Recently, I’ve noticed a massive shift in how successful businesses manage their financial health. In reality, the days of relying on local hires, shoeboxes of fading receipts, and desktop computers trapped in a locked back office are over. For instance, today’s technology allows for a seamless, secure, and highly efficient financial workflow that operates entirely through the cloud. However, many owners still wonder if remote bookkeeping is safe or effective for their specific industry. Because cloud accounting utilizes bank-level encryption and direct data feeds, it actually offers more security and accuracy than traditional methods. Therefore, adopting remote bookkeeping is not just a trend—it is the modern standard for growth-focused companies seeking real-time clarity.

Remote Bookkeeping Explained: How It Works & Why Businesses Switch

Geographical barriers to expert financial management have officially dissolved.

The Reality Check: Fundamentally, remote bookkeeping utilizes bank-level encryption and direct data feeds to maintain your general ledger without a physical presence in your office. Therefore, business owners gain access to real-time financial clarity and higher-level talent than their local geography might offer, all while significantly lowering overhead costs. Remember, you need accuracy and insight, not just a warm body in a chair.

Listen on The Deep Dive — where we explore this topic further:

‘The Logistics of Going Remote: Security, Workflow, and Freedom’

How Remote Bookkeeping Works in Practice

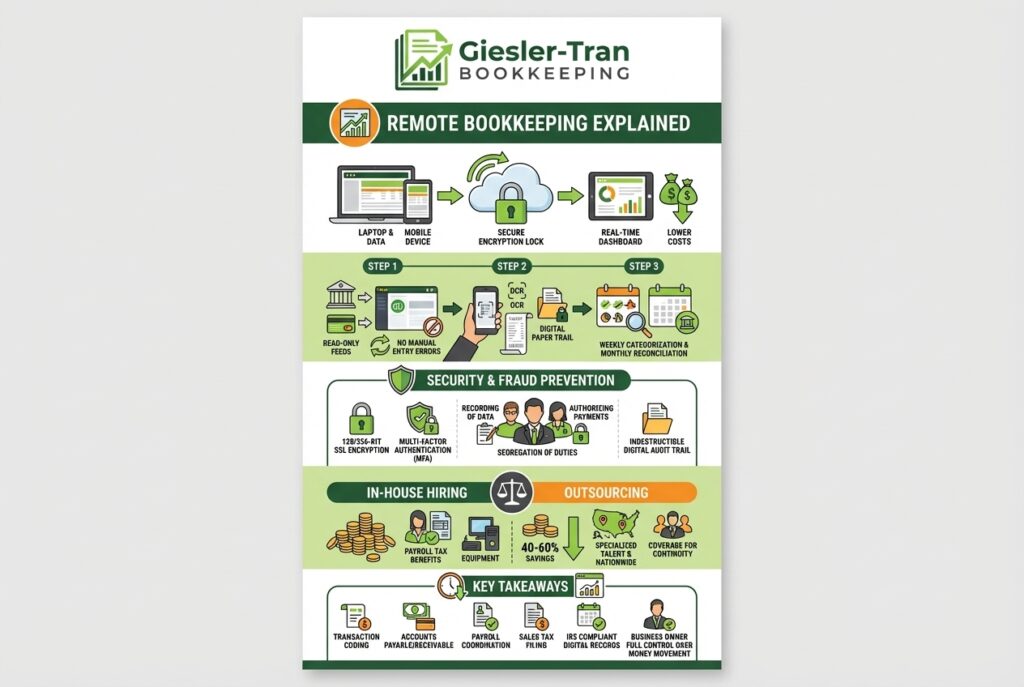

Initially, many business owners worry if a remote team can truly understand the nuances of their daily operations. In reality, a structured digital workflow provides substantially more accuracy than a distracted in-house employee. Here is the specific “tech stack” we utilize to ensure efficiency:

- Connecting Financial Sources: First, we establish read-only “bank feeds” that allow transaction data to flow automatically into your ledger every 24 hours. This virtually eliminates human data-entry errors like transposing numbers.

