Recently, a business owner asked if they could simply “estimate” their travel expenses because they lost the paperwork. Technically, a legal precedent exists for this, but relying on it is dangerous. In reality, dealing with missing receipts isn’t just about showing you paid; you must prove the expense was ordinary, necessary, and business-related. Below, we break down exactly what the IRS accepts, what the “Cohan Rule” actually covers, and why travel and meals require strict documentation.

Missing Receipts & The Cohan Rule: What the IRS Really Accepts

Estimates work sometimes. Documentation works always.

The Reality Check: Fundamentally, a deduction isn’t automatically lost just because the receipt is gone. However, you still have the burden of proof. Specifically, for travel, meals, and entertainment, the IRS is legally prohibited from accepting estimates. Therefore, missing receipts in these categories usually mean disallowed deductions—no debate.

Listen on The Deep Dive — where we dig deeper into this topic:

‘The Cohan Rule Is Dead For Travel Expenses’

What is the Cohan Rule?

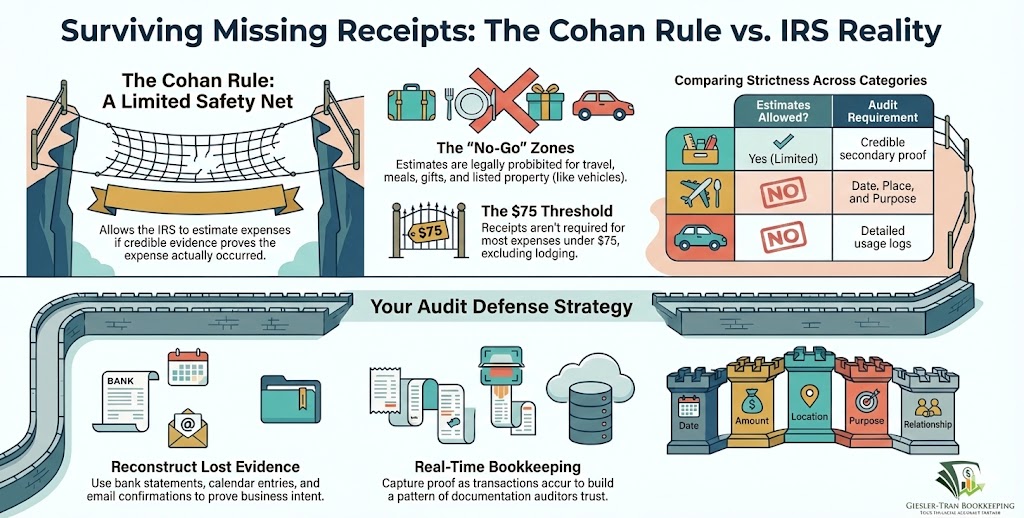

To clarify, the Cohan v. Commissioner case established a rule that allows the IRS (or a court) to estimate certain expenses when records are incomplete. However, this applies only if credible evidence exists that the expense actually occurred.

Important: This is not a “get-out-of-records” free card. You still need supporting proof like bank statements, invoices, or logs to substantiate the claim.

Why the Cohan Rule Does NOT Apply to Travel & Meals

Unfortunately, Congress created strict substantiation rules under IRC §274(d) that supersede the Cohan Rule. Specifically, for certain categories, the IRS is legally prohibited from estimating expenses.

Strictly Documented Categories

If you have missing receipts in the following areas, the auditor must deny them, even if they clearly happened:

- Travel (airfare, hotels, transportation)

- Meals (client dinners, travel meals)

- Entertainment (when deductible)

- Listed Property (vehicles, laptops with personal use)

- Gifts (subject to strict limits)

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

How to Rebuild Records for Missing Receipts

Conversely, if the paper receipt is gone, you must rebuild the file immediately. Specifically, for travel and meals, your records must clearly show the Date, Amount, Location, Business Purpose, and Business Relationship.

Audit-Proof Reconstruction Checklist

- Bank/Credit Card Statement: Proves payment occurred.

- Email Confirmations: Acts as a substitute for invoices.

- Calendar Entries: Proves where you were and who you met.

- Written Notes: Explains the “why” behind the expense.

Additionally, note that for most expenses under $75, receipts aren’t required (except lodging). However, you still need documentation of what it was and why it was business-related.

How Giesler-Tran Protects Your Deductions

Ultimately, this is where disciplined bookkeeping pays off. Unlike DIY methods, our professional process ensures safety through varied checkpoints:

- Proactively, we track documentation as transactions occur, not months later.

- Next, we flag missing receipts and help reconstruct proof immediately.

- Furthermore, we maintain audit-ready notes inside your records.

- As a result, we create consistent documentation patterns that auditors trust.

In Summary: Defensible Deductions

Bottom line: The Cohan Rule allows estimates only when strict substantiation doesn’t apply. If a receipt goes missing, rebuild the proof immediately. Systems—like the ones we set up at Giesler-Tran—protect deductions long before an audit ever happens.

The Bottom Line

Worried about specific missing receipts?

Tell us the expense type, and we’ll show you how to document it.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.