Identifying key bookkeeping mistakes early is critical, yet most business owners assume their books are “fine”—until something breaks. If your reports look “off,” you are likely already suffering from skipped or sloppy bank reconciliation. Typically, these errors manifest as a tax bill that looks too high, tight cash flow for no reason, or revenue that doesn’t match deposits. Worse yet, the IRS sends a letter. These are the silent errors hiding in your financials that lead to bad numbers, missed deductions, and preventable stress. At Giesler-Tran Bookkeeping (GTB), we clean up hundreds of files every year, and the patterns are always the same. Therefore, below are the most common warning signs that your financials aren’t telling the truth—and what to do before things get worse.

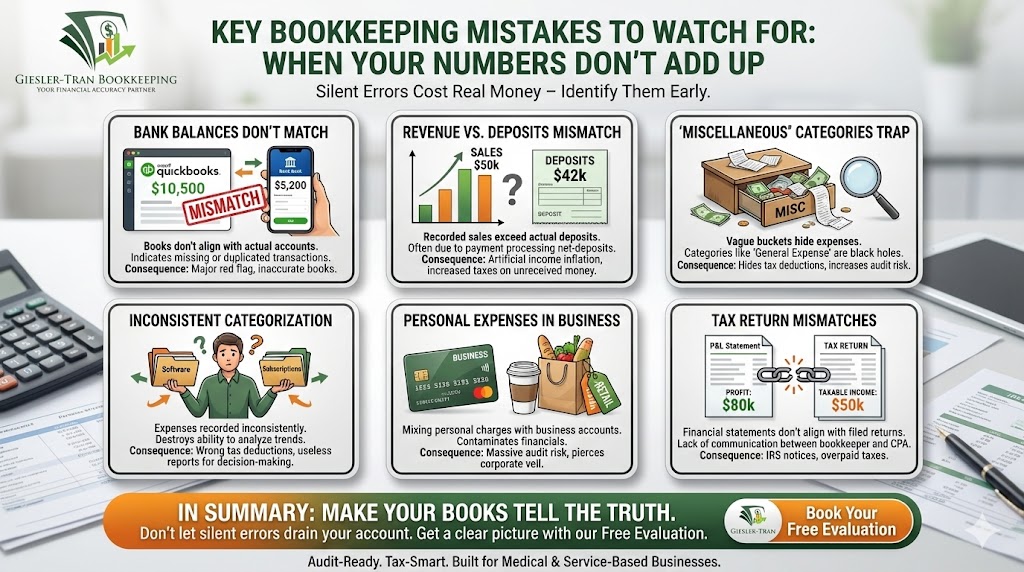

Key Bookkeeping Mistakes to Watch For: When Your Numbers Don’t Add Up

Silent Errors Cost Real Money

The Reality Check: Fundamentally, inaccurate books are not just a nuisance; they are a financial liability. If you don’t know the key bookkeeping mistakes to watch for, your books may be lying to you—and costing you money in silence. Real clarity only comes from rigorous, regular review. Without it, you are making decisions based on fiction.

Listen on The Deep Dive — where we reveal the truth:

‘Your Bookkeeping Lies That Cost You Tax Money’

When Bank Balances Don’t Match: A Major Red Flag

First, check your balance. If your bank balance in QuickBooks doesn’t match your real bank account, your books aren’t accurate. This is one of the biggest key bookkeeping mistakes, and it usually points to specific errors. Often, this stems from missing transactions, duplicated downloads, or wrong starting balances.

Additionally, it frequently indicates unreconciled accounts. Fixing this requires a commitment to reconcile weekly—not monthly. Monthly is simply too slow for catching errors before they compound. This is especially critical in medical and service-based businesses where transaction volume is high.

Revenue vs. Deposits: Where Did the Money Go?

Next, look at your top line. If you see $50,000 in sales but only $42,000 in deposits, something is wrong. This discrepancy is especially common for medical offices dealing with insurance reimbursements. Similarly, service businesses using payment apps and e-commerce platforms often face this issue due to net-deposit recording.

