The Expensive Truth Behind Fully Automated Bookkeeping: Why “Set It and Forget It” Fails

Fully automated bookkeeping is often marketed as the ultimate cure for the exhaustion that plagues modern business owners. Receipts pile up on desks, transactions blur together in bank feeds, and dashboards promise clarity but often deliver only noise. Consequently, when a software company promises a “set it and forget it” solution, it sounds like immediate […]

Why “Fast & Clean” Bookkeeping Services Are Gambling With Your Business

Many business owners, drowning in receipts and spreadsheets, are understandably tempted by the promise of fast & clean bookkeeping services. Initially, the idea of handing over a messy shoebox of data and receiving polished reports 48 hours later feels like a miracle. However, most business owners think bookkeeping is boring, while most volume-based firms think […]

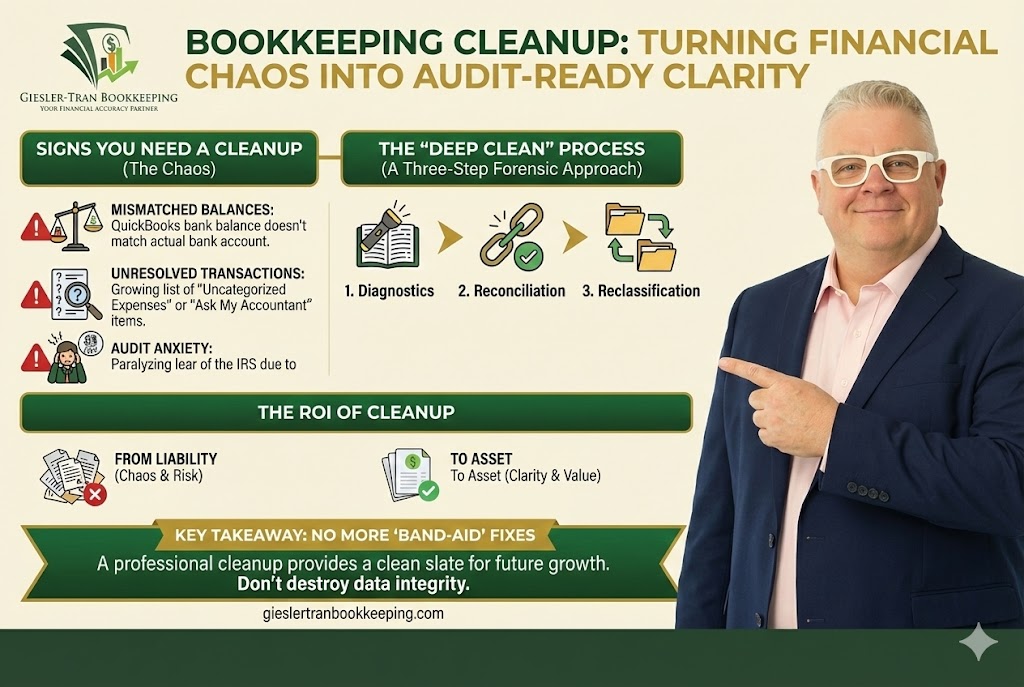

Bookkeeping Cleanup: Turning Financial Chaos Into Audit-Ready Clarity

Eventually, every growing business hits a period of chaotic expansion where the administrative tasks simply cannot keep up with the revenue. Consequently, the monthly reconciliation gets pushed to “next weekend,” and then to “next month.” Before you know it, you are six months behind, tax season is looming, and your financial data is a black […]

Bookkeeping Cleanup: How to Fix a Year of Messy Books in 30 Days

Overwhelmingly, fixing a full year of bad accounting can feel like an impossible task, but the right bookkeeping cleanup process can turn chaos into clarity faster than most business owners realize. Often, one missed month quietly becomes three, three roll into twelve, and suddenly you’re staring at financial reports that don’t match reality. Consequently, ignoring […]

Top Bookkeeping Mistakes That Trigger IRS Audits

Recently, I told a client something I genuinely believe: I surround myself with people smarter than I am so we can accomplish our mission at the highest level. In fact, successful business owners adopt this exact mindset when they stop trying to DIY their tax compliance and decide to hire a professional. Specifically, you need […]

