The Balancing Act: Patient Care vs. Business Health

Comprehensive medicine requires comprehensive operations.

Key Takeaway: The Specialist Advantage

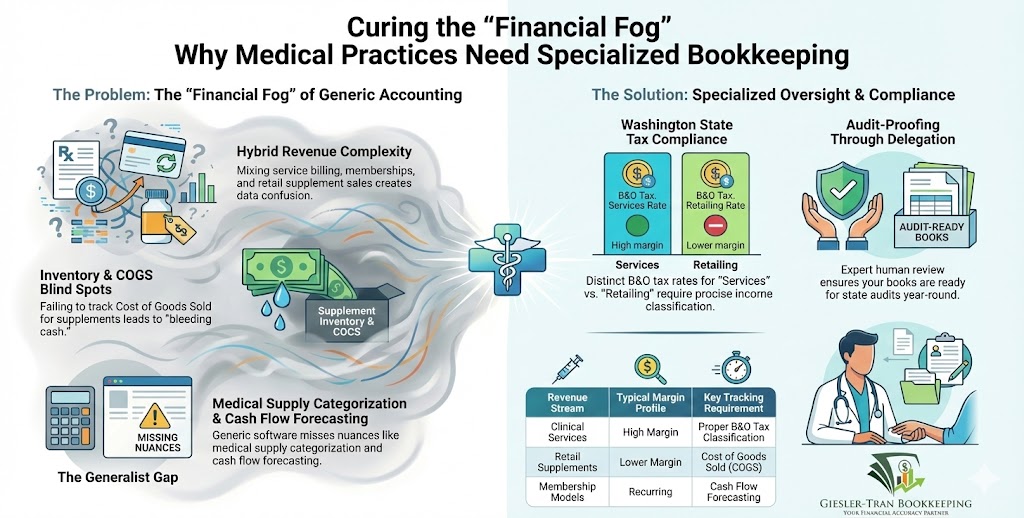

Fundamentally, medical practices are not standard retail businesses. Because of hybrid revenue streams—blending services, memberships, and product sales—generic bookkeeping often leads to “financial fog.” Therefore, success requires treating your back office with the same level of specialization as your clinical care.

Who is ShillMed?

Founded by Dr. Otto Shill, ShillMed has carved out a unique niche in the Pacific Northwest’s healthcare landscape. Unlike traditional quick-fix clinics, they focus intensely on Metabolic Health and Lifestyle Medicine.

From complex hormone replacement therapies to medically supervised weight loss programs, their approach is holistic. But a comprehensive medical approach requires a comprehensive operational strategy behind the scenes. To deliver high-level care effectively, the backend systems must be just as robust as the medical protocols.

The Hidden Complexity of a Modern Clinic

To the patient, a visit to ShillMed is seamless. But from a financial perspective, a clinic like this has moving parts that a standard retail business never faces.

Consider the specific variables that make medical bookkeeping unique:

- Hybrid Revenue Streams: ShillMed doesn’t just bill for visits. They manage recurring membership models and direct sales of supplements. Tracking these distinct streams is critical for profitability.

- Inventory Management: Managing medical-grade supplements involves tracking Cost of Goods Sold (COGS) to ensure margins stay healthy despite supply chain fluctuations.

- Regulatory Environment: Operating in Washington requires strict adherence to state tax laws and business regulations, which are distinct from Oregon or Idaho.

Consequently, failing to track these separately leads to bad data. When you mix service revenue with product revenue, you lose visibility on which part of your business is actually making money.

Why “General” Bookkeeping Isn’t Enough

Many doctors try to manage these financials with generic software or a generalist bookkeeper. This often leads to “financial fog”—where you see money in the bank, but don’t know if you’re actually profitable.

Successful practices like ShillMed understand that specialized medical practice bookkeeping is essential versus general accounting. This specialization ensures:

- Proper Categorization: Ensuring medical supplies aren’t lumped in with general office supplies.

- Cash Flow Forecasting: Predicting cash needs for future expansion or high-cost medical equipment purchases.

- Tax Readiness: Keeping books audit-proof year-round so tax season is a breeze, not a panic.

Ultimately, generalists guess; specialists know. And in medicine, guessing is not an option.

Tax Strategies for Medical Clinics

Profitability isn’t just about how much you make; it’s about how much you keep. For medical practices scaling up, proactive tax planning is the difference between a surprise bill and a surplus to reinvest.

Smart strategies often missed by generalists include:

- Section 179 Deductions: Accelerating depreciation on expensive medical equipment (like lasers or imaging units) to lower taxable income in the year of purchase.

- The Augusta Rule: Legally renting your personal residence to your business for board meetings or staff retreats (up to 14 days tax-free).

- B&O Tax Optimization: In Washington, ensuring you aren’t overpaying by incorrectly classifying “Service” revenue (higher rate) vs. “Retailing” revenue (lower rate) on supplements.

Ultimately, executing these strategies requires clean, real-time data throughout the year—not just a shoebox of receipts at tax time.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below to verify the risks.

The Takeaway for Washington Practice Owners

Dr. Shill’s success in Spokane proves that you can scale a private practice without sacrificing quality of care. The secret is building a “Circle of Competence.” You are the expert in medicine; you need partners who are experts in operations, legal, and finance.

At Giesler-Tran, we specialize in that financial piece. Whether you are a dental office in Vancouver, a therapy practice in Camas, or a specialized clinic like ShillMed in Spokane, our goal is the same: We watch the books so you can watch over your patients.

Q&A: Financial Health for Medical Practices

Q: Why do I need to track supplement sales separately?

A: Margins. Service revenue often has a high margin, while retail products (supplements) have lower margins. If you lump them together, you cannot see if your product sales are actually profitable or if they are bleeding cash.

Q: How does WA State taxation affect my clinic?

A: Washington has specific Business & Occupation (B&O) tax classifications. Service income is taxed at a different rate than Retailing income. Misclassifying these can lead to significant penalties during a state audit.

Q: Can automation handle my inventory?

A: Partially. Software can count units, but it often fails to account for spoilage, samples given to patients, or cost fluctuations. We provide the human oversight to ensure your inventory value on the balance sheet matches reality.

Q: What is the biggest mistake doctors make with their books?

A: Treating their practice like a personal checking account. Co-mingling funds and failing to capitalize expensive medical equipment are the most common errors we fix.

Key Takeaways

- Separate Streams: Always track service revenue separately from product sales/membership fees.

- Watch COGS: Inventory is cash sitting on a shelf; manage it tightly to preserve cash flow.

- Local Compliance: Washington state tax laws are nuanced; ensure your bookkeeper understands the local landscape.

- Delegate: Build a team of experts so you can focus on patient outcomes.

Final Word: Ready to Audit-Proof Your Practice?

If you are a medical practice owner in Washington or Oregon looking to gain control over your financial health, let’s talk. Special thanks to Dr. Otto Shill and the team at ShillMed for setting the standard for private practice excellence in our state.

The Bottom Line

We watch the books so you can watch over your patients.

Get a financial diagnosis for your practice today.

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.