Sticker shock is real. When you first see a quote for $600 a month, you might initially think professional bookkeeping too expensive for your current budget. Especially if you have been handling the books yourself or shopping for the absolute lowest price online, this figure can seem daunting. However, at Giesler-Tran Bookkeeping (GTB), we challenge you to look deeper than the monthly fee. Specifically, you must ask what you are really paying for and, conversely, what the true cost of “cheap” bookkeeping actually is. Therefore, this post breaks down the ROI of professional financial oversight and explains why skimping on this essential service often costs business owners far more in the long run.

Is $600/Month for Bookkeeping Too Expensive? The Math Behind the Fee

Don’t step over dollars to pick up pennies.

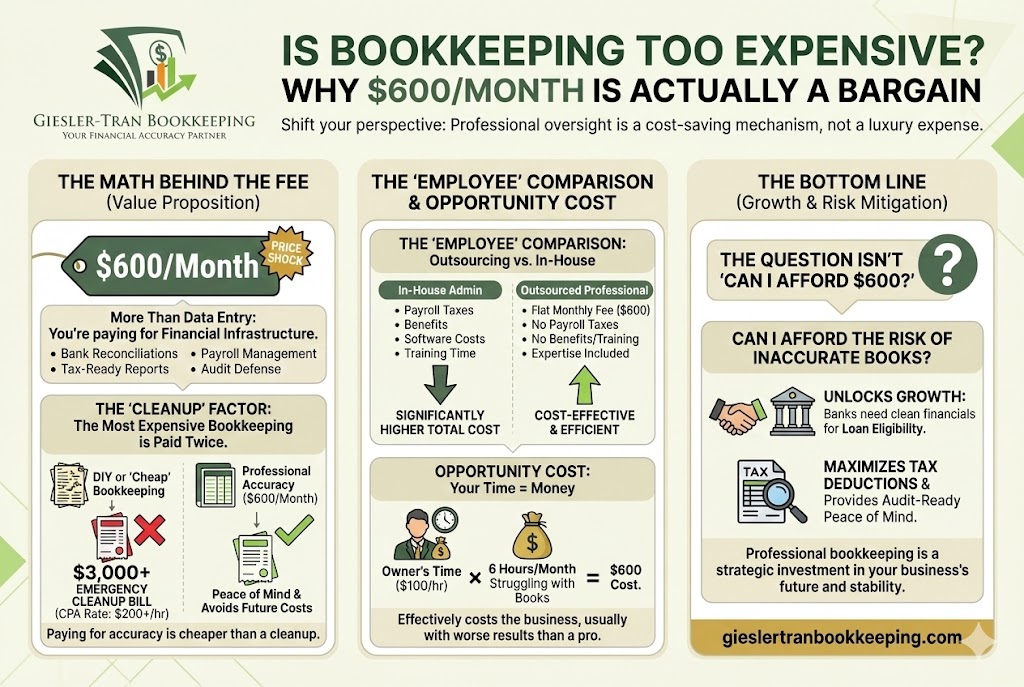

The Reality Check: Fundamentally, many owners believe bookkeeping too expensive because they view it as simple data entry. However, accurate bookkeeping is risk management. If you miss $2,000 in tax deductions because you didn’t know the rules, your “free” DIY bookkeeping just cost you $2,000. Ultimately, you pay for bookkeeping one way or another—either in monthly fees to a pro, or in overpaid taxes and stress to the IRS.

Listen on The Deep Dive — where we break down the costs:

‘The ROI of $600: Why Cheap Books Cost More’

Why You Might Think Bookkeeping Too Expensive

First, let’s address the psychology of pricing. When a business is small, cash flow is king. Consequently, every outgoing dollar feels like a threat to survival. In this context, paying someone $600 to “categorize transactions” seems like a luxury. However, this perspective ignores the complexity of what is actually happening. Expert bookkeeping isn’t just about recording history; it is about ensuring the future viability of the company.

Furthermore, business owners often compare this cost to the “free” labor of doing it themselves at night. But is that labor truly free? If your hourly rate as a CEO is $100, and you spend 6 hours a month struggling with QuickBooks, you have already “spent” $600—and likely did a worse job than a pro.

What Does $600/Month Actually Buy?

