Maximizing conference expense deductions should be a priority for every growth-minded business owner this year. While many entrepreneurs view industry events solely as a cost, they are actually a powerful investment vehicle. Specifically, attending these events is one of the fastest ways to uncover real growth opportunities—not just from the keynote sessions, but from the invaluable conversations that happen in the hallways. However, simply buying a ticket isn’t enough to satisfy the IRS. To fully leverage conference expense deductions, you must understand the rules regarding travel, meals, and documentation. At Giesler-Tran Bookkeeping (GTB), we encourage clients to talk to everyone—owners, operators, and vendors—while we handle the compliance. Therefore, this guide explains how to turn your next business trip into a legitimate tax strategy.

Conference Expense Deductions: Turn Networking Into Tax Savings

Invest in Your Growth. Write Off the Cost.

The Reality Check: Fundamentally, the IRS requires that business travel be “ordinary and necessary” to your trade. However, “necessary” does not mean indispensable; it simply means helpful and appropriate. If you attend a conference to learn new skills, network with vendors, or scout competitors, the costs are generally deductible. Conversely, if you spend 10% of your time at the seminar and 90% on the beach, you risk losing your conference expense deductions entirely.

Listen on The Deep Dive — where we break down the rules:

‘Conference Travel Deductions and IRS Traps’

Why Conference Expense Deductions Are an Investment

First, let’s shift the mindset from “cost” to “investment.” When you attend a conference, you are buying access. Specifically, you gain access to owners, operators, and vendors who can solve your current business problems. Furthermore, the IRS incentivizes this growth by allowing you to deduct the costs associated with getting there and participating.

In fact, successful owners know that one conversation in a hallway can yield a higher ROI than a year of cold calling. Therefore, utilizing valid conference expense deductions effectively lowers the barrier to entry for these high-value interactions. By capturing these costs correctly, you reduce your taxable income while simultaneously expanding your professional network.

What Qualifies for Conference Expense Deductions?

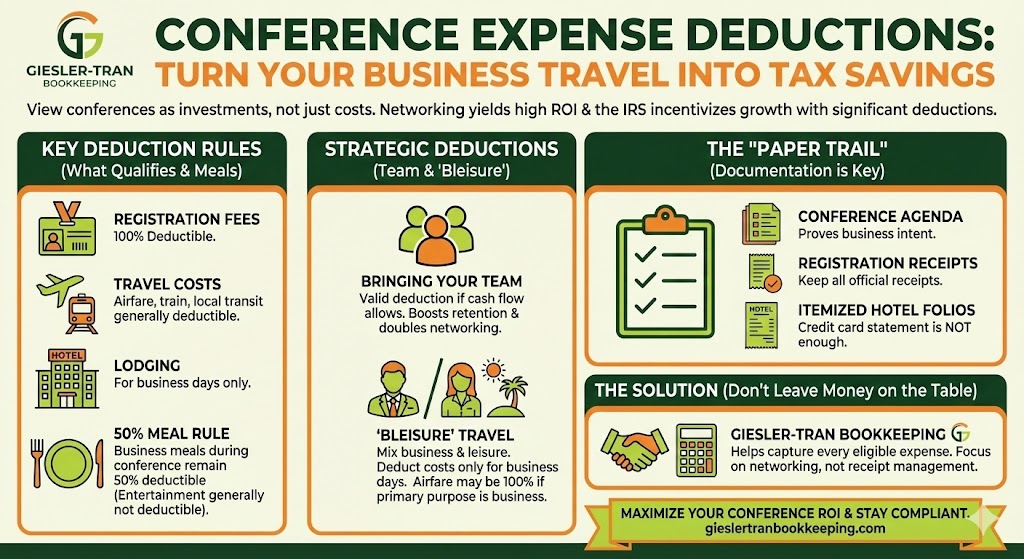

Crucially, not every dollar spent on a trip is deductible. To stay compliant, you must distinguish between personal luxuries and business necessities. According to IRS Publication 463, the following generally qualify:

- Registration Fees: The cost of the ticket itself is 100% deductible.

- Travel Costs: Airfare, train tickets, or mileage (if driving your personal car) to get to the destination.

- Lodging: Hotel costs are deductible for the days business is conducted.

