, worried that their bookkeeping challenges span far beyond the current calendar year. Naturally, they feel overwhelmed and ask if we only handle current records or if we possess the capability to help with older, messier situations. […]

Fast Bookkeeping Cleanup: The Emergency Plan for Tax Deadlines

Recently, business owners have been contacting us in a state of panic because tax season is arriving, and their books are simply not ready. Specifically, they realize that without a fast bookkeeping cleanup, they face steep penalties, missed deductions, and sleepless nights. Effectively, procrastination has turned a routine task into a financial emergency. Below, we […]

Can a Bookkeeper Help During an IRS Audit? What to Expect

Effectively, receiving an audit notice is one of the most stressful moments a business owner can face. Naturally, your first question is likely: “Can my bookkeeper help me get through this?” The short answer is yes. Specifically, while a bookkeeper cannot legally represent you in tax court, they play a critical role in organizing records, […]