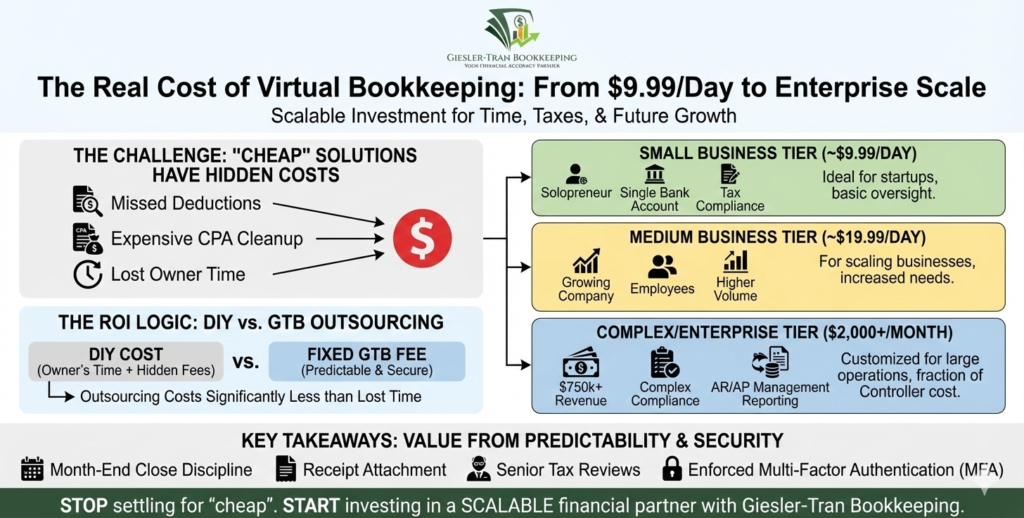

Effectively, analyzing the true cost of virtual bookkeeping is one of the most critical financial exercises a growing business owner can undertake. Often, pricing can be confusing, ranging from cut-rate DIY apps to expensive hourly firms. However, the right question isn’t simply “Is this cheap?” Instead, you must ask, “Will this choice scale with me as I grow from startup to $750k+ in revenue?” Specifically, professional virtual bookkeeping at a starting rate of $9.99/day for small businesses—scaling up to $19.99/day for medium operations—can deliver enormous value when done right. Below, we break down why this tiered investment protects your time, taxes, and future growth.

The Real Cost of Virtual Bookkeeping: From $9.99/Day to Enterprise Scale

The Reality Check: Fundamentally, one-size-fits-all pricing rarely works in finance. Because a solopreneur has different compliance needs than a clinic generating $750k in revenue, your bookkeeping solution must adapt. Therefore, the cost of virtual bookkeeping should be viewed as a scalable infrastructure investment, not a static expense.

Listen on The Deep Dive — where we explore this topic further:

‘The Hidden Tax of Cheap Bookkeeping’

Scalable Tiers: Understanding the True Cost of Virtual Bookkeeping

First, it is vital to distinguish between “cheap” labor and “scalable” value. Specifically, the GTB model is designed to grow with you, ensuring you never overpay for what you don’t need, nor are you underserved when complexity increases. Here is how the tiers break down logically:

1. Small Business Tier ($9.99/day)

Typically, this tier (approx. $300/month) is perfect for solopreneurs or low-transaction service businesses. Ideally, if you have a single bank account and a credit card but need professional oversight to ensure tax compliance, this is your starting point.

2. Medium Business Tier ($19.99/day)

In contrast, growing businesses with employees, higher transaction volumes, or multiple revenue streams fit here (approx. $600/month). Specifically, this covers the increased time required for detailed categorization and more frequent reconciliation.

3. Complex/Enterprise Tier ($2,000+/month)

Furthermore, for businesses generating $750,000+ in revenue, the needs shift dramatically. Consequently, pricing scales to accommodate complex compliance, high-volume AR/AP management, and sophisticated reporting. Even at this level, the cost is a fraction of hiring a full-time Controller.

Ultimately, facing the cost of virtual bookkeeping is about matching the service level to your current reality. If you choose a provider who cannot scale past the “Small” tier, you will eventually face expensive migration costs when you outgrow them.

Why Even the “High” Tier is an Incredible Value

Next, let’s break down the math against the alternative: hiring in-house. Comparatively, a qualified in-house bookkeeper costs $45k–$60k annually, plus taxes and benefits. Specifically:

- Small Tier ($9.99/day): ~$3,600/year (vs. $45k employee)

- Medium Tier ($19.99+/day): ~$7,200/year (vs. $45k employee)

- Complex Tier ($2,000+/mo): ~$24,000/year (vs. $85k+ Controller)

Furthermore, compare this to the cost of missed opportunities. Ideally, the GTB model is designed to pay for itself by freeing up your time to generate revenue. For example, if your time is worth $100/hour and you spend 5 hours a week on books, you are “spending” over $2,000 a month. Thus, outsourcing—even at the medium tier—saves you thousands immediately.

