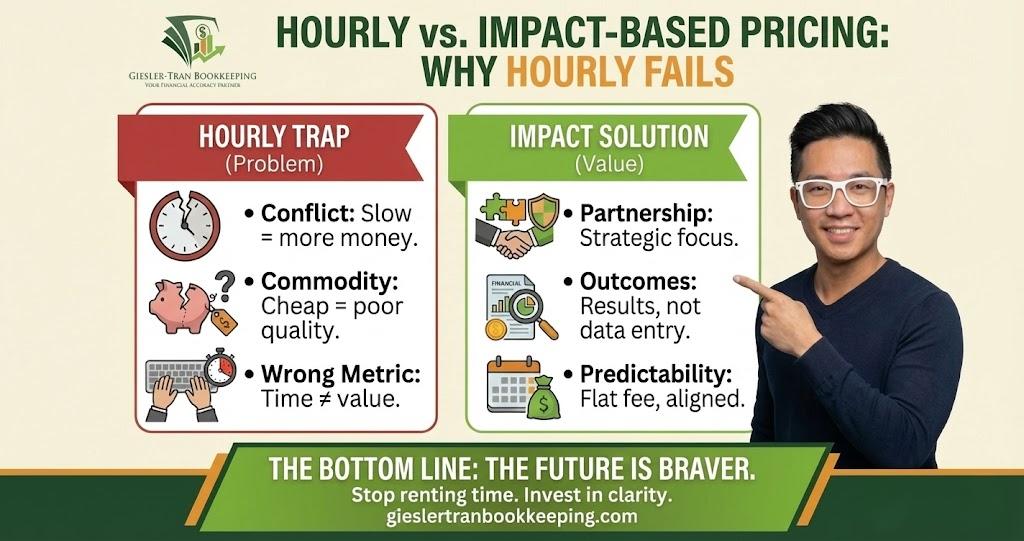

Bookkeeping Fees vs. Impact: Why Hourly Pricing Is Fails Your Business

Imagine if bookkeeping fees were charged based on impact—not on how long someone sat in a chair. Currently, most of the industry operates on an outdated model where value is measured by the tick of a clock. Specifically, business owners pay for how fast someone clicks, not for the clarity they bring to cash flow. […]

Chiropractic Pricing Strategy: Triangulation for Higher Profit and Acceptance

Recently, I reviewed the financials of a thriving chiropractic clinic that was seeing record patient numbers but struggling with stagnant profits. In reality, their issue wasn’t a lack of patients; it was a lack of pricing structure. For instance, they were using a simple fee-for-service model that forced patients into a binary “yes or no” […]

