Recently, I’ve noticed a concerning trend where product-based business owners approach their financials with the same mindset as service providers. In reality, managing manufacturing & sales bookkeeping is nothing like balancing a checkbook for a consultant or a marketing agency.

For instance, a service business primarily tracks money in and money out. However, in manufacturing, you are managing a living ecosystem:

- Raw materials constantly fluctuating in price.

- Work-in-Process (WIP) moving through production.

- Finished goods sitting on shelves.

Because a single error in inventory valuation or overhead allocation can compound silently for months, treating this function like simple data entry is a recipe for disaster.

Precision in Production: The Ultimate Guide to Manufacturing & Sales Bookkeeping for Profitability

This post was inspired by our friends over at: Loowitgear.com

When the numbers lie, the decisions follow.

Key Takeaway: The Reality Check

Fundamentally, most manufacturing bookkeeping mistakes don’t show up immediately; they hide inside your inventory asset accounts. Therefore, specialized manufacturing & sales bookkeeping isn’t just about tax compliance—it’s the only way to ensure your cash flow actually matches your paper profits. Remember, “profit” on a P&L statement means nothing if you can’t find the cash in your bank account.

Listen on The Deep Dive — where we explore this topic further:

‘Manufacturing COGS Inventory and Job Costing’

Why Manufacturing & Sales Bookkeeping is Different (and Riskier)

Initially, it is vital to understand why standard accounting methods fail in a production environment. Unlike a consulting firm that primarily tracks revenue, payroll, and simple office expenses, a product business operates within a complex ecosystem.

Specifically, you must track the entire lifecycle of a product:

- Moving raw materials into Work-in-Process (WIP).

- Transitioning WIP to finished goods.

- Allocating labor and overhead correctly to each unit.

Furthermore, external factors create a web of financial interactions where one small error can warp your entire bottom line. Common risks include:

- Inventory Shrinkage: Physical loss that isn’t recorded.

- Vendor Lead Times: affecting cash flow timing.

- Shipping Logistics: fluctuating landed costs.

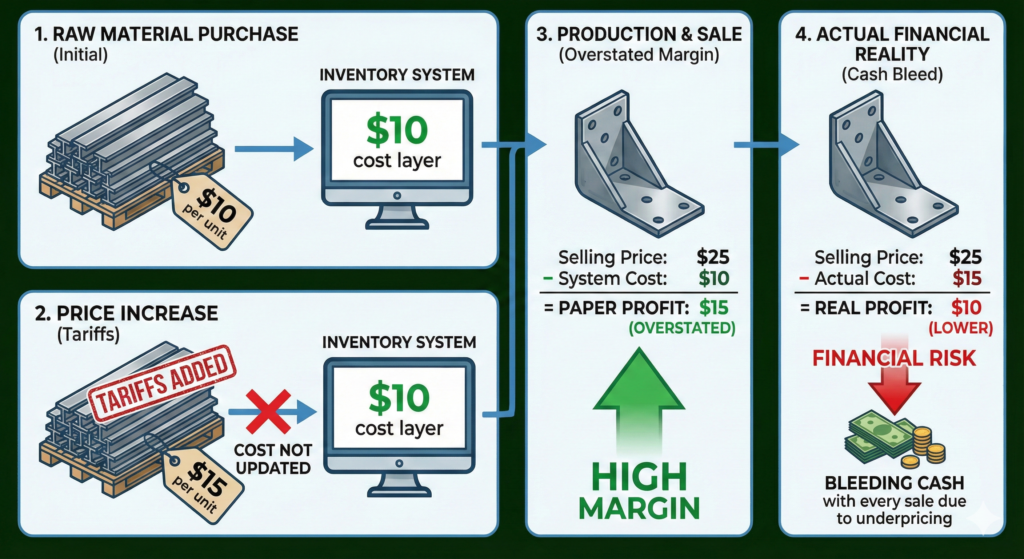

For example, if a shipment of raw steel increases in price due to tariffs, but your inventory system doesn’t update the cost layer for that specific batch, your profit margins on the finished product will be overstated. Consequently, you might continue selling that product at a price that no longer covers your actual costs, bleeding cash with every sale.

The Heartbeat of the Business: Cost of Goods Sold (COGS)

Undoubtedly, COGS is the most critical metric in manufacturing & sales bookkeeping. When calculated correctly, this metric tells you your true margins. Conversely, when done incorrectly (e.g., expensing materials immediately upon purchase), it creates a dangerous sense of false confidence.

Crucially, accurate COGS must include more than just the price of wood, plastic, or steel. It must account for:

- Direct Materials: The raw inputs.

- Direct Labor: The hands-on time used in production.