Consequently, this is one of the most expensive key bookkeeping mistakes because it artificially inflates income, increasing your taxes on money you never received. The fix is rigorous: tie every single deposit to the source, whether it’s an EOB, invoice, or platform report. Verify reality before you file.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to verify the risks.

The Danger of “Miscellaneous” Categories

Furthermore, beware of vague buckets. Categories like “Miscellaneous,” “General Expense,” and “Ask My Accountant” are black holes that hide thousands in deductible expenses. If you see these on your P&L, your books are effectively lying to you. Fixing this requires eliminating these categories completely.

Instead, ensure every transaction has a specific home. Doing so transforms your books from a junk drawer into a data-rich resource. Remember, audit-ready books do not have “Miscellaneous” lines; they have clear, defensible answers.

Inconsistent Expense Categorization

Additionally, consistency is king. If “software” sometimes lives under Technology, sometimes Office Expense, and sometimes Subscriptions, your financial reports are useless. This is one of the most overlooked key bookkeeping mistakes because it destroys your ability to analyze trends.

Specifically, inconsistency leads to wrong tax deductions and bad profitability analysis. It also makes budgeting impossible. To fix this, use a standardized, industry-specific Chart of Accounts and stick to it.

Personal Expenses: A Massive Audit Risk

Moreover, keep it separate. Even “just a few” personal charges in your business account contaminate your financials. Common offenders include groceries, gas, retail purchases, and travel. This is a massive audit risk that pierces your corporate veil.

Therefore, the fix is simple: keep personal spending out completely. If mistakes happen, split and categorize them properly as “Owner Draws.” Never let personal life bleed into business records.

Tax Return Mismatches

Crucially, your numbers must align. If your profit and loss statement shows one number, but your tax return shows another, there’s a problem. This mismatch is one of the most serious key bookkeeping mistakes because it often leads to IRS notices and overpaid taxes.

To avoid this, ensure your bookkeeper and tax preparer actually communicate. Better yet, use an integrated system like GTB’s Bookkeeper + Tax Integration Service to ensure seamless data flow.

Financial Reports You Can’t Read

Finally, trust your gut. If you can’t read your own reports, or the numbers don’t feel accurate, you are likely right. Signs your financials are lying include profit looking high while cash is low, or expenses disappearing suddenly. Vendor totals that don’t match reality are another red flag.

The fix is to demand monthly explanations—not just reports. Reports without context are useless. Real bookkeeping provides the narrative behind the numbers.

Q&A: Spotting Errors

Q: Why do my books show a profit if I have no cash?

A: Often, this is due to principal payments on loans (which are not expenses) or owner draws being misclassified. It creates a “phantom profit” scenario.

Q: How often should I reconcile my credit cards?

A: Monthly, without fail. Treat credit cards exactly like bank accounts to catch missing expenses and duplicate charges.

Q: What if I find a mistake from two years ago?

A: We can help you correct it. Depending on the size of the error, you may need to file an amended tax return to reclaim lost money.

Q: Does my bookkeeper need to ask me questions?

A: Yes. If they never ask for receipts or clarification, they are likely guessing. Silence is a warning sign of poor bookkeeping.

Q: Can I fix these mistakes myself?

A: Technically, yes, but it is risky. Forensic cleanup is complex, and amateur fixes often create new problems.

Key Takeaways

- Match the Bank: If your QuickBooks balance doesn’t match your bank statement, stop everything and fix it.

- Verify Revenue: Ensure your recorded sales match your actual deposits to avoid paying tax on phantom income.

- Ditch “Misc”: Eliminate vague categories to uncover hidden deductions and reduce audit risk.

- Demand Context: Don’t settle for silent reports; demand explanations that help you run your business.

In Summary: Make Your Books Tell the Truth

Ultimately, missing deductions isn’t just a bookkeeping issue—it’s a profit issue. With the right systems, clarity, and tax-smart structure, your business can keep more of what it earns while staying fully compliant. If you’re tired of guessing, dealing with messy books, or wondering what you’re missing, we can help. Start your journey toward financial truth today.

Are Your Books Lying?

Don’t let silent errors drain your bank account.

Get a clear picture with our Free Evaluation.

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response