Recently, new clients have come to us in a panic because tax deadlines are looming and their financial records are in disarray. Naturally, their first anxious question is often: “How fast can you get my books in order?” While we pride ourselves on efficiency at Giesler-Tran Bookkeeping, the honest answer depends on several specific variables regarding the state of your data. Below, we break down the realistic bookkeeping cleanup timeline and detail exactly what you can expect when you partner with us to restore your financial clarity.

Effectively, understanding this timeline is crucial for managing your own expectations and reducing stress. Specifically, a proper cleanup is not just about speed; it is about accuracy, compliance, and ensuring that your deductions will stand up to IRS scrutiny. Therefore, we have outlined the phases of our process to help you plan your bookkeeping cleanup timeline effectively.

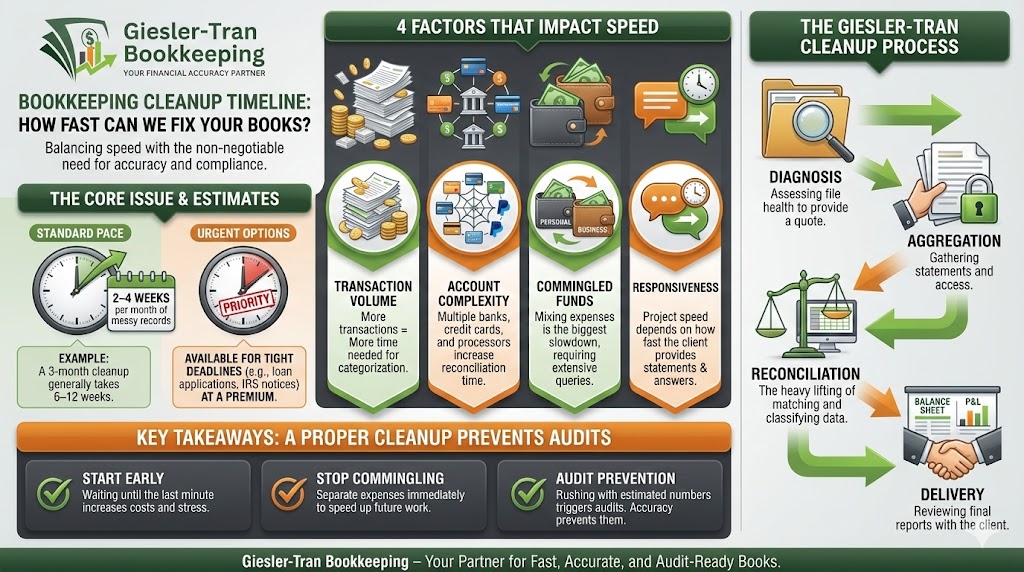

Bookkeeping Cleanup Timeline: How Fast Can We Fix Your Books?

Accuracy takes time, but we move fast.

The Reality Check: Fundamentally, the speed of your clean-up depends heavily on your responsiveness. If we have to wait weeks for bank statements or answers to queries, the project inevitably stalls. Therefore, the fastest way to accelerate your bookkeeping cleanup timeline is to provide requested documents immediately upon request.

Listen on The Deep Dive — where we dig deeper into this topic:

‘The Speed of Clean: Setting Expectations’

Understanding the Average Bookkeeping Cleanup Timeline

To start, we generally base our initial estimates on the sheer volume of “messy” months we need to address. Typically, for a standard small business with moderate activity, we observe the following ranges for a complete restoration:

- Standard Pace: Usually, we require roughly 2–4 weeks per month of disorganized records to ensure forensic accuracy.

- Example Scenario: If you have 3 months of messy books to fix, you should expect a total turnaround of 6–12 weeks.

- Urgent Options: However, we do offer priority clean-up services at a premium for those facing tight IRS deadlines or loan applications.

Crucially, these are merely estimates. In reality, your specific bookkeeping cleanup timeline may be shorter if your digital records are organized, or longer if we must manually reconstruct paper trails. Ultimately, the goal is to provide you with a clean set of books that you can rely on for decision-making.

4 Factors That Impact Your Bookkeeping Cleanup Timeline

However, every business is unique, and several variables can accelerate or drag down the process. Specifically, four main factors will directly influence your specific bookkeeping cleanup timeline:

1. Volume of Transactions

Simply put, more transactions mean more time is required to categorize them correctly. For instance, reviewing 2,000 transactions takes significantly longer than reviewing 200. Consequently, high-volume e-commerce businesses often face a longer bookkeeping cleanup timeline compared to low-volume consultants.