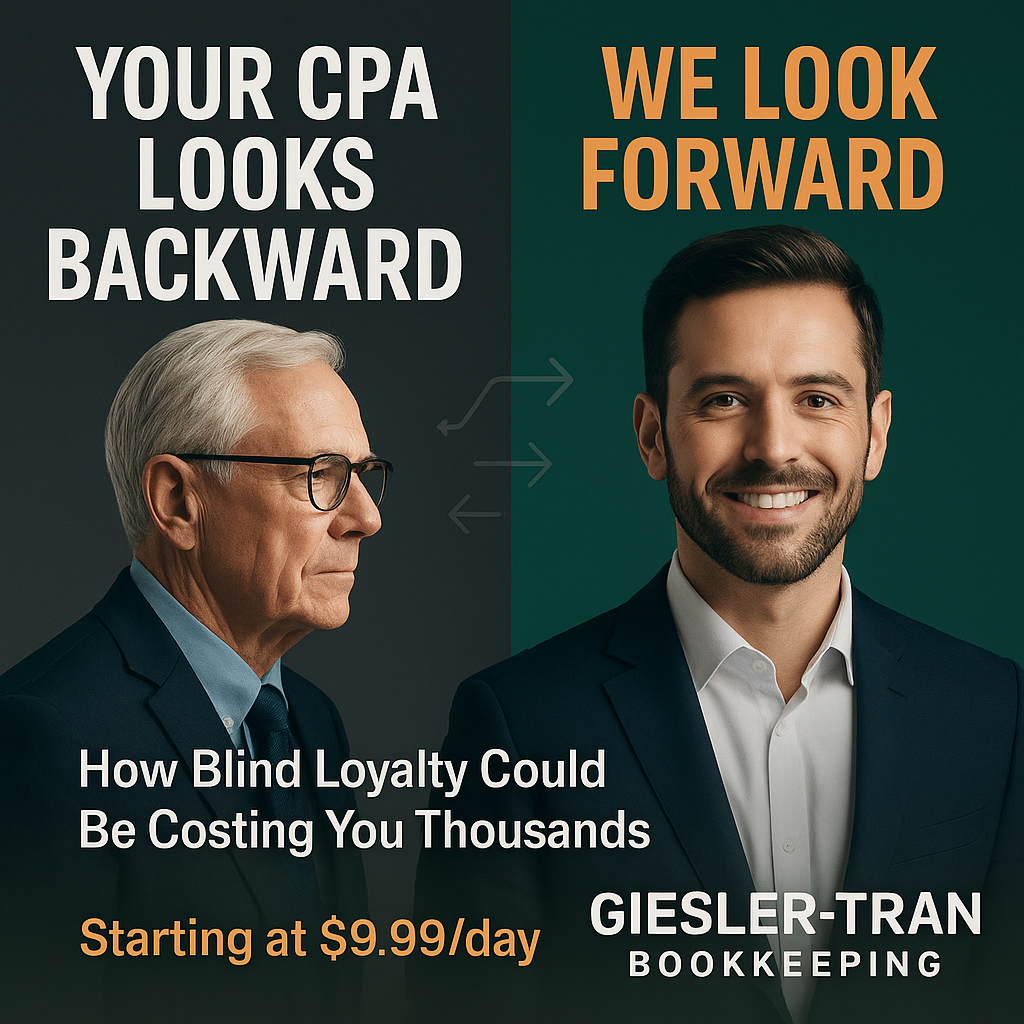

Your CPA Looks Backward — We Look Forward: How Blind Loyalty Could Be Costing You Thousands.

Effectively, maintaining robust financial oversight is the difference between surviving tax season and thriving year-round. However, many business owners mistakenly believe that having a CPA equals having financial control. Specifically, while a CPA files your taxes, true financial oversight requires daily attention to cash flow, categorization, and strategy. Below, we explore why blind loyalty to […]

Bookkeeping Services in Vancouver, WA: The Local Advantage for Growing Brands

Recently, I’ve had numerous conversations with Pacific Northwest business owners who are struggling to find reliable financial help. In reality, searching for competent bookkeeping services in Vancouver WA often feels like looking for a needle in a haystack. For instance, you might find a large national firm that treats you like a number, or a […]

Portland Bookkeeping Services: The Strategic Advantage for Local Business Growth

Recently, I’ve had numerous conversations with Oregon business owners who are struggling to find reliable financial help. In reality, searching for competent Portland bookkeeping services often feels like looking for a needle in a haystack. For instance, you might find a large national firm that treats you like a number, or a solo freelancer who […]