- Manufacturing Overhead: Facility rent, utilities, and equipment depreciation.

If you fail to apply these costs to the product, you might be pricing your items below their actual cost to produce. For further reading on the strict requirements for capitalization, the IRS Publication 538 provides essential guidelines on inventory accounting.

Inventory Strategy in Manufacturing & Sales Bookkeeping

Beyond simple tracking, inventory management is a core component of financial strategy. Ideally, a strategic bookkeeping approach ensures that:

- Inventory values reflect current replacement costs.

- Dead stock is identified before it becomes a total loss.

- Turnover ratios are monitored to free up cash flow.

Furthermore, inventory represents both an asset and a significant risk. Specifically, wrongly valued inventory can destroy your tax position by overstating your income, leading to tax bills for money you haven’t actually made.

Therefore, implementing proper controls to reconcile multiple warehouses or storage locations is essential for risk management. If your current inventory counts rarely match your financial reports, our Diagnostic Review and Cleanup services can help realign your physical reality with your financial data.

Job Costing: The Difference Between Guessing and Knowing

Significantly, manufacturers live or die by the accuracy of their job costing. Within the framework of manufacturing & sales bookkeeping, a strong system tracks:

- Materials used per batch.

- Specific labor hours.

- Equipment time.

- Waste and scrap.

Consequently, this level of granularity allows you to know with certainty which product lines deserve expansion and which clients cost more to serve than they pay.

Cash Flow Realities and Multi-Channel Complexity

Typically, product businesses face a distinct cash flow cycle where cash goes out for materials and labor months before revenue comes in. Because of this gap, Accrual Accounting is vital. It matches expenses to the revenue they produce, giving you a realistic picture of performance rather than a roller-coaster P&L based solely on bank deposits.

Additionally, modern manufacturers rarely sell in just one location. Often, you may juggle:

- Shopify & Amazon

- Wholesale accounts

- Trade shows

Unfortunately, each platform introduces unique fees, return policies, and payout schedules. Therefore, trying to reconcile these manually is a recipe for chaos. Instead, we integrate these sales channels directly into your accounting software to ensure revenue is recorded without double-counting and fees are captured accurately.

The Hidden Cost of “Cheap” in Manufacturing & Sales Bookkeeping

Admittedly, it can be tempting to hire a low-cost generalist bookkeeper. However, cut-rate providers often lack the technical expertise to handle inventory valuation or sales tax nexus issues. Frequently, they will:

- Skip accrual accounting entirely.

- Use manual spreadsheets to “plug” gaps they don’t understand.

- Fail to separate direct costs from overhead.

Short term, this feels inexpensive. Long term, it produces messy financials that require costly cleanup, leads to damaged margins, and significantly raises your audit risk.

At Giesler-Tran Bookkeeping, we treat your financial system with the same respect you treat your production equipment. If you are ready to upgrade from data entry to financial strategy, visit our Monthly Bookkeeping Services page to learn more.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight. Is a generalist bookkeeper safe for a manufacturing business?

Q&A: Mastering Financials for Product Businesses

Q: Why can’t I just use cash-basis accounting?

A: While allowed for taxes for some, cash-basis gives a distorted view of profitability for manufacturers. Specifically, because you buy inventory months before selling it, your monthly P&L will look like a roller coaster, making it impossible to track true margins month-over-month.

Q: How do you handle multi-state sales tax?

A: This is a major compliance trap known as “economic nexus”. Once you hit a volume threshold in a state, you must remit tax there. Consequently, we use specialized tools to track this exposure automatically so you don’t have to monitor every jurisdiction manually.

Q: My inventory count never matches QuickBooks. Is that normal?

A: Common, but not acceptable. Usually, this stems from theft, unrecorded waste, or timing differences in recording receipts. Therefore, we implement regular cycle counts to keep your balance sheet accurate.

Q: What’s the difference between direct costs and overhead?

A: Direct costs are tied immediately to the product, like wood or labor. In contrast, manufacturing overhead includes indirect costs like factory rent or electricity. Correctly allocating overhead is essential for knowing the true cost to produce a unit.

Q: Can you help me find my most profitable products?

A: Absolutely. By utilizing precise job costing and breaking down COGS by SKU, we generate reports that highlight winners and losers, so you can make data-driven decisions on what to promote.

In Summary: Stop Guessing, Start Growing

Ultimately, proper manufacturing bookkeeping is the operating system of a sustainable brand. Stop letting inventory leaks and pricing errors drain your hard-earned revenue. Instead, partner with experts who understand the physics of product-based finance and treat your books with the same care as your production floor.

The Bottom Line

You wouldn’t run production with broken machines.

Don’t run your business with broken numbers.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.