10 Deducciones Fiscales Ocultas Que Ahorran Miles a las Empresas de Servicios

Deje de perder dinero pasando por alto las críticas deducciones fiscales para empresas de servicios. En realidad, para consultores, agencias y firmas profesionales, la diferencia entre una factura de impuestos masiva y una justa a menudo se reduce al conocimiento. Específicamente, entender la gama completa de deducciones fiscales para empresas de servicios disponibles para usted […]

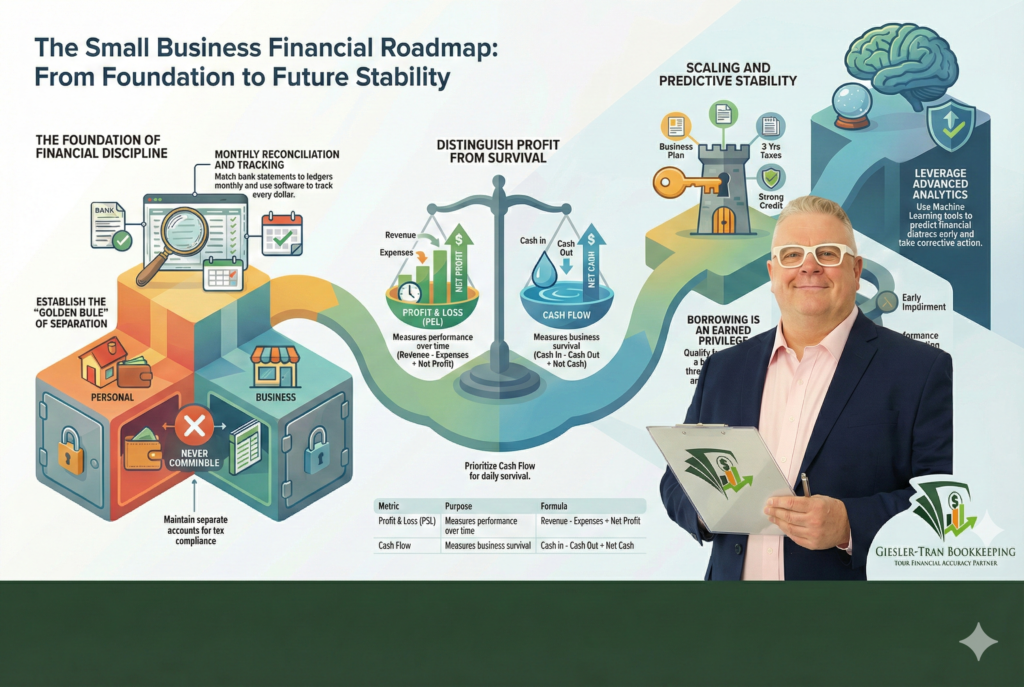

Small Business Financial Management: From Basic Books to Advanced Growth

Small Business Financial Management is the absolute bedrock of stability in an increasingly volatile global economy. Specifically, business owners today face tightening capital requirements and fluctuating labor markets that make the margin for error slimmer than ever before. However, many entrepreneurs still treat their finances as an afterthought, focusing solely on product development while their […]

The Expensive Truth Behind Fully Automated Bookkeeping: Why “Set It and Forget It” Fails

Fully automated bookkeeping is often marketed as the ultimate cure for the exhaustion that plagues modern business owners. Receipts pile up on desks, transactions blur together in bank feeds, and dashboards promise clarity but often deliver only noise. Consequently, when a software company promises a “set it and forget it” solution, it sounds like immediate […]