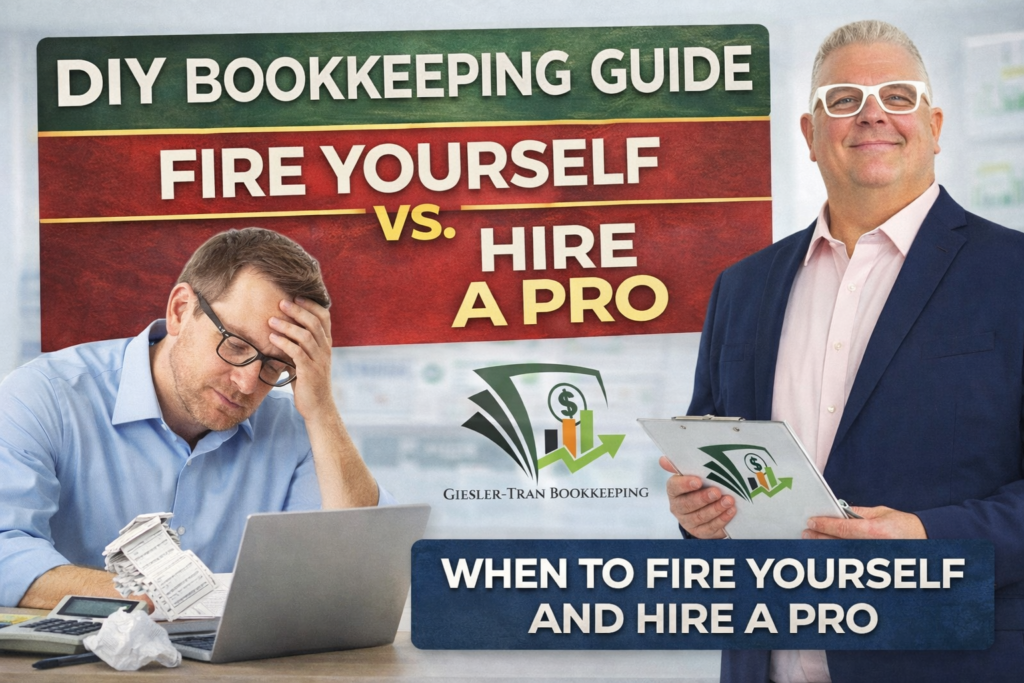

DIY Bookkeeping Guide: When to Fire Yourself and Hire a Pro

Recently, I spoke with a passionate entrepreneur who was spending her Saturday nights wrestling with spreadsheets instead of resting. In reality, DIY bookkeeping is often the first hat a business owner wears, and frequently the last one they are willing to take off. For instance, in the early days, managing your own finances feels prudent, […]

Bookkeeping vs Accounting: Why Your Business Needs Both for Financial Health

Understanding the nuance between bookkeeping vs accounting is often the first step toward true financial maturity for any business owner. Initially, many entrepreneurs use these terms interchangeably, assuming that recording transactions is the same as analyzing them. In reality, while both functions deal with financial data, they serve distinct but equally vital roles in your […]

