Maintaining audit-ready financial records is the single most effective way to protect your business from regulatory nightmares. While many business owners view bookkeeping as a simple data-entry chore, Giesler-Tran Bookkeeping (GTB) treats it as a critical defense strategy. Specifically, we believe that the best results come from a clear, consistent process that leaves nothing to chance. Unlike amateur bookkeepers who scramble to fix errors only when tax season arrives, our approach is built on transparency, proven systems, and a relentless focus on accuracy. Therefore, we have designed every step of our workflow—from onboarding to monthly reporting—to ensure your organization remains audit-ready every single day of the year.

Our Bookkeeping Process: Transparent, Proven, and Audit-Ready

Consistency is the enemy of anxiety.

The Reality Check: Fundamentally, the IRS does not care about your intentions; they care about your documentation. If you cannot prove an expense with an audit-ready receipt and a clear paper trail, that deduction effectively does not exist. Consequently, relying on memory or disorganized shoeboxes invites disaster. Effective bookkeeping is not just about knowing where your money went—it is about proving it.

Listen on The Deep Dive — reviewing our workflow:

‘The Anatomy of an Audit-Proof Business’

Step 1: The Free Audit-Ready Assessment

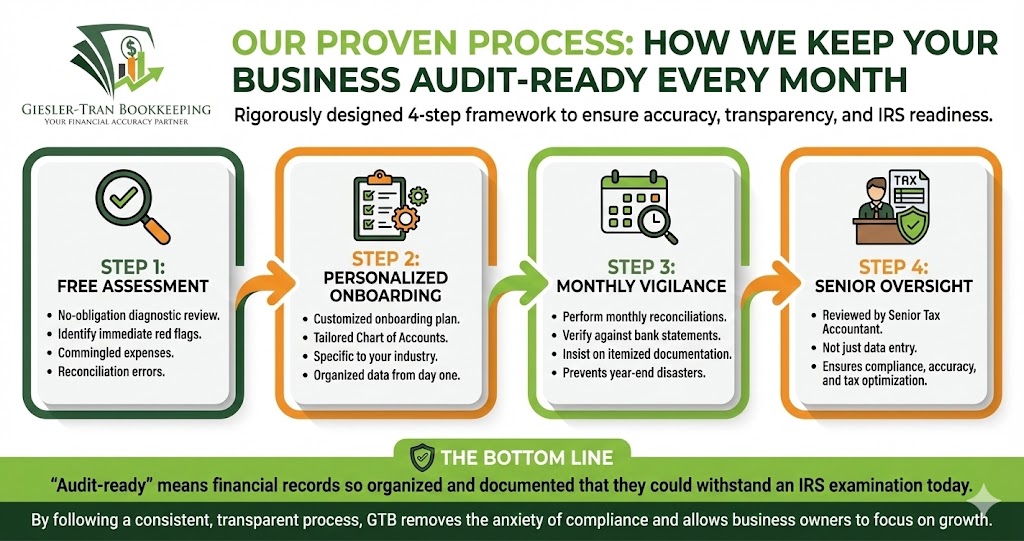

First, we never start a relationship blindly. Before we sign a contract or touch your ledger, we conduct a comprehensive, no-obligation review of your current financial state. This initial step serves as a diagnostic tool to identify immediate red flags that prevent you from being audit-ready. Specifically, we look for commingled personal expenses, unclassified transactions, and reconciliation discrepancies that may have compounded over time.

Furthermore, this assessment allows us to give you honest feedback. If your books are in disarray, we will recommend our cleanup services to establish a solid foundation. Ultimately, you cannot build a skyscraper on a swamp, and you cannot build a tax strategy on messy data.

Step 2: Personalized Onboarding for Audit-Ready Success

Once we agree to move forward, we initiate a structured onboarding phase. Every client receives a tailored checklist designed to gather the necessary access and documentation without overwhelming them. At GTB, we understand that “one size fits all” rarely works in accounting. Therefore, we customize your Chart of Accounts to reflect the specific nuances of your industry, whether you are a medical practice or a service agency.

