Investing in yourself is the best investment you can make, but investing with pre-tax dollars is even better. For ambitious entrepreneurs, business skills development is not just a buzzword; it is a critical strategy for survival in a competitive market. However, many business owners hesitate to book that conference in Las Vegas or that workshop in New York because they are unsure of the tax implications. Specifically, they ask: “Can I really write this off?” The answer is often “yes,” provided you follow the strict rules laid out by the IRS. At Giesler-Tran Bookkeeping (GTB), we want you to grow your expertise without fearing an audit. Therefore, this guide will explain exactly what qualifies as deductible business skills development travel and provide you with a foolproof template to document it.

Business Skills Development: How to Turn Your Education into a Tax Deduction

Don’t leave money on the table when you learn.

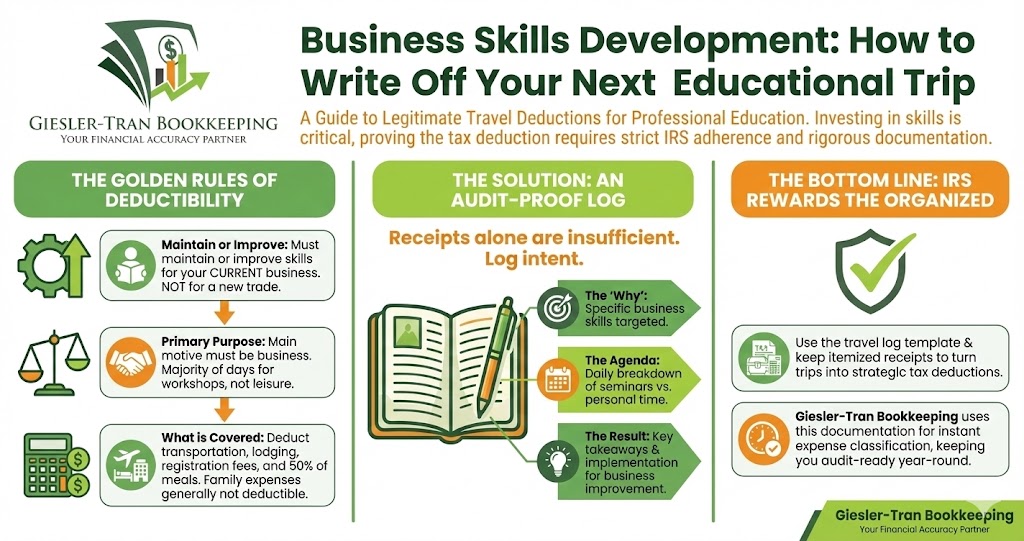

The Reality Check: Fundamentally, the IRS loves documentation more than it loves honesty. You can have the most legitimate reason in the world for traveling to a seminar, but if you cannot prove the intent was business skills development, your deduction will vanish in an audit. Unfortunately, credit card statements alone are rarely enough to satisfy an examiner. To protect your deduction, you need a contemporaneous log that details the “who, what, where, and why” of your trip.

The Golden Rule: Maintain or Improve Skills

First, let us clarify the IRS standard for educational expenses. To be deductible, the education must either maintain or improve skills required in your current business, or be required by law to keep your present status (like Continuing Professional Education for CPAs). Crucially, the travel cannot be for the purpose of learning a new trade or business. For example, if you are a real estate agent traveling to a seminar on advanced sales techniques, that qualifies as business skills development. However, if you are a real estate agent traveling to learn how to become a yoga instructor, that is personal education and is not deductible.

Furthermore, the IRS looks closely at the “primary purpose” of the trip. If you fly to Florida for a week, spend one hour at a seminar, and six days on the beach, the trip is primarily personal. Conversely, if you spend the majority of your days in workshops focused on business skills development, the travel costs (airfare, lodging) generally become deductible. You can read the specific details in IRS Publication 463.

What Exactly Is Deductible?

Once you have established that the trip is for legitimate business skills development, you need to know what expenses to track. Generally, the following costs are deductible if they are “ordinary and necessary”:

- Transportation: Airfare, train tickets, or mileage to get to the destination. Also includes Uber/Lyft fares between the airport, hotel, and training venue.

- Lodging: Hotel or Airbnb costs for the days you are attending the business skills development event.

- Meals: Generally, 50% of the cost of meals while traveling is deductible. Keep itemized receipts!

- Registration Fees: The actual cost of the conference, seminar, or workshop.

