Let’s talk honestly about loyalty and your CPA. Frequently, business owners stick with the same tax professional year after year—sometimes out of habit, sometimes out of fear that change will be a hassle. However, you must ask yourself a hard question: Is that loyalty costing you money? Below, we explore the hidden costs of sticking with a reactive CPA and how proactive bookkeeping changes the game.

Loyalty is expensive when it ignores results.

Does Loyalty to Your CPA Cost You Money?

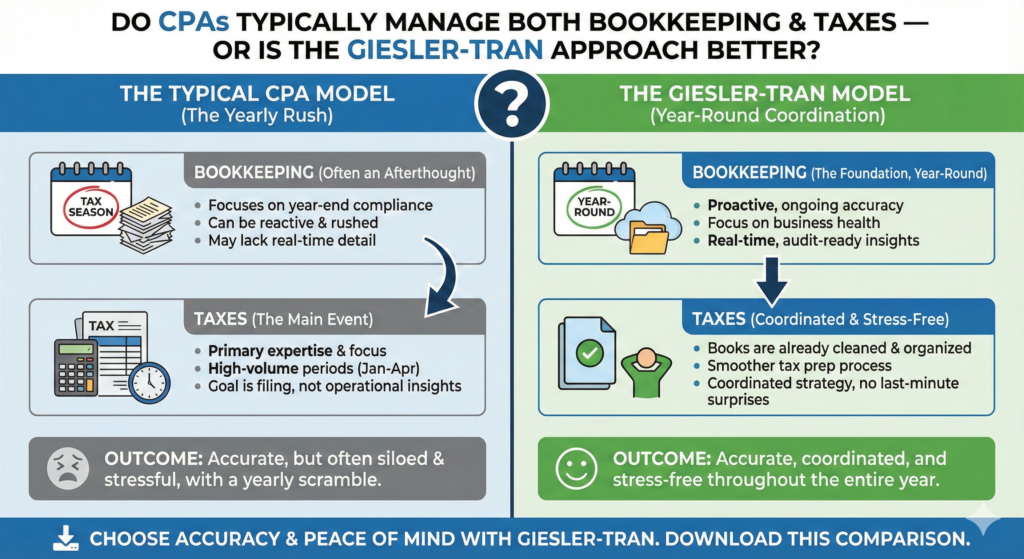

The Reality Check: Fundamentally, a CPA is often a historian, recording what happened last year. In contrast, a dedicated bookkeeper is a news reporter, telling you what is happening right now. Therefore, relying solely on a CPA for daily insights is like driving a car while looking only in the rearview mirror.

Listen on The Deep Dive — where we dig deeper into this topic:

‘The Loyalty Trap: When to Fire Your CPA’

A Real Story: The $8,000 Surprise

Consider one of our clients, a busy consultant, who had relied on the same CPA for years. Each spring, she handed over her messy books and got her taxes done—no questions asked. But one year, her CPA handed her a bill for $8,000 in “bookkeeping cleanup” fees, just so they could prepare her return. Sadly, she never received proactive advice or suggestions to save on taxes—just a bigger bill every year.

Eventually, she switched to Giesler-Tran Bookkeeping. Immediately, we cleaned up her records, set up monthly reconciliations, and worked with her year-round. The result? The next tax season brought no surprise fees, and she saved thousands in deductions her CPA never mentioned.

CPAs Don’t Manage Your Day-to-Day Books

Here’s the truth: Most CPAs are not involved in your monthly bookkeeping. Instead, they take your numbers—however messy—and plug them into tax forms. Consequently, if your books are a mess, they will charge you a premium for a cleanup just to get the numbers they need to fill in the boxes.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

When’s the Last Time Your CPA Called?

Be honest: Has your CPA ever called proactively to help you save on taxes, optimize your deductions, or streamline your finances? Or do you just get a bill and a tax return, with little insight into how you could do better next year? In contrast, see how we support your CPA to ensure you get the best of both worlds.

What Real Bookkeeping Support Looks Like

- Ongoing Oversight: A great bookkeeper keeps your books clean all year—not just at tax time.

- Proactive Savings: We spot tax-saving opportunities and flag issues before they become expensive problems.

- Transparent Pricing: No surprise cleanup fees. We help you avoid messy books in the first place.

- Personalized Support: We’re available for questions, advice, and strategy—not just once a year.

Common Questions on CPA Loyalty

- Q: If I switch bookkeepers, will my CPA get upset?

- A: Most CPAs are happy to work with a professional bookkeeper who delivers clean, organized records. It actually makes their job easier!

- Q: Can a bookkeeper really save me more than my CPA?

- A: Yes! Bookkeepers keep your finances organized year-round, spot tax-saving opportunities, and help you avoid costly mistakes your CPA may only see once a year.

- Q: Why do CPAs charge so much for cleanup?

- A: Because messy books take hours to fix—especially under a tight tax deadline. Routine bookkeeping prevents these expensive surprises.

“If your CPA isn’t helping you save thousands, it’s time to rethink where your loyalty lies.”

In Summary: Loyalty Should Be Earned

Ultimately, your business deserves a financial partner who is invested in your success, not just someone who fills in the boxes. Loyalty is great—but only when it is rewarded with real value, savings, and proactive support.

The Bottom Line

Ready to stop paying surprise fees?

Discover the difference a real partnership makes!

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response