Stipend vs. Reimbursement: The Tax Truth Every Business Needs

Question submitted by: Larry Grenevitch (Dynamic Marketing Collaboration).

Answered by: Giesler-Tran Bookkeeping — audit-ready, tax-smart bookkeeping for growing businesses.

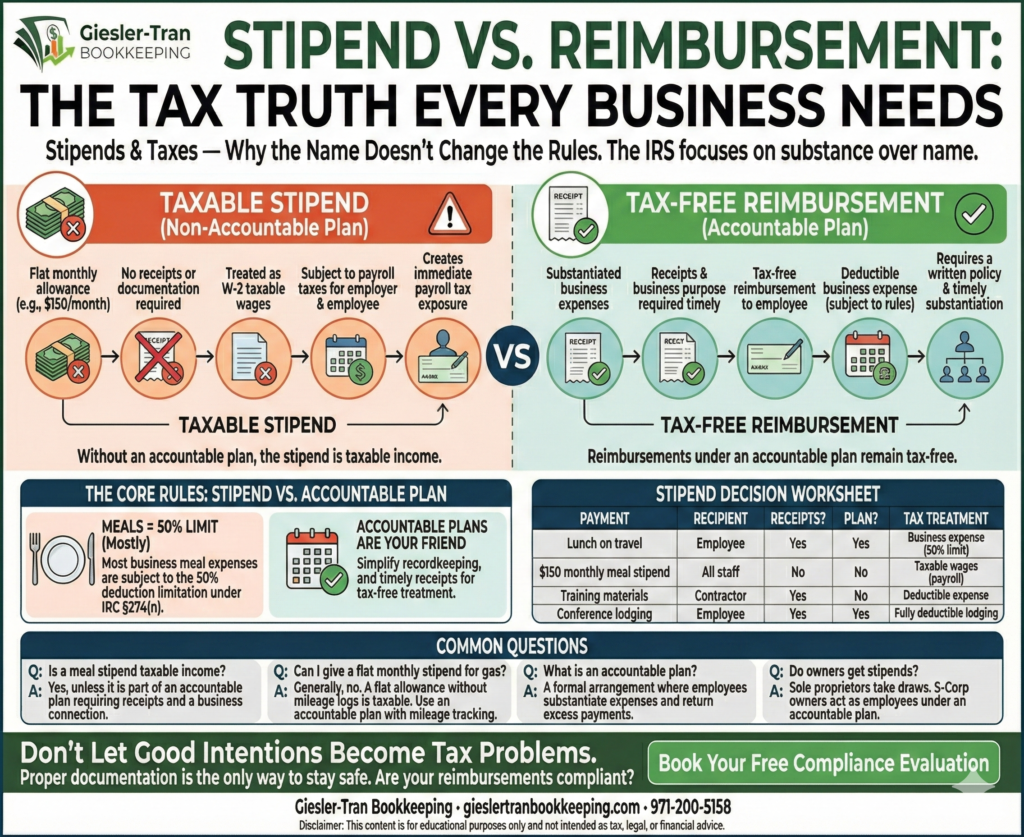

The Short Answer: No. Calling a payment a stipend doesn’t make it tax-free. Fundamentally, tax treatment depends on what the payment covers and how it’s documented. If you fail to follow “accountable plan” rules, that stipend becomes taxable wages.

Listen on The Deep Dive — where we dig deeper into this topic:

‘Stipend vs. Taxable Wage: The IRS Accountable Plan Rules That Kill the Tax-Free Magic Loophole’

Why You Should Care About Stipend Rules

First, many business owners try to use a stipend as an easy fix for expenses. However, the IRS prioritizes substance over form. Specifically, if you do not document the business purpose or collect receipts, you invite trouble. Consequently, you may create immediate payroll tax exposure and lose valuable deductions. Ultimately, managing a stipend correctly requires a little process and the right paperwork.

The Core Rules: Stipend vs. Accountable Plan

Next, let’s look at the specific regulations that govern these payments. Ideally, you should follow these four principles:

1. Meals = 50% Limit (Mostly)

Crucially, most business meal expenses are subject to the 50% deduction limitation under IRC §274(n). Note that labeling a payment as a “meal stipend” does not exempt it from this rule.

2. Accountable Plans Are Your Friend

Furthermore, an accountable plan requires a written policy and timely receipts. As a result, reimbursements remain tax-free to the recipient. Conversely, no plan means the stipend is taxable income.

3. Per-Diems Help, But Meals Are Special

Additionally, per-diems simplify recordkeeping significantly. However, the meal portion of a per-diem is still subject to the 50% deduction limit.

4. Entity Type Matters

Finally, your business structure changes the rules. For example, S-Corp owners must follow accountable plan rules, while partners in a partnership face different restrictions on a stipend.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

Real-World Scenarios: Stipend Success vs. Failure

To illustrate, consider two common situations. Scenario A involves travel meals with receipts reimbursed under an accountable plan. Here, the payment is a valid business expense. Scenario B involves a $150 monthly “meal stipend” with no receipts. Unfortunately, this must be treated as taxable wages, requiring payroll taxes.

For more details, refer to IRS Publication 463 regarding travel expenses.

Stipend Decision Worksheet

To assist you, use this decision table to classify your payments. Simply copy this into a spreadsheet to track your decisions.

Lunch on travel,Employee,Y,Receipts,Y,Business expense (meals 50%),Keep receipts; file under accountable plan

$150 monthly ‘meal stipend’,All staff,?,No,N,Taxable wages (payroll),Convert to accountable plan or treat as wages

Training materials,Contractor,Y,Receipts,N,Deductible expense (company),Reimburse with invoice; document purpose

Conference lodging,Employee,Y,Receipts,Y,Fully deductible lodging,Ensure lodging receipts

Alternatively, if you need help cleaning up past mistakes, our cleanup services can help. Then, we can ensure future compliance with our monthly bookkeeping services.

Common Questions on Stipend Taxation

- Q: Is a meal stipend taxable income?

- A: Yes, unless it is part of an accountable plan requiring receipts and a business connection. Otherwise, it is W-2 wages.

- Q: Can I give a flat monthly stipend for gas?

- A: Generally, no. A flat allowance without mileage logs is taxable. Using an accountable plan with mileage tracking is the tax-free method.

- Q: What is an accountable plan?

- A: It is a formal arrangement where employees must substantiate expenses with receipts and return any excess payments to the company.

- Q: Do owners get stipends?

- A: Sole proprietors cannot reimburse themselves tax-free in the same way; they take draws. S-Corp owners must act as employees under an accountable plan.

Also, see IRS Publication 15-B for more on fringe benefits.

Don’t Let Good Intentions Become Tax Problems

Offering a stipend is generous, but doing it wrong creates tax liabilities for you and your employees. Proper documentation is the only way to stay safe.

Are your reimbursements compliant?

We can review your current policies. Book a complimentary Compliance Evaluation today. We’ll check your stipend structure and ensure your accountable plan is audit-ready.

Book Your Free Compliance Evaluation

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.