Protecting your business involves more than just generating profit; it demands a rigorous defense of your digital assets. When you share your financial records, you are sharing the blueprint of your livelihood. Therefore, security & privacy must be the non-negotiable foundation of any bookkeeping relationship. Unlike casual providers who might share passwords via email or store files on unsecured laptops, Giesler-Tran Bookkeeping (GTB) treats your data with the same severity as a financial institution. Specifically, our commitment to security & privacy gives you confidence and peace of mind—so you can focus on your business, not on whether your data is vulnerable.

Security & Privacy: How We Protect Your Financial Data

Your data deserves bank-level protection.

The Reality Check: Fundamentally, cybercrime targets small businesses because they often lack sophisticated defenses. If a hacker gains access to your Quickbooks file or bank login, they can drain accounts or steal identities in minutes. Unfortunately, recovering from a breach can cost hundreds of thousands of dollars and destroy your reputation. Prioritizing security & privacy in your bookkeeping is not an optional “add-on”; it is your first line of defense against modern threats.

Listen on The Deep Dive — exploring our protocols:

‘The Vault: Securing Your Financial Life’

⬇ Download

Robust Digital Security & Privacy Measures

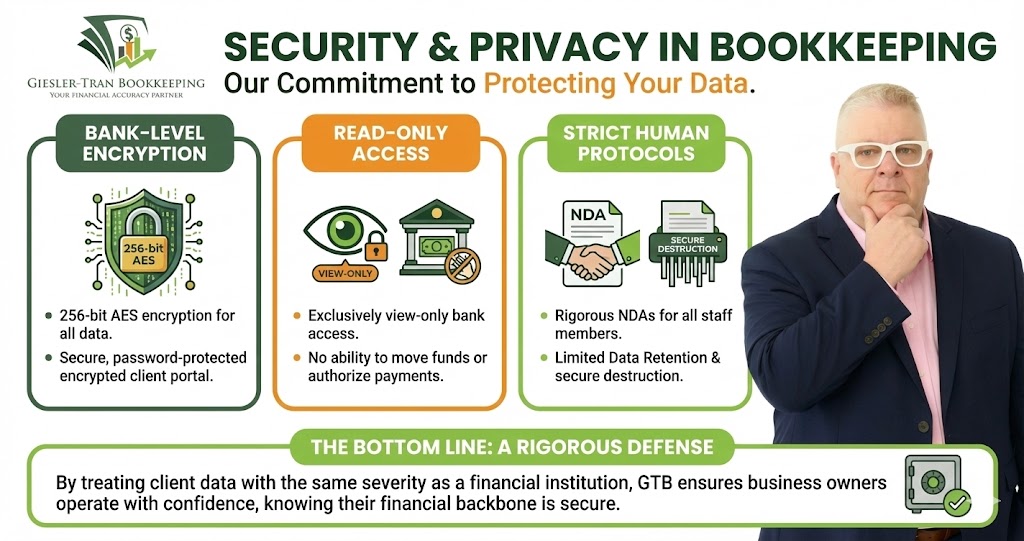

First, let’s discuss the technology that safeguards your information. We employ bank-level encryption (256-bit AES) for all data transmission and storage. This means that even if a file were intercepted during transfer, it would be unreadable to the attacker. Additionally, we never ask for your passwords via email or text message, as these are insecure channels.

Furthermore, we utilize secure client portals for all document sharing. Instead of attaching a sensitive tax return to a standard email, we upload it to a password-protected environment that only you can access. This dedicated focus on digital security & privacy ensures that your confidential documents remain confidential. For more on why encryption matters, the Federal Trade Commission (FTC) provides guidelines on protecting personal information.

The “Read-Only” Standard for Security & Privacy

Crucially, one of our most important protocols involves how we access your bank accounts. We exclusively use “read-only” or “view-only” access permissions. This means that while we can see the transactions to categorize them, we have zero ability to move money, write checks, or initiate wires. Consequently, your funds remain completely safe from accidental or malicious transfers.

Moreover, this separation of duties is a classic internal control that prevents fraud. By ensuring that the person recording the transactions (us) is different from the person authorizing payments (you), we create a system of checks and balances. If you are unsure how to set up these permissions, we guide you through the process during our onboarding phase.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see the industry standard.

Strict Privacy Protocols and NDAs

Beyond technology, we enforce strict human protocols. Every staff member and partner at GTB operates under rigorous Non-Disclosure Agreements (NDAs). We understand that your financial data is personal and sensitive. Therefore, we have a zero-tolerance policy for unauthorized data sharing.

Additionally, we practice “Limited Data Retention.” We only keep your information as long as is legally necessary or operationally required. Once records are outdated, they are securely destroyed to minimize your digital footprint. This proactive approach to security & privacy ensures that old data doesn’t become a liability later on.

Proactive Risk Management

Security is not a one-time setup; it is an ongoing process. We conduct regular reviews of our internal workflows to identify potential vulnerabilities. Whether it is updating software patches or refining our password management policies, we stay ahead of emerging threats. Similarly, we educate our clients on best practices.

Often, the weakest link in security is human error, like clicking a phishing link. By advising you on how to share documents safely, we extend our security & privacy umbrella to your entire operation. If you are concerned about past record-keeping practices, our cleanup services can help secure and organize your historical data.

Building Trust Through Security & Privacy

Ultimately, these measures are about more than just compliance; they are about trust. We know that trust matters in bookkeeping above all else. By demonstrating a relentless commitment to protecting your assets, we aim to be the partner you can rely on indefinitely. Knowing that your financial backbone is secure allows you to take bold risks in your market, secure in the knowledge that your rear flank is defended.

Finally, no information is ever shared with third parties (like lenders or CPAs) without your explicit, written consent. You retain total control over who sees your numbers. For additional reading on cybersecurity for small business, the Small Business Administration offers excellent resources.

Q&A: Data Protection Essentials

Q: What is “read-only” access?

A: It is a bank setting that allows us to view transactions and download statements but prevents us from moving money or paying bills. This ensures your funds are always under your sole control.

Q: How do I send you tax documents safely?

A: We provide a secure, encrypted client portal. You simply upload files there rather than attaching them to insecure emails.

Q: Do you sell my data?

A: Never. Our business model is service-based, not data-based. Your privacy is absolute, and we strictly adhere to confidentiality agreements.

Q: What happens if I lose my password to the portal?

A: We have secure reset protocols in place. We will verify your identity before helping you regain access, ensuring no unauthorized person can take over your account.

Q: Is cloud-based bookkeeping safe?

A: Yes, when managed correctly. Modern cloud platforms like QuickBooks Online use the same encryption standards as major banks, often making them safer than storing files on a physical hard drive that can be stolen.

Key Takeaways

- Demand Encryption: Ensure your bookkeeper uses bank-level encryption for all file transfers.

- Use Read-Only Access: Never give anyone full administrative rights to your bank account; view-only is sufficient for bookkeeping.

- Verify NDAs: Make sure confidentiality agreements are in place for everyone handling your data.

- Prioritize Privacy: Work with a partner who views security & privacy as a core value, not an afterthought.

In Summary: Your Safety is Our Priority

Ultimately, the integrity of your data is the integrity of your business. At Giesler-Tran Bookkeeping, safeguarding your sensitive financial information is our highest priority. Our comprehensive approach to security & privacy ensures that you can operate with confidence. Trust your books to a partner who puts your safety first. Book your free consultation with Giesler-Tran Bookkeeping today and experience the peace of mind that comes with secure, professional service.

Secure Your Financial Future

Don’t leave your sensitive data vulnerable.

Partner with the experts in data protection.

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.