- Local Transit: Ubers, taxis, or rental cars used between the hotel and the venue.

- Meals: Generally 50% deductible if they are business-related (not lavish).

However, you cannot deduct expenses for your family if they tag along. Consequently, keeping detailed records that separate your conference expense deductions from personal family costs is non-negotiable.

Bringing Employees: Boosting Conference Expense Deductions

Additionally, if you have positive cash flow, consider bringing an employee or two. Shared exposure builds smarter teams and stronger businesses. More importantly, the costs associated with their attendance are also valid conference expense deductions. When key team members attend, they bring back diverse perspectives and actionable strategies you might have missed.

Furthermore, it aids in retention. Employees often view conference attendance as a perk and a sign that the company is investing in their professional development. Thus, the ROI extends beyond the immediate tax write-off to long-term team loyalty.

Navigating the “Bleisure” Trap

Currently, blending business and leisure (“bleisure”) is popular, but it complicates conference expense deductions. If you extend your stay for a vacation, you can only deduct the costs related to the business days. For example, if the conference is Monday through Wednesday, and you stay until Sunday for sightseeing, the hotel nights for Thursday through Sunday are personal expenses.

However, your airfare might still be 100% deductible if the primary purpose of the trip was business. Because this area is nuanced, we recommend documenting your daily itinerary. Without a clear schedule proving business intent, the IRS may view the entire trip as a vacation.

Meals vs. Entertainment Rules

Previously, business entertainment (like taking a client to a golf game) was deductible. Currently, under the Tax Cuts and Jobs Act, entertainment is generally nondeductible. However, business meals purchased during the conference remain 50% deductible. This distinction is vital for accurate conference expense deductions.

Therefore, if you take a vendor to dinner to discuss a contract, the meal is deductible. But if you take them to a baseball game afterwards, the tickets are not. To avoid errors, always ask for separate receipts or clearly annotate the business purpose on the bill.

The Documentation Scavenger Hunt

Ultimately, the validity of your conference expense deductions relies on proof. You must keep the conference agenda, your registration receipt, and folio receipts for the hotel. A credit card statement alone is often insufficient for an audit.

Specifically, the IRS wants to see the “who, what, where, and why” of the expense. We recommend using a digital receipt capture tool immediately. By snapping a photo of the agenda and receipts in real-time, you create an audit-proof paper trail that saves you headaches later.

Q&A: Maximizing Your Write-Offs

Q: Can I deduct my spouse’s travel costs?

A: Generally, no. Unless your spouse is a bona fide employee with a business reason to attend, their costs are personal. However, you can still deduct the cost of a single hotel room even if they stay with you.

Q: What if I stay at a luxury hotel?

A: As long as it is not “lavish or extravagant” under the circumstances, it is deductible. Business travel does not require you to stay in a motel.

Q: Are virtual conference tickets deductible?

A: Yes. Registration fees for online webinars and virtual summits are fully deductible as education or professional development expenses.

Q: How do I prove the trip was for business?

A: Keep the conference program or schedule. This proves the dates and the relevance to your industry, substantiating your conference expense deductions.

Q: Is the flight deductible if I use points?

A: No. Since you didn’t pay cash, there is no monetary expense to deduct. However, any taxes or fees paid in cash are deductible.

Key Takeaways

- Invest in Growth: Conferences are a tax-advantaged way to build your network and skills.

- Separate Costs: Keep personal vacation days distinct from business days to protect your conference expense deductions.

- Document Everything: Save agendas and itemized receipts, not just credit card totals.

- Bring the Team: Leverage employee attendance to multiply the educational value and the tax benefit.

In Summary: You Will Thank Yourself Later

Finally, make conferences a priority this year. They are a tax deduction, an investment in your business, and one of the fastest ways to uncover real growth opportunities. But remember, the value isn’t just in the sessions—it is in the compliance that allows you to keep more of your money. Don’t leave valid conference expense deductions on the table due to poor record-keeping. Start planning your next trip with a tax strategy in mind. At Giesler-Tran Bookkeeping, we help you capture every eligible expense so you can focus on the networking.

Travel Smart. Deduct Confidently.

Don’t let tax rules stop you from growing your network.

See if your books are capturing every deduction.

Book Your Free Financial Evaluation

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.