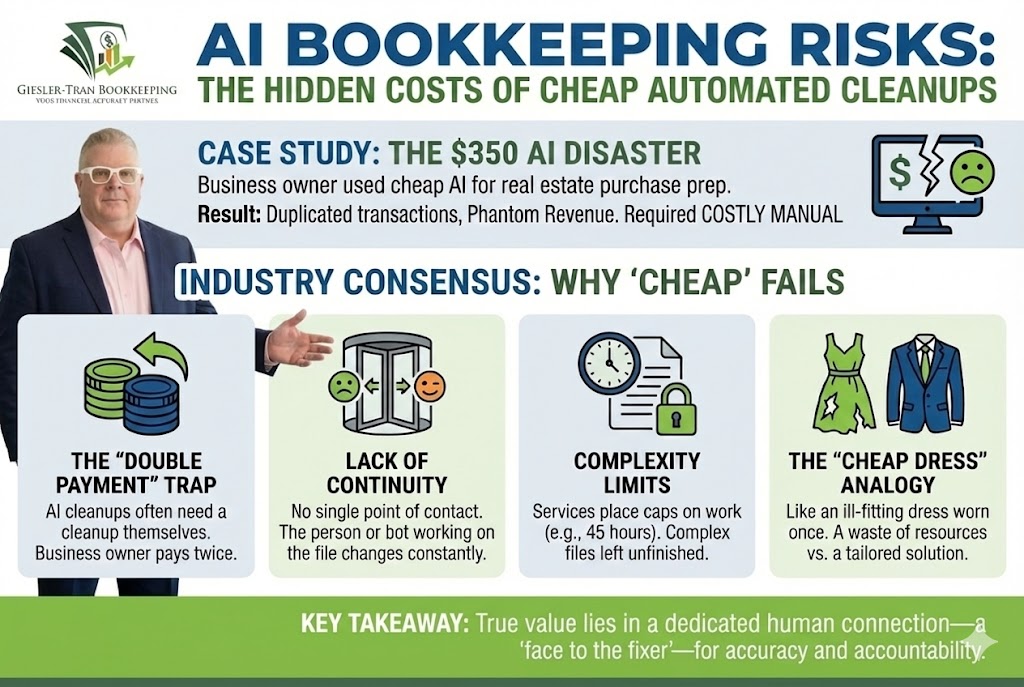

AI Bookkeeping Dangers: The $350 Shortcut That Cost a Business Thousands

Recently, the promise of AI bookkeeping has flooded the market, offering business owners a tempting proposition: fully automated financial records for a fraction of the cost of a human professional. Initially, this sounds like a dream come true for entrepreneurs looking to cut overhead. However, at Giesler-Tran Bookkeeping (GTB), we have witnessed the fallout when […]

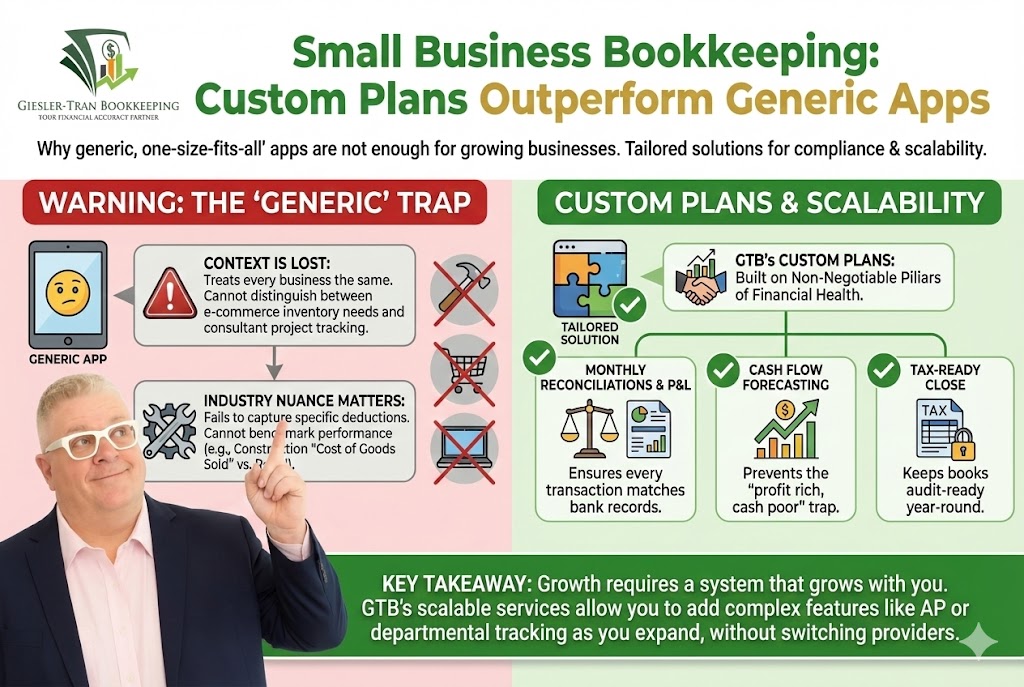

Small Business Bookkeeping Services: Why Custom Plans Outperform Generic Apps

Every small business owner eventually faces a critical crossroads: continue managing finances on a spreadsheet or invest in professional business bookkeeping services. Initially, the DIY approach seems cost-effective, but as transaction volume grows, so does the complexity. Consequently, what worked for a solo operator often becomes a liability for a growing team. At Giesler-Tran Bookkeeping […]