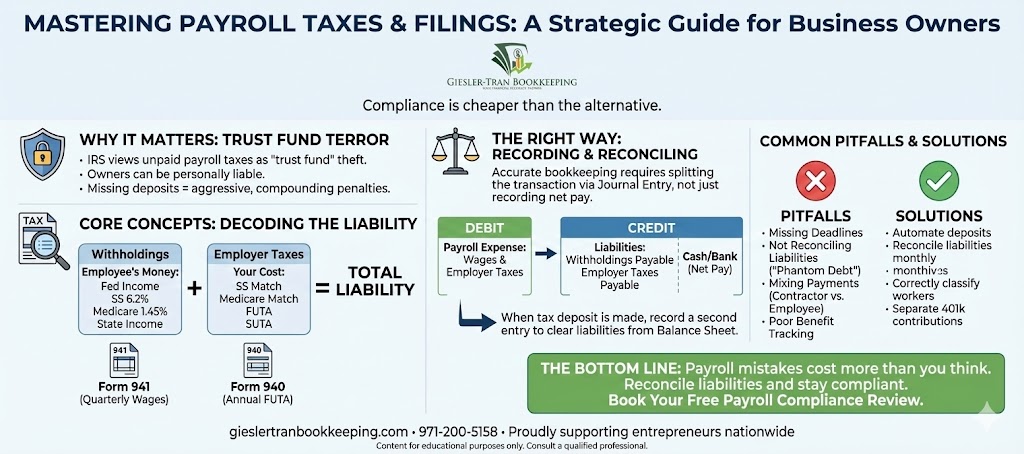

I recently encountered a small business owner who was treating their payroll responsibilities as a simple administrative task, unaware of the severe risks involved. In reality, managing payroll taxes and filings is often the most dangerous compliance minefield a growing company faces. A single missed deposit deadline or a miscalculated withholding amount, for instance, can trigger aggressive IRS penalties that compound daily. Despite these high stakes, many entrepreneurs still attempt to handle this manually to save a few dollars, unknowingly putting their entire operation at risk. Since the IRS views unpaid payroll taxes as “trust fund” theft, they possess the power to pierce the corporate veil and hold owners personally liable. Therefore, mastering the mechanics of payroll taxes and filings—from liability reconciliation to timely deposits—is not merely about bookkeeping; it is a fundamental requirement for business survival.

Mastering Payroll Taxes and Filings: A Strategic Guide for Business Owners

Compliance is cheaper than the alternative.

The Reality Check: Fundamentally, payroll taxes include both employee withholdings and employer taxes like Social Security, Medicare, and FUTA. Consequently, proper bookkeeping requires you to reconcile liabilities each pay period, deposit taxes on strict schedules, and produce accurate W-2s. Remember, missing a deposit isn’t just a mistake; to the government, it looks like you are stealing your employees’ money.

Listen on The Deep Dive — where we explore this topic further:

‘Payroll Tax Trust Fund Terror: How to Master Payroll Tax Deposits and Liability Accounts to Avoid IRS Penalties’

Why Payroll Taxes and Filings Matter for Your Survival

You might initially view payroll as simply the act of cutting checks to your team every two weeks. However, the hidden complexity lies in the fact that you are acting as an unpaid tax collector for the federal government. Specifically, when you withhold money from an employee’s paycheck for Income Tax, Social Security, and Medicare, that money strictly belongs to the Treasury, not to you. Consequently, using those funds for operational expenses—even for a single day—is a severe violation of trust fund recovery penalty laws.

Consider the story of a startup we helped recently. They had tried to save money previously by calculating payroll taxes and filings manually in a spreadsheet. Unfortunately, they missed a semi-weekly deposit deadline because they didn’t fully understand the IRS “lookback period” rules. As a result, they were hit with penalties that far exceeded the annual cost of the payroll software they were trying to avoid. Ultimately, after switching to a professional provider and implementing our monthly reconciliation process, they regained control of their cash flow.

Core Concepts of Payroll Taxes and Filings

The terminology can be confusing undoubtedly if you don’t have a formal accounting background. To clarify, let’s break down the essential components that make up your total liability. Here are the key elements every business owner must track:

- Withholdings: These are deductions taken directly from the employee’s gross pay, including federal income tax, Social Security (6.2%), Medicare (1.45%), and applicable state income taxes.

- Employer Taxes: These are additional costs you pay on top of wages, including the employer match for Social Security and Medicare, plus FUTA (Federal Unemployment) and SUTA (State Unemployment).

- Form 941: This is the quarterly federal tax return where you report wages paid, taxes withheld, and liability due.