2. Complexity of Accounts

Furthermore, the number of financial institutions involved matters. If you have five credit cards, three bank accounts, and a PayPal feed, reconciling the inter-account transfers becomes complex. Ideally, consolidating your accounts can speed up future work, but untangling the historical web takes time.

3. Commingled Funds

Unfortunately, mixing personal and business expenses is the biggest speed bump we encounter. When you pay for groceries with the business card, we must query every single transaction to determine its nature. This back-and-forth communication drastically extends the bookkeeping cleanup timeline.

According to the IRS Recordkeeping Standards, maintaining separate accounts is critical for audit defense. Therefore, stopping this habit now will save you money on future cleanups.

4. Responsiveness

Finally, the “You” factor is significant. The faster you provide answers to our queries regarding unidentified expenses, the faster we work! Specifically, delays in uploading statements or answering email questions are the most common cause of a stalled bookkeeping cleanup timeline.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below to see independent insights.

The Phases of Your Bookkeeping Cleanup Timeline

Consequently, we have developed a streamlined system to keep things moving efficiently. When you engage Giesler-Tran Bookkeeping, we strictly follow these phases to ensure nothing falls through the cracks:

Phase 1: Diagnosis & Assessment (Week 1)

Initially, we dive into your existing file to diagnose the health of the data. We look for broken bank connections, negative balances, and undeposited funds issues. This allows us to give you a firm quote and a realistic bookkeeping cleanup timeline.

Phase 2: Data Aggregation (Weeks 2-3)

Next, we gather the raw materials. You receive a step-by-step checklist of exactly what we need (PDF statements, loan documents, prior tax returns). Once we have the data, we begin the heavy lifting of data entry and import.

Phase 3: Reconciliation & Classification (Weeks 4+)

Then, the core work begins. We reconcile every account to the penny against the bank statements. Simultaneously, we classify transactions, ensuring assets are capitalized correctly and expenses are categorized for maximum tax benefit.

Phase 4: Review & Delivery

Finally, we review the reports with you. We resolve any outstanding queries and deliver a set of financial statements (Balance Sheet and Profit & Loss) that are ready for your CPA. Ultimately, this marks the successful end of your bookkeeping cleanup timeline.

For more on what happens after the cleanup, visit our Monthly Bookkeeping Services page to see how we maintain this new standard of clarity.

“Giesler-Tran Bookkeeping made my year-end so much easier. The clean-up was fast, thorough, and I felt supported every step of the way.”

Common Questions About the Bookkeeping Cleanup Timeline

Q: Can you just fix the last month?

A: Generally, no. Because bookkeeping is cumulative, errors in January affect the balances in December. Therefore, we usually need to review the entire fiscal year to ensure the bookkeeping cleanup timeline results in accurate tax returns.

Q: What if I am missing receipts?

A: While receipts are ideal, bank statements can often suffice for certain expenses under $75. However, for large asset purchases, we will need to work with you to find documentation. Using resources like SCORE mentors can help you establish better document retention systems for the future.

Q: Do I need to switch software?

A: Usually, we can work within your existing QuickBooks Online or Xero file. However, if the file is corrupted beyond repair, starting a new file might actually shorten the bookkeeping cleanup timeline.

Q: Will this trigger an audit?

A: Actually, cleaning up your books prevents audits. Filing a tax return with estimated or messy numbers is what triggers red flags. Thus, investing time now protects you later.

Q: How much will this cost?

A: Because every mess is different, we provide a custom diagnostic quote. You can learn more about our pricing philosophy on our pricing guide page.

Key Takeaways for a Fast Cleanup

- Be Responsive: Answering questions quickly is the #1 way to speed up the process.

- Separate Funds: Stop commingling expenses immediately to stop the mess from growing.

- Trust the Process: We have a proven system to handle even the most chaotic books.

- Start Now: Waiting until April only increases the stress and the cost.

In Summary: Start Early to Beat the Clock

In short, don’t let messy books slow you down or jeopardize your business growth. The sooner we start, the sooner you can relax knowing your financial house is in order. Effectively, managing your bookkeeping cleanup timeline is about being proactive rather than reactive.

Ready to get caught up and leave the stress behind? Giesler-Tran Bookkeeping is ready to help you cross the finish line.

The Bottom Line

Need a custom timeline for your books?

Let’s beat the clock—book now.

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

2 Responses