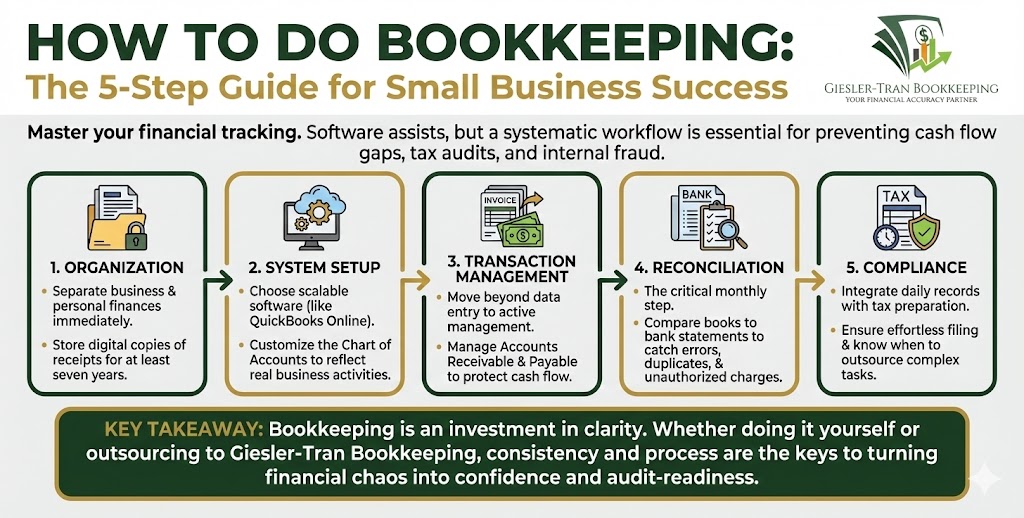

Learning exactly how to do bookkeeping is often the dividing line between a hobbyist and a successful CEO. Initially, many entrepreneurs view financial tracking as a simple chore of recording money in and money out. However, your financial foundation determines how strong (or fragile) your business actually is. Consequently, whether you are just starting out or managing an established operation, following the right process keeps your numbers organized and your stress levels low. Therefore, mastering how to do bookkeeping is not just about tax compliance; it is about gaining the clarity needed to grow. At Giesler-Tran Bookkeeping (GTB), we have refined this process into a clear system that delivers accuracy and peace of mind. Below, we walk you through the 5 essential steps to financial mastery.

How to Do Bookkeeping for Your Small Business — The GTB Way

5 Steps to Stress-Free Financial Management

The Reality Check: Fundamentally, understanding how to do bookkeeping correctly protects you from the three biggest business killers: cash flow gaps, tax audits, and internal fraud. While software tools make data entry easier, they do not replace the need for a systematic workflow. Remember, garbage data in equals garbage reports out. Thus, following a proven protocol is the only way to ensure your financial safety.

Listen on The Deep Dive — where we discuss:

‘The 5-Step Bookkeeping Blueprint: Turning Chaos Into Clarity’

Step 1: Gather and Organize Your Financial Documents

Before you can manage your books, you need the right paperwork. Effectively, you must collect everything—invoices, receipts, bank statements, credit card reports, and payroll records. Crucially, you must separate your business and personal finances immediately. If you have not already done so, open a dedicated business checking account and use a business credit card exclusively for company expenses. Mixing personal and business spending is a recipe for chaos come tax time and can pierce your corporate veil.

Furthermore, you should keep records organized by storing copies (digital or physical) for at least seven years. This practice is not just smart bookkeeping; it is your audit safety net. To streamline this, use receipt capture tools like Dext or the snap-and-attach feature in QuickBooks Online. For more on organization, check our Bookkeeping Tips & Resources.

Step 2: Set Up Your Bookkeeping System

Next, you must realize that your system is the backbone of financial management. When learning how to do bookkeeping, choosing the right platform is critical. Options like QuickBooks Online, Xero, or Wave allow you to scale. Once selected, you must create a Chart of Accounts to separate income, expenses, assets, liabilities, and equity.

Additionally, you need to choose your accounting method—cash vs. accrual—based on your business needs. At GTB, we help customize your Chart of Accounts by industry so your reports reflect real business decisions, not just generic categories. Ideally, this setup prevents you from having a “Miscellaneous Expense” category that hides profitability leaks.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see what an AI accountant suggests regarding separation of finances.

Step 3: Record and Manage Every Transaction

Undoubtedly, bookkeeping is not just data entry; it is accuracy in action. Every single transaction should be recorded using double-entry bookkeeping so your books stay balanced and reliable. Specifically, you must categorize consistently: income, expenses, payroll, taxes, and owner draws. Also, tracking Accounts Payable and Accounts Receivable is vital to maintain predictable cash flow.

Moreover, proactive invoice management prevents lost revenue. Many businesses lose thousands to unbilled work or late collections simply because they lack a routine. By recording transactions weekly , you ensure that your financial narrative is always up to date. This discipline transforms your data from a pile of receipts into a strategic asset.

Step 4: Reconcile and Review Regularly

Ultimately, your books are only as accurate as your last reconciliation. Each month, you must compare your bookkeeping records with bank and credit card statements. This process allows you to catch duplicates, missing transactions, or unauthorized charges. If you skip this step, you are essentially flying blind.

After reconciliation, generate key reports: Profit & Loss, Balance Sheet, and Cash Flow. Then, review these monthly to spot trends and plan ahead for taxes. Regular review sessions prevent the end-of-year panic that plagues so many small business owners. To see why this matters, read about our Monthly Bookkeeping services.

Step 5: Stay Tax-Compliant (And Know When to Get Help)

Finally, accurate bookkeeping simplifies tax season. Elements like sales tax, payroll tax, quarterly estimates, and annual filings all depend on clean books. At GTB, we integrate bookkeeping and tax prep so files flow seamlessly from daily records to tax returns.

However, you must know when to delegate. When learning how to do bookkeeping becomes a distraction from sales or produces unreliable reports, it is time to outsource. Outsourcing prevents costly mistakes and protects your growth trajectory. For guidance on compliance, consult the IRS Recordkeeping Guidelines.

Q&A: Mastering How to Do Bookkeeping

Q: Can I use Excel to do my bookkeeping?

A: Technically yes, but it is risky. Excel does not link to bank feeds or provide an audit trail, making errors likely. Software like QuickBooks is safer and more efficient.

Q: What is the difference between cash and accrual accounting?

A: Cash basis records revenue when money hits the bank. Accrual basis records revenue when the invoice is sent. Accrual gives a more accurate picture of long-term health.

Q: How often should I reconcile my accounts?

A: Ideally, you should reconcile monthly. Waiting until the end of the year makes it nearly impossible to find small errors that compound over time.

Q: What happens if I miss a receipt?

A: If you are audited, the IRS may disallow the deduction. Always try to get a digital copy immediately or use a bank statement as secondary proof if acceptable.

Q: When should I hire a professional bookkeeper?

A: When you spend more time managing books than generating revenue. Also, if your expenses become complex (payroll, inventory, loans), professional help is vital.

In Summary: Consistency Wins

Ultimately, bookkeeping done right is an investment, not a cost. Clean books help you make faster decisions, access financing, and avoid penalties. If you are ready to stop guessing and start knowing, Giesler-Tran Bookkeeping is here to help you master how to do bookkeeping—or take it off your plate entirely.

The Bottom Line

Get your books audit-ready.

Gain clarity and confidence today.

Schedule Your Free Consultation

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.