- Form 940: This is the annual return for reporting Federal Unemployment Tax Act (FUTA) liabilities, which funds unemployment administration.

If you need assistance setting up these accounts in your general ledger, our Monthly Bookkeeping Services can handle the configuration for you.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see what an AI tax specialist suggests regarding compliance risks.

Act as a payroll tax specialist. I am a small business owner. Explain the difference between “payroll tax expense” and “payroll tax liability” on my balance sheet, and how Giesler-Tran Bookkeeping helps business owners track both correctly. Clarify why it’s dangerous to rely only on my bank balance to decide whether I can afford to hire a new employee — especially when unpaid payroll liabilities may already be building behind the scenes. Include a clear warning about the IRS Trust Fund Recovery Penalty, and explain how expert bookkeeping support can prevent this from becoming a catastrophic financial mistake.

How to Record Payroll Taxes and Filings Correctly

Accurate bookkeeping is the only way crucially to ensure your filings match your payments. Business owners often simply record the net withdrawal from their bank as “wages,” but this is technically incorrect and dangerous. To do it right, you must split the transaction into its component parts using a detailed journal entry.

Here is how a simplified payroll journal entry should look specifically for a single pay period:

Debit: Payroll Expense – Wages ($8,000)

Debit: Payroll Expense – Employer Taxes ($700)

Credit: Federal Tax Withholding Payable ($1,200)

Credit: Social Security Withholding Payable ($496)

Credit: Medicare Withholding Payable ($116)

Credit: Employer Taxes Payable ($700)

Credit: Cash/Bank ($6,188 – Net Pay)

When you actually make the tax deposit to the IRS then, you record a second entry to clear the liabilities. This ensures that your Balance Sheet accurately reflects that the debt has been paid. For detailed guidance on record retention, you should consult IRS Employment Tax Recordkeeping standards.

Common Mistakes in Payroll Taxes and Filings

Even with software admittedly, errors happen. However, being aware of common pitfalls can save you thousands in fines. Here are the most frequent mistakes we see when reviewing new client books:

- Missing Deadlines: Failing to automate deposits through a provider leads to immediate penalties, often ranging from 2% to 15% of the unpaid amount.

- Not Reconciling Liabilities: Ignoring the balance sheet accounts means you might be carrying “phantom debt” or underpaying taxes without realizing it.

- Mixing Payments: Paying contractors via payroll instead of Accounts Payable (or vice versa) creates a 1099/W-2 compliance nightmare.

- Poor Benefit Tracking: Failing to separate employee 401k contributions from employer matches confuses the liability accounts and complicates audits.

Additionally, one of the most insidious errors is misclassifying employees as independent contractors to avoid payroll taxes and filings entirely. Because the Department of Labor has tightened rules on this, getting it wrong can lead to massive back-tax assessments.

Worksheet — Payroll Liability Tracker

Use this simple tracker to monitor your deposit status manually if you are not yet fully automated. Ideally, you should paste this into Excel or Google Sheets to track deadlines.

| Pay Period End | Register Total | Emp. Withholdings | Employer Taxes | Deposit Due | Paid (Y/N) |

| 2025-09-15 | 12,000 | 1,800 | 900 | 2025-09-17 | Y |

| 2025-09-30 | 15,000 | 2,250 | 1,125 | 2025-10-15 |

Download the CSV — Payroll Liability Tracker

Q&A: Managing Payroll Taxes and Filings

Q: What if I missed a payroll tax deposit?

A: Immediately pay it. Then, record the payment and contact the IRS or your state agency to address penalties. Proactive communication is always better than waiting for a notice.

Q: Can I handle payroll taxes and filings in-house?

A: Yes, but it is risky. With robust software and strict processes, it is possible, but many small businesses prefer outsourcing to reduce compliance risk significantly.

Q: How long should I keep payroll records?

A: Generally, you must keep records for at least 4 years after filing the 4th quarter for the year. Check your local state requirements, as they may require longer retention.

Q: Why do I need to reconcile liabilities if I use a payroll service?

A: Because data sync errors happen. Reconciliation ensures that what your payroll provider says happened matches what actually cleared your bank account.

Q: What is the most common payroll audit trigger?

A: Misclassification of workers. If you treat an employee as a contractor to avoid taxes, you are inviting a Department of Labor audit.

In Summary: Accuracy Protects Your Business

Managing payroll taxes and filings is about protecting your business’s future ultimately. By reconciling liabilities and automating deposits, you eliminate the risk of penalties. If you need help untangling your current payroll mess, visit our Tax Services page or book a review call below.

The Bottom Line

Payroll mistakes cost more than you think.

Reconcile liabilities and stay compliant.

Book Your Free Payroll Compliance Review

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.