Ultimately, choosing the best bookkeeping software is one of the most critical operational decisions a business owner will make. Initially, many entrepreneurs grab the cheapest option or rely on a simple spreadsheet to track their pennies. However, as transaction volume grows and complexity increases, these basic tools often become liabilities. Consequently, the search for the best bookkeeping software shifts from “what is cheapest” to “what will help me scale.” At Giesler-Tran Bookkeeping (GTB), we have tested nearly every platform on the market. Therefore, we have created this comprehensive guide to help you navigate the noise and find the solution that turns your data into decision-making power.

Finding the Best Bookkeeping Software: A Guide to Financial Clarity

Why We Love QBO and How to Choose the Right Fit for You

The Reality Check: Fundamentally, the best bookkeeping software for your business is the one that you will actually use. Too often, business owners purchase robust, expensive systems that are too complex for their needs. Conversely, fast-growing startups often cripple their potential by staying on Excel too long. Ideally, your software should automate the mundane, providing you with reports that drive strategy rather than just recording history.

Listen on The Deep Dive — where we review the tech stack:

‘Spreadsheets vs. Robots: Choosing Your Financial Tools’

Defining the Best Bookkeeping Software for Modern Business

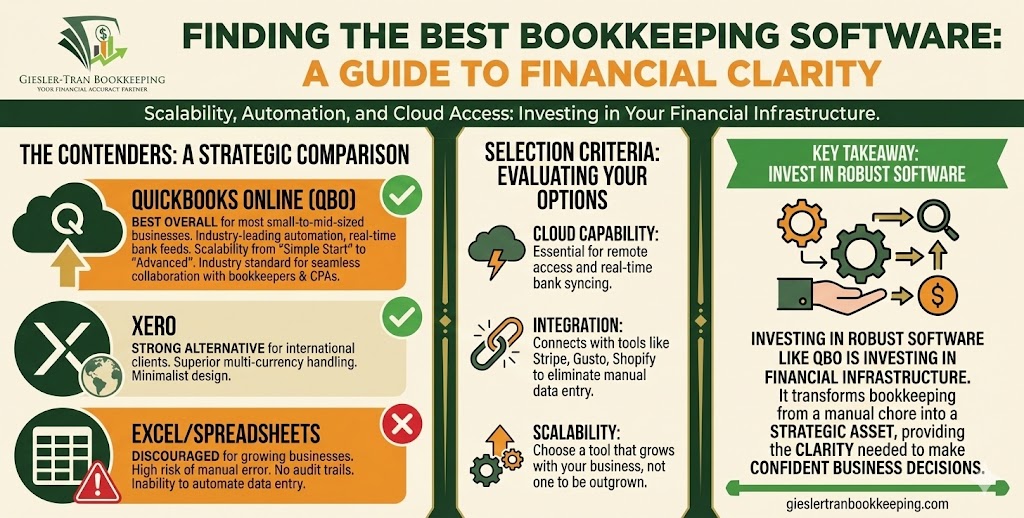

Before comparing brands, we must define the criteria. Specifically, modern businesses require cloud access, automation, and integration. Gone are the days when desktop software trapped your data on a single hard drive. Today, the best bookkeeping software must live in the cloud.

Furthermore, it must play nicely with others. Your accounting tool should talk to your bank, your credit card processor, and your payroll provider. If you are manually entering data from Stripe into Excel, you are wasting valuable time. Therefore, integration capability is often the deciding factor between a good tool and a great one. According to PCMag’s annual review, automation features are the primary driver of high user satisfaction scores.

Why QuickBooks Online is Often the Best Bookkeeping Software

At GTB, we are platform-agnostic, but we find ourselves recommending QuickBooks Online (QBO) repeatedly. Why does it consistently rank as the best bookkeeping software? Primarily, it balances power with usability. It offers industry-leading features like robust invoicing, detailed expense tracking, and a mobile app that actually works.

Additionally, QBO scales effortlessly. You can start on a “Simple Start” plan and upgrade to “Advanced” as you hire employees or add inventory. Moreover, because it is the industry standard, almost every CPA and tax professional knows how to use it. This ubiquity makes collaboration seamless. If you ever need to hand your books over to a professional, using QBO ensures a smooth transition. For a deeper look at how we utilize this tool, visit our Strategic Advantage page.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to compare the top contenders.

Evaluating Other Contenders for Best Bookkeeping Software

While QBO is a powerhouse, it is not the only option. Sometimes, the best bookkeeping software depends on your specific niche. For instance, Xero is a fantastic alternative for businesses with international clients.

Specifically, Xero handles multi-currency transactions beautifully and offers a clean, minimalist interface that designers often love. Alternatively, FreshBooks is a strong contender for freelancers who prioritize invoicing over deep accounting. However, be cautious with “free” software like Wave. Although the price is right, you often pay for it later with limited reporting and a lack of scalability. Check Investopedia’s comparison for a detailed feature breakdown of these platforms.

Why Spreadsheets Are Rarely the Best Bookkeeping Software

Initially, Excel seems like the logical choice. It is free, customizable, and familiar. But as a long-term solution, it fails. Why? Because it relies entirely on manual entry. This introduces human error at every keystroke.

Furthermore, spreadsheets lack an audit trail. If a formula breaks or a cell is deleted, you might never know until tax season arrives. Unlike the best bookkeeping software options which lock periods and track changes, Excel is fluid and fragile. Consequently, we spend a significant amount of time performing Bookkeeping Cleanups for clients who stayed on spreadsheets for too long.

Q&A: Choosing Your Financial Tech Stack

Q: Can I switch software later?

A: Yes, but it is painful. Migrating historical data is complex and often requires a professional. It is much better to choose the right platform from the start.

Q: Is QuickBooks Desktop better than Online?

A: Generally, no. Intuit is phasing out support for Desktop, and it lacks the remote collaboration features of QBO. The future is definitely in the cloud.

Q: Do I need software if I have a bookkeeper?

A: Absolutely. Your bookkeeper needs a tool to work in. We use your software to organize your data; we don’t keep it in a secret ledger.

Q: How much should I pay for software?

A: Expect to pay between $30 and $90 per month for a solid plan. This cost is negligible compared to the value of accurate data.

Q: Does the software do my taxes?

A: No. It organizes the data so your CPA can do your taxes. Garbage in, garbage out—software doesn’t fix bad data entry.

Key Takeaways

- Scalability Matters: Choose software that grows with you, not a tool you will outgrow in six months.

- Cloud is King: Remote access and bank feed automation are non-negotiable for modern efficiency.

- Integration is Key: The best bookkeeping software connects to your other tools (POS, Payroll, CRM).

- Expert Support: Using industry-standard tools like QBO allows you to easily hire pros like GTB for support.

In Summary: Invest in Your Infrastructure

Ultimately, the best bookkeeping software is the foundation of your financial house. By investing in a robust platform like QuickBooks Online, you are not just buying software; you are buying clarity, efficiency, and scalability. Don’t let the fear of technology hold you back. At GTB, we can help you set it up, clean it up, and manage it so you can focus on what you do best.

The Bottom Line

The right tools. The right partner.

Let us set up your QBO for success.

Schedule Your Free Consultation

Check our pricing guide to see how we work with QBO.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response