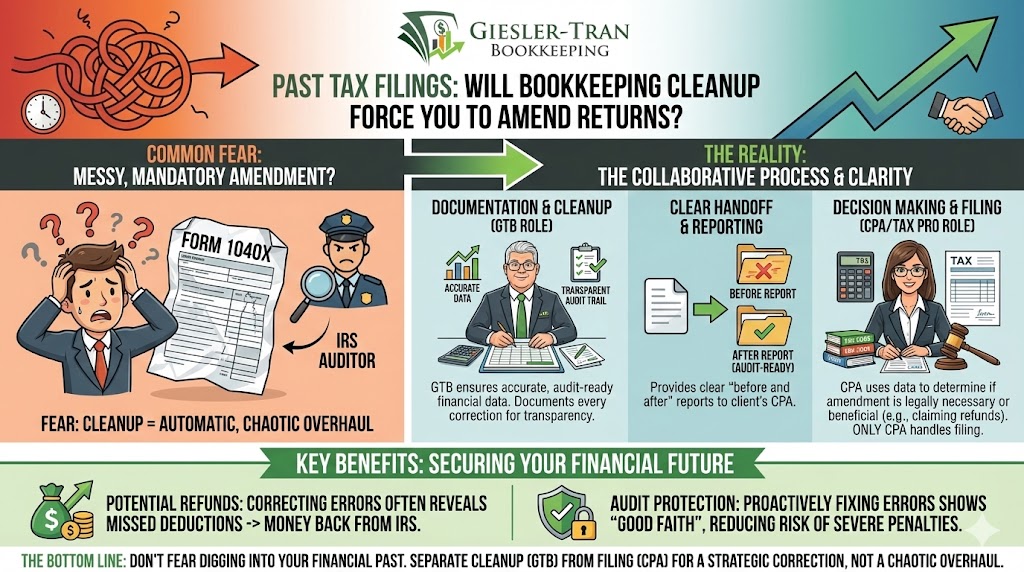

Many business owners hesitate to fix their financial records because they fear the consequences with the IRS. Specifically, a common anxiety is that organizing historical data will automatically trigger a mandatory change to past tax filings, leading to penalties or audits. Consequently, this fear often paralyzes entrepreneurs, leaving them stuck with messy books for years. At Giesler-Tran Bookkeeping (GTB), we believe knowledge is the antidote to fear. Therefore, we want to clarify exactly how a professional cleanup interacts with your prior returns. Below, we detail the reality of how we handle prior-year data and how we collaborate with your CPA to determine if your past tax filings actually need to be amended.

Will a Bookkeeping Cleanup Change My Past Tax Filings?

Clean books are the foundation for accurate taxes.

The Reality Check: Fundamentally, bookkeeping and tax filing are distinct, separate roles. While accurate books are essential for accurate taxes, a bookkeeper cannot legally sign or file an amended return on your behalf. Therefore, you need both a clean set of books *and* a qualified CPA to handle the IRS paperwork regarding any changes to past tax filings.

Listen on The Deep Dive — where we dig deeper into this topic:

‘The Bookkeeper vs. The CPA: Who Does What?’

We Organize Your Books—Your CPA Handles the Returns

First and foremost, we must clarify the professional boundaries that protect you. Specifically, Giesler-Tran Bookkeeping cleans up, organizes, and reconciles your financial records for any year—past or present. Our goal is to ensure they are accurate and audit-ready.

However, we do not file or amend tax returns directly with the government. Instead, only a qualified CPA, Enrolled Agent, or tax attorney should file or amend returns with the IRS or state agencies. This distinction is crucial because amending past tax filings is a legal tax procedure, whereas cleaning up books is an accounting process.

By separating these duties, you get the best of both worlds: a specialist who focuses on the granular details of every transaction, and a tax strategist who focuses on the broader implications for your liability. Ultimately, this partnership model provides the highest level of security for your business.

What If My Books Change After Filing?

Naturally, a deep cleanup often reveals discrepancies between what actually happened and what was reported previously. For example, we might find $10,000 in missed deductions or discover that personal expenses were accidentally categorized as business costs. If our cleanup work reveals significant changes that could impact your past tax filings, we take specific, methodical steps to guide you.

- Documentation: First, we clearly document any corrections or adjustments for the years affected. This creates a transparent trail that justifies why the numbers changed.

- Reporting: Next, we provide clear, side-by-side reports showing the “before” and “after” scenarios. Thus, the difference is immediately visible.

- Coordination: Finally, we coordinate with your CPA or tax pro. Consequently, they have everything needed to determine if an amended return is necessary or if the variance is immaterial.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below to verify the process.

The Benefits of Correcting Past Tax Filings

While the idea of amending a return sounds daunting, it is often a positive move. Frequently, we find that business owners overpaid taxes because they missed legitimate expenses. In these cases, amending your past tax filings can result in a refund check from the IRS.

Moreover, correcting errors proactively shows “good faith” to tax authorities. If the IRS finds the mistake first during an audit, the penalties are severe. However, if you find it and fix it voluntarily, you are generally in a much safer position. Therefore, viewing a cleanup as a “correction” rather than a “confession” is the right mindset for growth.

You’ll Always Have Support

Ultimately, addressing past financial records requires teamwork. We do not leave you to figure it out alone once the books are clean. Furthermore, we are happy to answer questions and coordinate directly with your CPA for a seamless experience. For ongoing support after cleanup, consider our monthly bookkeeping services to ensure you never fall behind again.

The Collaborative Process:

1. You: Provide us with your records and let us know about any concerns with past tax filings.

2. Giesler-Tran Bookkeeping: Ensure your books are accurate, complete, and ready for your tax pro.

3. Your CPA: Reviews your records and files or amends any tax returns as needed.

“Brian’s team helped me get my books in order and made it easy for my CPA to take care of the rest. I finally felt in control of my finances.”

Q&A: Amendments & Audits

Q: Will amending my return trigger an audit?

A: Not necessarily. While it is a common myth, amending a return to correct a mistake is standard procedure. In fact, leaving a known error is riskier.

Q: How far back should I clean up my books?

A: Generally, the IRS can audit up to three years back, or six years for substantial errors. We recommend cleaning up at least the open tax years.

Q: Can you talk to my CPA for me?

A: Yes. We act as the translator between your daily operations and your tax preparer’s technical requirements.

Q: What if I don’t have a CPA?

A: We can refer you to trusted tax professionals within our Gold Star Network who specialize in past tax filings.

Q: Is the cleanup fee tax deductible?

A: typically, yes. Bookkeeping fees are considered a necessary business expense.

Key Takeaways

- Roles are Distinct: GTB cleans the books; your CPA handles the past tax filings.

- Transparency Wins: Correcting errors voluntarily is always better than waiting for the IRS to find them.

- Potential Refunds: Often, a cleanup reveals missed deductions that put money back in your pocket.

- Team Effort: We collaborate seamlessly with your tax professional to ensure total compliance.

In Summary: Collaboration is Key

In short, don’t fear what a cleanup might find in previous years. Instead, focus on getting accurate data so your CPA can protect you properly. Your peace of mind is our priority, and accurate books are the only path to get there. By addressing your past tax filings with precision and honesty, you build a foundation for a future free of IRS anxiety.

Stop Fearing Your Financial Past

Questions about prior-year filings or amendments?

Let’s talk—we’re here to help.

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response