Crucially, this phase sets the expectations for our partnership. We establish the communication channels and document submission protocols that keep your files organized. By clarifying these workflows early, we ensure that your records remain audit-ready from day one. For more on the importance of organized records, the IRS Recordkeeping Guide offers essential standards every business should meet.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see why process matters.

Step 3: Monthly Reconciliations and Itemized Documentation

Moreover, the heartbeat of our process is the monthly reconciliation. We do not just enter data; we verify it against your bank and credit card statements to catch errors immediately. This proactive approach ensures that your balances are always accurate to the penny. Simultaneously, we insist on itemized documentation for every significant transaction. Guesswork is the enemy of an audit-ready file, so we leave no receipt behind.

Additionally, this rigorous attention to detail prevents small issues from snowballing. If a check is missing or a deposit is mislabeled, we flag it now rather than waiting for your CPA to find it next year. This consistent vigilance is why our clients experience lower stress levels and lower tax preparation fees. If you are curious about costs, review our guide on bookkeeping pricing to see the value of expert oversight.

Step 4: Senior Oversight and Regular Updates

Perhaps the most unique aspect of the GTB process is our layered review system. Unlike solo bookkeepers who work in a vacuum, every set of books we produce undergoes an executive review. Specifically, a Senior Tax Accountant analyzes your financials for accuracy, compliance, and tax optimization opportunities. This ensures that your reports are not just mathematically correct, but strategically useful and fully audit-ready.

Similarly, we believe you should never wonder about the state of your business. We provide timely summaries, detailed reports, and proactive reminders so you are always in the loop. By keeping you informed, we empower you to make data-driven decisions confidently. For additional context on financial controls, the Small Business Administration (SBA) emphasizes that regular financial review is key to longevity.

Why Transparency Matters for Audit-Ready Records

Finally, transparency is the bedrock of trust. Clients deserve to know exactly what is happening with their books—no surprises, ever. Our transparent process creates audit-ready records that stand up to scrutiny from the IRS, lenders, or potential investors. When you apply for a loan or face an inquiry, you will have a pristine, organized history at your fingertips.

Ultimately, this consistency allows you to focus on growth rather than administration. By trusting GTB to maintain an audit-ready posture, you secure your business’s future. If you are ready to upgrade your financial infrastructure, learn more about choosing the right partner.

Q&A: The Audit-Ready Standard

Q: What does “audit-ready” actually mean?

A: It means your financial records are so organized, accurate, and documented that you could hand them to an IRS auditor today without fear. Every number has proof behind it.

Q: Do you really check the books every month?

A: Yes. Waiting until year-end inevitably leads to errors. Monthly reconciliations ensure your data is always current and reliable.

Q: Why is a Senior Tax Accountant review important?

A: Bookkeeping affects taxes directly. Having a tax expert review the books ensures we catch deductions and compliance issues that a standard data entry clerk would miss.

Q: Can you help if my books are currently a mess?

A: Absolutely. Our process starts with a diagnostic review. If cleanup is needed, we handle that first to get you back to an audit-ready baseline.

Q: What do I need to provide during onboarding?

A: We need read-only access to bank/credit card accounts and prior tax returns. Our checklist guides you through everything, making it a painless process.

Key Takeaways

- Start with Assessment: Never assume your books are fine; let us conduct a free review to find hidden risks.

- Reconcile Monthly: Consistent monthly checks are the only way to ensure your files remain audit-ready year-round.

- Demand Oversight: Senior review prevents costly tax mistakes and ensures high-level accuracy.

- Value Transparency: Clear, regular reporting helps you make faster, smarter business decisions.

In Summary: Peace of Mind Through Process

Ultimately, excellence is not an act, but a habit. At Giesler-Tran Bookkeeping, our habits are designed to protect you. Our transparent, proven process ensures that being audit-ready is the standard, not the exception. Discover the peace of mind that comes from knowing your numbers are solid. Book your free consultation with Giesler-Tran Bookkeeping today and experience the difference a professional system makes.

Is Your Business Audit-Ready?

Don’t wait for a letter from the IRS to find out.

Get a free assessment of your books today.

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.