Your Personal ROI Worksheet

Now, copy and paste this worksheet to calculate your specific cost of virtual bookkeeping savings based on your business size. Simply fill in the blanks:

Step 1: Calculate Current Costs

1. Owner hourly rate = $________ /hr

2. Hours/week you spend on bookkeeping = _______ hrs

3. Monthly Owner Time Cost (C) = (Rate × Hours × 4.33) = $________

4. Current Spend (D) = $________ (Software fees, contractors, etc. Enter $0 if DIY)

5. Est. Annual CPA Cleanup / Tax Surprises (E) = $________

6. Monthly Hidden Cost = (E ÷ 12) = $________

Step 2: Compare to GTB Tiers

7. DIY Total Monthly Cost = (C + D + Monthly Hidden Cost) = $________

8. Select Your GTB Tier (F):

– Small ($300)

– Medium ($600)

– Complex ($2,000+)

Selected Cost: $________

Step 3: The Result

Net Monthly Savings = (DIY Total) − (GTB Cost) = $________

A Worked Example (Medium Business)

To illustrate, let’s assume an owner values their time at $100/hr and spends 6 hours a week on finances. Additionally, they pay $2,400 annually for CPA cleanup.

- DIY Cost: ($100 × 6 × 4.33) + ($200 monthly cleanup avg) = $2,798/month

- GTB Medium Tier: Fixed fee = $600/month

- Net Savings: $2,798 – $600 = $2,198/month saved

Consequently, the decision to outsource becomes obvious when you look at the data. For more on valuing your time, visit the SBA Guide to Managing Finances.

Evaluating the Cost of Virtual Bookkeeping: A Scoring Guide

Moreover, you can use this quick scoring system to see if you are ready for professional help. Assign points as follows: 0 = No, 1 = Sometimes, 2 = Yes.

- ____ I spend 5+ hours/week on bookkeeping.

- ____ My revenue exceeds $750k/year (Automatic Complex Tier).

- ____ Receipts are scattered across email/phone/paper.

- ____ I’ve paid CPA cleanup fees or had tax surprises.

- ____ I want predictable monthly costs (no hourly surprises).

Score Guide:

0–4: DIY might be okay for very small starts.

5–9: Small/Medium Tier ($9.99–$19.99/day) recommended.

10–14: Strong fit for GTB Full Service — immediate ROI.

What You Get for the Cost of Virtual Bookkeeping with GTB

Specifically, our model is built on transparency. When you pay for GTB, you aren’t just paying for data entry; you are paying for peace of mind. Here is what is included in our standard maintenance:

- Full bank & credit card reconciling (month-end close discipline).

- Categorization & rules for recurring vendors.

- Receipt attachment & secure portal storage.

- Financial Reports: P&L, Balance Sheet, Cash Flow + 1-page summary.

- Year-end tax-ready file prep and Senior Tax Accountant review.

Comparison Grid: Cheap vs. GTB Scalable Tiers

| Feature | Cheap Provider / DIY | GTB Scalable Tiers |

|---|---|---|

| Flat-rate predictable fees | ❌ Often no | ✅ Yes (Small/Med/Large) |

| Scales to $750k+ revenue | ❌ No (Break/fix model) | ✅ Yes (Complex Tier) |

| Senior tax review included | ❌ No | ✅ Yes (All Tiers) |

| Security & MFA | ❌ Weak | ✅ Enforced |

Essentially, the cost of virtual bookkeeping with GTB includes an entire finance department for less than the cost of a part-time intern.

Common Questions on the Cost of Virtual Bookkeeping

- Q: Which tier is right for me?

- A: If you are a solopreneur, start at the Small ($9.99/day) tier. If you have employees or complex transactions, the Medium ($19.99/day) tier is safer. For $750k+ revenue, we customize a Complex plan.

- Q: What if my books are currently a mess?

- A: We will scope a specific cleanup project first. Once clean, the monthly maintenance cost drops to your standard tier rate.

- Q: How secure is this process?

- A: Highly secure. We use read-only bank feeds, enforced Multi-Factor Authentication (MFA), and encrypted portals. It is safer than emailing spreadsheets.

- Q: Is the monthly fee fixed even at the $2,000 level?

- A: Yes. You will never receive a surprise bill for hourly overages on standard scope work. This predictability is key for cash flow, regardless of your size.

For more details on record keeping requirements, check the IRS Recordkeeping Page.

Stop Treating Bookkeeping as a Cost

You now understand the true cost of virtual bookkeeping. Effectively, whether you pay $9.99/day as a startup or scale up to complex support, it is a small price to pay for audit protection, tax optimization, and the freedom to focus on growing your business. Therefore, don’t settle for “cheap” when you can have “scalable.”

Ready to see which tier fits you?

Partner with Giesler-Tran Bookkeeping to ensure your controls are rock-solid. Schedule a complimentary consultation to calculate your personal ROI.

Serving businesses nationwide with scalable virtual support.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response