Crucially, when you hire a firm like GTB, you are purchasing more than data entry. You are purchasing a financial infrastructure. Specifically, that monthly fee covers a comprehensive suite of services designed to keep you compliant and profitable:

- Comprehensive Service: Included are bank reconciliations, payroll management, and tax-ready financial reports.

- Certified Expertise: You get a seasoned professional, not a generic call center rep or a side-hustler learning on your dime.

- Audit Readiness: Your records are always proofed and prepared for taxes, loans, or potential investors.

- Proactive Guidance: A good bookkeeper flags risks and finds savings before problems become expensive liabilities.

- Time Savings: Free up your weekends to focus on sales and strategy instead of fixing ledger mistakes.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see the ROI data.

The Hidden Costs That Make Cheap Bookkeeping Too Expensive

Moreover, the most expensive bookkeeping is often the kind that looks the cheapest upfront. When you choose a bargain-bin provider or go the DIY route, you expose your business to significant leakage. For example, inexperienced bookkeepers often overlook nuanced tax-saving opportunities.

Additionally, consider the “Cleanup Factor.” Messy books mean your CPA will charge a premium rate—sometimes thousands of dollars—to untangle the web at tax time. In reality, paying $600 a month for perfection is far cheaper than paying a CPA $3,000 to fix a disaster in April. Thus, the perception that professional **bookkeeping too expensive** is a fallacy when you look at the total annual cost of compliance.

The “Employee” Comparison

Often, owners forget to compare outsourcing to the alternative of hiring in-house. If you hired a part-time employee to handle finances, you aren’t just paying their hourly wage. You are paying payroll taxes, benefits, training costs, and software licensing fees. Suddenly, a $20/hour employee costs the business $2,500 a month.

In contrast, outsourcing to GTB provides you with a team of experts for a fraction of that cost. We handle the training, the software, and the overhead. Therefore, for the level of expertise provided, the monthly fee is incredibly efficient. This is why savvy owners realize that thinking **bookkeeping too expensive** at this price point is a miscalculation of labor market realities.

Stalled Growth: The Ultimate Cost

Finally, the biggest cost of cheap bookkeeping is the inability to grow. Inaccurate books mean you cannot get loans. Banks require clean, accrual-based financials to assess risk. If your Profit & Loss statement doesn’t match your tax returns, your application will be denied.

Similarly, you cannot make smart hiring or inventory decisions if you don’t know your true cash position. By investing in professional oversight, you gain the clarity needed to scale. One client told us: “I used to spend weekends fixing mistakes and still worried about missing something. Now, I have accurate reports every month and my CPA is happy. It’s worth every penny.”

Q&A: Bookkeeping Value & Cost

Q: Isn’t $600/month more than I’d pay an admin?

A: Actually, no. Hiring in-house costs far more when you add payroll taxes and benefits. Outsourcing gives you expert results without the overhead.

Q: What if my books are “simple”?

A: Even simple books have complex tax implications. Expert oversight prevents small errors from compounding into large audit risks over time.

Q: Can’t I just use software like QuickBooks myself?

A: Software is a tool, not a accountant. Without expert guidance, it is easy to misclassify assets or duplicate income. Professional oversight ensures the tool is used correctly.

Q: What is the ROI on professional bookkeeping?

A: Clients routinely save more in taxes and avoided cleanup fees than they pay in monthly retainers. Often, the service effectively pays for itself.

Q: How do I know if I’m getting value?

A: You should receive clear reports, proactive advice, and total peace of mind. If you are still confused or stressed, it is time to upgrade.

Key Takeaways

- Look Beyond Price: Sticker shock is natural, but compare the fee to the cost of employee overhead and tax errors.

- Avoid Cleanups: Paying a pro monthly prevents the massive “cleanup” bills that DIY books generate at year-end.

- Reclaim Time: Your hourly rate as an owner is high; don’t waste it on data entry.

- Invest in Growth: Accurate financials unlock loans, investors, and better strategic decisions.

In Summary: Value Over Cost

Ultimately, the question isn’t “Is **bookkeeping too expensive**?” The real question is “Can I afford the risk of doing it cheaply?” At Giesler-Tran Bookkeeping, we provide the expertise that turns a monthly expense into a strategic investment. Ready for stress-free, expert bookkeeping that pays for itself? Don’t let sticker shock hold your business back from the financial clarity it deserves.

Stop Stepping Over Dollars to Pick Up Pennies

Get a quote that reflects true value and peace of mind.

See how affordable expertise can be.

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

3 Responses