10 Hidden Tax Deductions That Save Service Businesses Thousands

Stop leaving money on the table by overlooking critical service-based business tax deductions. In reality, for consultants, agencies, and professional firms, the difference between a massive tax bill and a fair one often comes down to awareness. Specifically, understanding the full range of service-based business tax deductions available to you is the fastest way to […]

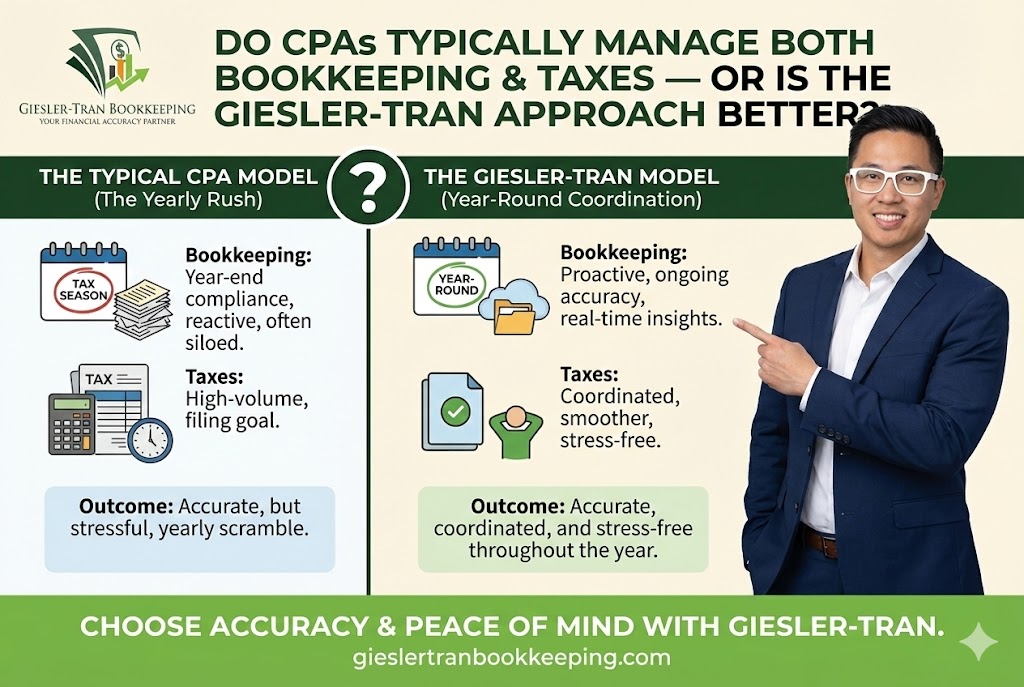

Does Loyalty Matter When You Could Be Saving Thousands? | Giesler-Tran Bookkeeping

Let’s talk honestly about loyalty and your CPA. Frequently, business owners stick with the same tax professional year after year—sometimes out of habit, sometimes out of fear that change will be a hassle. However, you must ask yourself a hard question: Is that loyalty costing you money? Below, we explore the hidden costs of sticking […]

