Effectively, navigating the complex web of state sales tax regulations is one of the biggest challenges for growing businesses. However, failure to register, collect, or file correctly often leads to aggressive assessments, penalties, and interest. Specifically, for ecommerce and multi-state sellers, understanding where you owe sales tax is critical to survival. Below, we outline a step-by-step process to determine nexus, manage certificates, and automate your sales tax compliance.

Sales Tax Guide: Nexus, Compliance & Audit Protection for Sellers

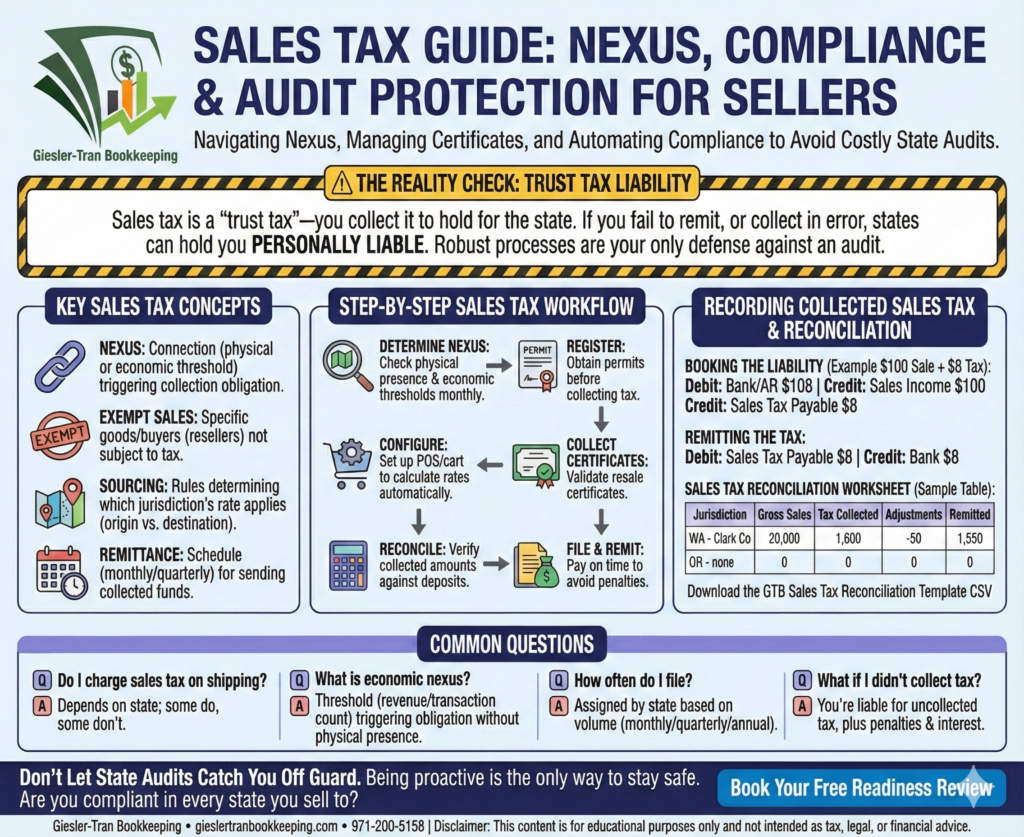

The Reality Check: Fundamentally, sales tax is a “trust tax”—you collect it from the customer to hold in trust for the state. If you fail to remit these funds, or if you collect them in error, states can hold you personally liable. Therefore, robust processes are your only defense against an audit.

Listen on The Deep Dive — where we dig deeper into this topic:

‘Sales Tax Nightmare—How Remote Sellers Avoid Nexus Audits and Crippling Penalties’

Why Sales Tax Compliance Matters

First, sales tax rules are state-driven and notoriously complex. Consequently, ignoring them does not protect you. Consider an online seller who began shipping out-of-state without realizing they crossed economic nexus thresholds. Eventually, a state audit revealed they owed back taxes in two states. Fortunately, proactive controls, like implementing a tax engine, can prevent this exposure.

For official definitions, refer to the SBA Guide on Business Taxes.

Key Sales Tax Concepts to Master

Next, you must understand the terminology to stay compliant. Ideally, you should familiarize yourself with these four pillars:

- Nexus: A connection (physical presence or economic threshold) that triggers your obligation to collect sales tax.

- Exempt Sales: Specific goods or buyers (like resellers) that are not subject to tax.

- Sourcing: Rules determining which jurisdiction’s rate applies (origin vs. destination).

- Remittance: The schedule (monthly/quarterly) for sending collected funds to the state.

Additionally, the Streamlined Sales Tax Governing Board offers resources for multi-state sellers.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

Act as a Sales Tax Consultant. Explain “Economic Nexus” for an e-commerce seller, including how varying state thresholds determine where sales tax must be collected. Then describe how Giesler-Tran Bookkeeping helps businesses track nexus obligations, record sales tax accurately, and implement automated tools to stay compliant across multiple states, reducing risk of penalties and audits.

Step-by-Step Sales Tax Workflow

Furthermore, establishing a routine is key to avoiding penalties. Specifically, follow this process monthly:

- Determine Nexus: Check physical presence and economic sales volume in new states.

- Register: Obtain permits before you start collecting sales tax.

- Configure: Set up your POS or cart (Shopify, WooCommerce) to calculate rates automatically.

- Collect Certificates: Validate resale certificates for exempt customers.

- Reconcile: Verify collected amounts against your bank deposits.

- File & Remit: Pay on time to avoid interest charges.

Moreover, if your past filings are messy, our cleanup services can reconcile your liability accounts. Then, we can maintain compliance with our monthly bookkeeping support.

Recording Collected Sales Tax

To illustrate, here is how to book the liability. Suppose a taxable sale of $100 plus 8% tax ($108 total):

Credit: Sales Income $100

Credit: Sales Tax Payable $8

Then, when you remit the $8 to the state:

Credit: Bank $8

Sales Tax Reconciliation Worksheet

To assist you, use this table to track your obligations by state. Simply copy this into a spreadsheet for automation.

WA – Clark County,20000,1600,-50,1550,Monthly

OR – none,0,0,0,0,N/A

Alternatively, download the ready-to-use file here: Download the CSV — GTB Sales Tax Reconciliation Template.

Common Questions on Sales Tax

- Q: Do I charge sales tax on shipping?

- A: It depends on the state. Some states consider shipping taxable, while others do not. Check the specific rules for your nexus states.

- Q: What is economic nexus?

- A: It is a threshold (usually revenue or transaction count) that triggers a collection obligation even if you have no physical presence in the state.

- Q: How often do I file?

- A: Filing frequency (monthly, quarterly, or annual) is assigned by the state based on your sales volume.

- Q: What if I didn’t collect tax?

- A: You are still liable for the uncollected tax. You will likely have to pay it out of pocket, plus penalties and interest.

Don’t Let State Audits Catch You Off Guard

Sales tax obligations can appear suddenly due to a new shipping location or hitting an economic threshold. Being proactive is the only way to stay safe.

Are you compliant in every state you sell to?

We can identify your risks before the state does. Book a complimentary Sales Tax Readiness Review today. We’ll highlight your top vulnerabilities and show you how to fix them.

Book Your Free Readiness Review

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.