Important Note: If you bring a spouse or child who does not have a business purpose, their expenses are not deductible. You can only deduct what it would have cost for you to travel alone (e.g., the cost of a single hotel room vs. a double, though usually the rate is the same). For guidance on family travel, check Entrepreneur.com’s guide.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to verify the rules.

Your Audit-Proof Document Template

Crucially, the biggest mistake business owners make is failing to record the intent of the trip. An airline receipt proves you flew; it does not prove why you flew. Therefore, we have created this simple template. Copy and paste this into a Word document or email it to your bookkeeper (us!) along with your receipts immediately after your trip.

Business Skills Development Travel Log

Trip Dates: [Start Date] to [End Date]

Destination: [City, State/Country]

Primary Business Purpose: To attend [Conference/Seminar Name] in order to improve [Specific Skill] for my business.

Daily Agenda (The “Why”):

- [Date]: Traveled to location.

- [Date]: Attended seminar on [Topic] from [Start Time] to [End Time].

- [Date]: Networking lunch with [Name/Company] to discuss [Business Topic].

- [Date]: Attended workshop on [Topic].

Key Takeaways Applied to Business:

[Briefly describe 1-2 things you learned and how you will implement them. This proves the value of the trip.]

Attached Receipts:

- [ ] Airfare / Train

- [ ] Hotel Folio

- [ ] Conference Registration

- [ ] Meals (Itemized)

- [ ] Ground Transport

By filling out this simple form, you create a contemporaneous record that links your spending directly to business skills development. If the IRS ever asks, you won’t be scrambling to remember what you did three years ago; you will have the proof ready to go.

Why Documentation Matters for Bookkeeping

Moreover, providing this level of detail helps us, your bookkeepers, categorize your expenses correctly. When we see a charge for a hotel in Las Vegas without context, we have to ask questions to determine if it is a personal draw or a business expense. This back-and-forth slows down your monthly reports. However, if you upload the template above to your secure portal along with the receipt, we can instantly classify it as “Professional Development” or “Travel.”

Additionally, this habit builds discipline. Successful entrepreneurs treat their finances with the same rigor they treat their product development. If you are ready to get your travel expenses organized, consider reading about our audit-ready process.

Strategic Planning for Next Year

Finally, use business skills development as a tax planning tool. If you are having a profitable year, booking a conference before December 31st can increase your expenses and lower your taxable income, even if the conference is in January (depending on your accounting method). Always consult with us or your CPA before making large expenditures solely for tax reasons. For more on how we work with your tax team, review our collaboration strategy.

Q&A: Travel & Deductions

Q: Can I deduct a trip if I stay extra days for vacation?

A: Yes, but only the business days. You can deduct the flight (if the trip is primarily business), but you cannot deduct the hotel or meals for the personal days.

Q: Does watching a webinar in my hotel room count?

A: Generally, no. If you could have watched the webinar from home, the travel was not “necessary.” The event usually needs to be in-person to justify the travel cost.

Q: What if I lose a meal receipt?

A: For expenses under $75, the IRS is lenient, but we recommend keeping everything. However, you must still document the time, place, and business purpose, even if the receipt is missing.

Q: Is a cruise deductible if there are seminars on board?

A: This is tricky. The IRS has very specific (and low) limits for cruise ship conventions. Always speak to a tax pro before booking a cruise for business skills development.

Q: Can I deduct clothing I bought for the conference?

A: No. Business suits or casual wear are not deductible, even if you only wear them for work. Only specialized safety gear or uniforms are deductible.

Key Takeaways

- Define the Purpose: Ensure your trip is primarily for business skills development, not leisure.

- Use the Template: Documenting the “why” is just as important as the “how much.”

- Keep Receipts: Digital copies are fine; just make sure they are legible.

- Separate Days: Clearly distinguish between business days and personal days to calculate your deduction accurately.

In Summary: Document to Deduct

Ultimately, the IRS rewards the organized. Business skills development is a vital part of growing your company, and the government wants to help you pay for it—but only if you follow the rules. By using the template provided and keeping clean records, you can travel with confidence. If you are tired of guessing what is deductible, let us handle your books. Book your free consultation with Giesler-Tran Bookkeeping today and let us turn your receipts into tax savings.

Stop Guessing, Start Saving

Let us handle the details while you handle the growth.

Partner with an audit-ready bookkeeping firm.

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response