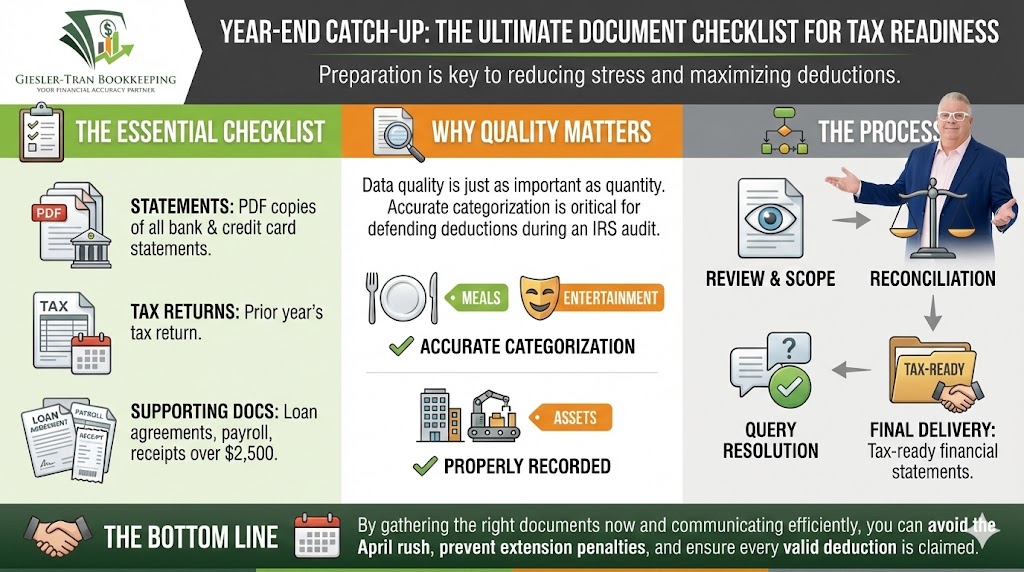

Year-End Catch-Up: The Ultimate Document Checklist for Tax Readiness

Performing a comprehensive year-end catch-up is the single most effective way to prepare for tax season without the usual stress and anxiety. Recently, many clients have asked us how to navigate this process efficiently. Specifically, they want to know exactly what documents they must gather to get their books audit-ready before the filing deadline. Fortunately, […]

Real Estate Bookkeeping: The Ultimate Guide to Commissions & Compliance

Recently, I worked with a high-performing agent who assumed their net commission deposit was their total revenue. After carefully reviewing six months of their data, we found that referral fees and broker splits were never recorded, and deductible marketing expenses were missing receipts entirely. Consequently, their tax liability was wildly inaccurate because they were underreporting […]

Nonprofit Internal Controls: The Essential Guide to Fraud Prevention

Nonprofit internal controls were the missing piece that led to a significant loss of funds for a beloved community organization we recently reviewed. Sadly, the cause wasn’t a sophisticated cyber-attack but a simple lack of oversight in their accounts payable process. Consequently, this vulnerability allowed a trusted volunteer to divert small amounts of cash over […]

Restricted vs Unrestricted Funds: Nonprofit Accounting Guide

Restricted vs unrestricted funds management is the absolute cornerstone of nonprofit financial integrity and donor trust. However, many organizations struggle significantly to keep these buckets separate, leading to commingled cash, inaccurate reporting, and eventual compliance nightmares. If you want to survive your next audit and build lasting relationships with major donors, you must track spending […]

Bookkeeping Services Near Me: Local Expertise, Nationwide Reach

Searching for bookkeeping services near me is often the very first step business owners take when they feel overwhelmed by their finances. However, finding a partner who truly understands your industry matters far more than finding someone who simply shares your zip code. At Giesler-Tran Bookkeeping, we combine local expertise with nationwide reach—offering in-person support […]

Bank Loan Denial: How Disorganized Books Kill Funding (and How to Fix it)

A bank loan denial is often the harsh wake-up call that forces a business owner to look closely at their financial records for the first time. Effectively, presenting disorganized books to a lender is the fastest way to get your loan application denied, regardless of how profitable your business might actually be. However, many business […]

Bookkeeping for Small Business: The 5-Step GTB System for Audit-Ready Books

Bookkeeping for small business success starts with a single, non-negotiable goal: keep every transaction organized, accurate, and easy to verify. However, many entrepreneurs view this essential task as a distraction from their “real work,” leading to shoeboxes full of receipts and panic at tax time. Consequently, this lack of organization doesn’t just cause stress; it […]