- Digitizing the Paper Trail: Instead of managing physical receipts, you simply snap a photo using a mobile app. Consequently, we extract the data via Optical Character Recognition (OCR) and attach the image directly to the transaction, creating an audit-proof trail.

- Categorization & Reconciliation: Periodically, we categorize transactions and reconcile accounts against the official bank statement. This identifies discrepancies immediately, rather than waiting until year-end.

Is Remote Bookkeeping Secure?

Undoubtedly, security is the most common concern for business owners transitioning to the cloud. In fact, cloud-based platforms like Intuit’s QuickBooks Online utilize 128-bit or 256-bit SSL encryption, the same standard used by major banks. Conversely, physical offices often pose greater risks due to unlocked file cabinets or printed checks left on desks.

At Giesler-Tran Bookkeeping (GTB), we implement strict controls that most in-house teams lack. Specifically, we enforce Multi-Factor Authentication (MFA) on all logins, use encrypted portals for sensitive documents, and maintain detailed digital audit trails. Ultimately, these measures provide a level of transparency and fraud protection that manual, paper-based systems simply cannot match.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see what an AI fraud examiner thinks about remote vs. in-house security.

Why Remote Bookkeeping Often Beats In-House Hiring

Admittedly, hiring internally feels comfortable, but it involves hidden costs like payroll taxes, benefits, and equipment. Typically, a full-time in-house bookkeeper costs $45,000 to $60,000 annually. In contrast, outsourced remote bookkeeping services are generally a fraction of that cost, often saving businesses 40% to 60% annually.

Furthermore, hiring locally limits you to the talent pool within a 20-mile radius. By going remote, you gain access to specialists who understand your specific industry nuances, regardless of location. At GTB, we serve clients from Washington to Florida, bringing a strategic advantage derived from seeing hundreds of business scenarios across the country. This means we have likely already solved the problem you are facing today.

Services Included in Remote Bookkeeping

Comprehensive remote service goes far beyond simple data entry; we act as your complete back-office finance department. Here is what our monthly service packages typically include:

- Transaction Coding: Accurate classification of all inflows and outflows to maximize deductions.

- Bank Reconciliations: Ensuring the ledger matches the bank to the penny every single month.

- Accounts Payable (AP): Managing bill payments and vendor relationships so you never miss a due date.

- Financial Reporting: Delivering Balance Sheets, P&Ls, and Cash Flow statements that make sense.

- Sales Tax Filing: Managing compliance across different state jurisdictions to avoid penalties.

If you need to understand how these tasks differ from high-level tax strategy, review our guide on Bookkeeping vs. Accounting.

Q&A: Common Questions About Remote Bookkeeping

Q: What happens if I get audited by the IRS?

A: You will be far better prepared than most businesses. Because we attach digital receipts to transactions throughout the year, substantiating your expenses is simple and compliant with IRS recordkeeping guidelines.

Q: How do I get my physical documents to you?

A: You rarely need to mail anything. We set you up with a mobile app to snap photos of receipts, so your paperwork is processed instantly rather than piling up on a desk.

Q: Can you work directly with my CPA?

A: Absolutely. CPAs love working with us because we provide clean, reconciled books. Plus, our in-house Senior Tax Accountant ensures we speak their language.

Q: Do I lose control of my money?

A: Never. You retain sole authority over signing checks and authorizing payments. We prepare transactions for your approval, but money never leaves your account without consent.

Q: How do we communicate if you aren’t in the office?

A: We utilize scheduled Zoom reviews, email for quick questions, and a dedicated client portal. Most clients find they get faster responses from us than they did from their previous in-house staff.

In Summary: Freedom and Clarity

Ultimately, remote bookkeeping is about freedom. It gives you the freedom to run your business from anywhere, confident that your financial foundation is solid. If you are ready to reclaim your time, we are here to help.

The Bottom Line

Stop worrying about your books.

Start focusing on your growth.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response