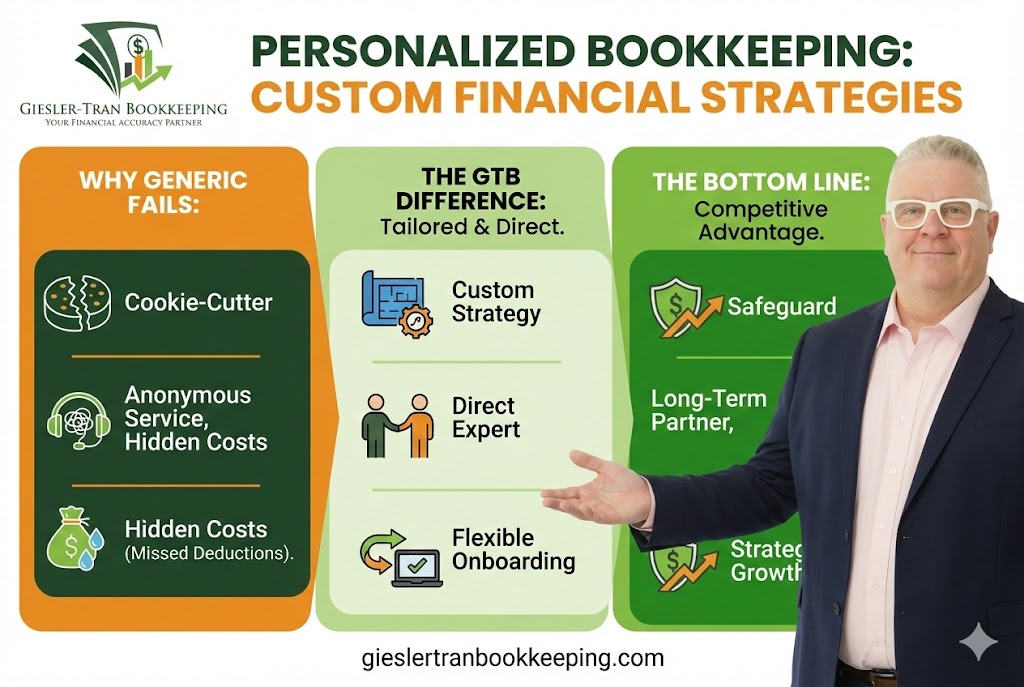

Personalized Bookkeeping: Custom Financial Strategies for Unique Businesses

Every business starts with a unique vision, yet too many entrepreneurs settle for generic financial advice. In a marketplace saturated with automated apps and high-volume call centers, personalized bookkeeping is the secret weapon for sustainable growth. Most business owners eventually realize that “cookie-cutter” accounting simply cannot capture the nuances of their specific industry. Therefore, Giesler-Tran […]

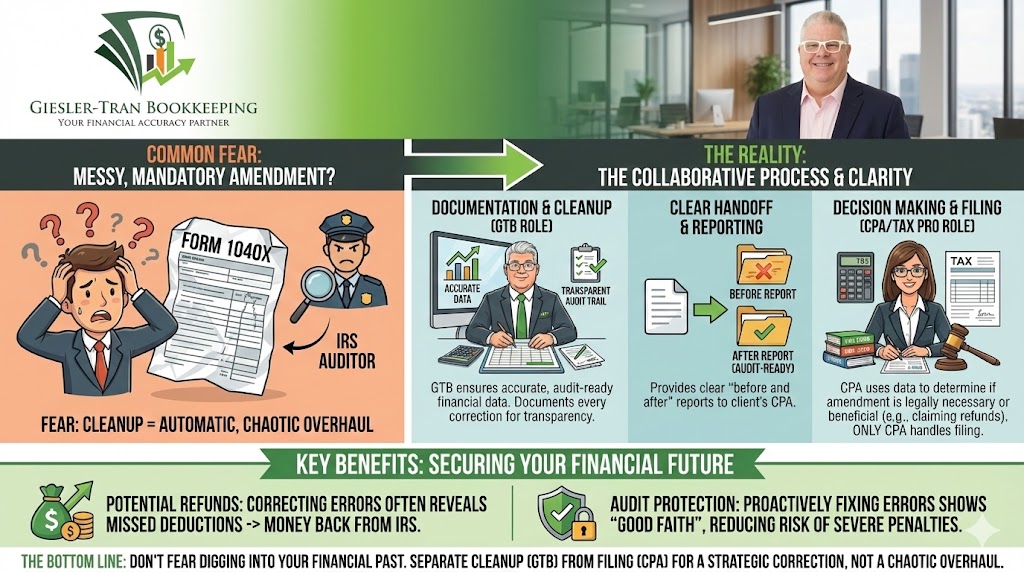

Past Tax Filings: Will Bookkeeping Cleanup Force You to Amend Returns?

Many business owners hesitate to fix their financial records because they fear the consequences with the IRS. Specifically, a common anxiety is that organizing historical data will automatically trigger a mandatory change to past tax filings, leading to penalties or audits. Consequently, this fear often paralyzes entrepreneurs, leaving them stuck with messy books for years. […]

Documents for Your Bookkeeper: The Ultimate Checklist for a Smooth Handoff

Effectively, gathering the right documents for your bookkeeper to review is the single most important step you can take to ensure accurate financials. However, many business owners find this process overwhelming, leading to delays and increased costs. Specifically, providing a complete, organized set of records allows your bookkeeper to work efficiently, catch errors early, and […]