Historical Bookkeeping Cleanup Services | Giesler-Tran Bookkeeping

Historical bookkeeping cleanup is more than just data entry; it is a financial rescue mission. For many business owners, the initial goal is simple: survive the startup phase. However, the reality of running a growing company often means that back-office tasks, like reconciling bank feeds, get pushed to the bottom of the pile. Consequently, months […]

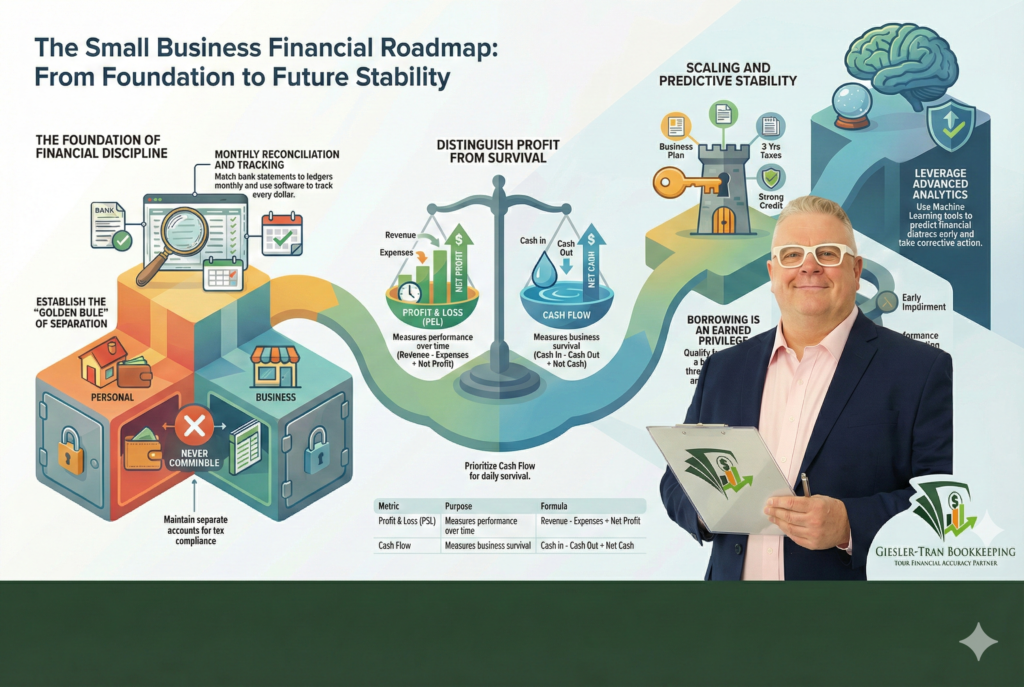

Small Business Financial Management: From Basic Books to Advanced Growth

Small Business Financial Management is the absolute bedrock of stability in an increasingly volatile global economy. Specifically, business owners today face tightening capital requirements and fluctuating labor markets that make the margin for error slimmer than ever before. However, many entrepreneurs still treat their finances as an afterthought, focusing solely on product development while their […]

The Expensive Truth Behind Fully Automated Bookkeeping: Why “Set It and Forget It” Fails

Fully automated bookkeeping is often marketed as the ultimate cure for the exhaustion that plagues modern business owners. Receipts pile up on desks, transactions blur together in bank feeds, and dashboards promise clarity but often deliver only noise. Consequently, when a software company promises a “set it and forget it” solution, it sounds like immediate […]

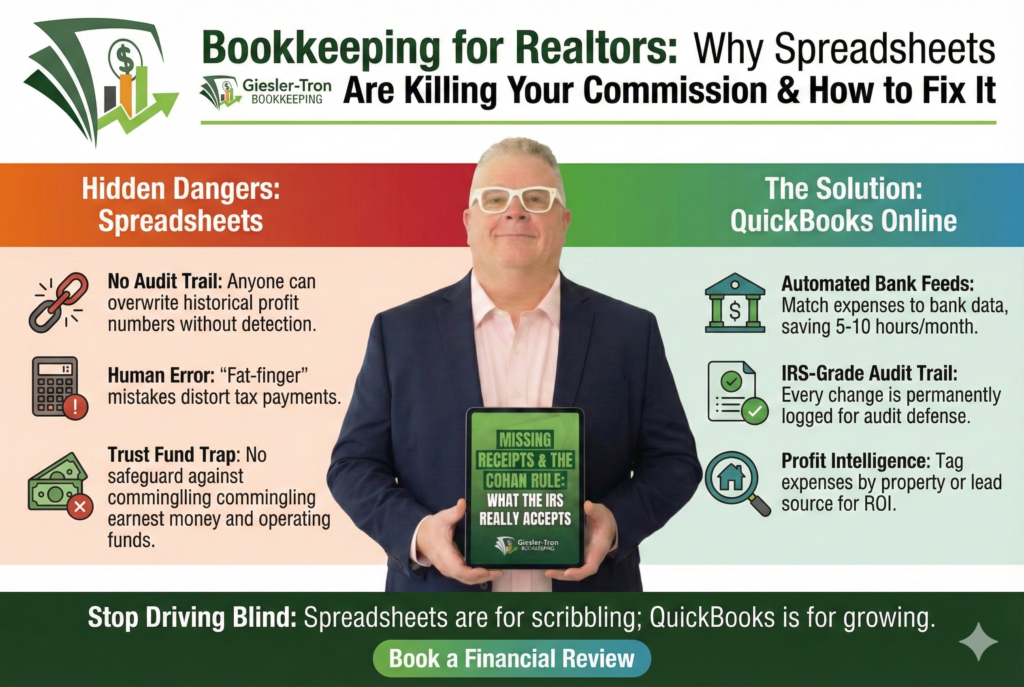

Bookkeeping for Realtors: Why Spreadsheets Are Killing Your Commission & How to Fix It

Effectively, professional bookkeeping for realtors is the foundation of a scalable real estate business. However, many agents still rely on “digital napkins”—otherwise known as spreadsheets—to track their financial lives. Specifically, while Excel or Google Sheets might feel convenient for scribbling down expenses, they are dangerous tools for managing business records. Below, we explore why relying […]

Mineral Rights Bookkeeping: Mastering Royalty Payments and Division Orders

Effectively, owning mineral rights can be a lucrative passive income stream, but the associated mineral rights bookkeeping is anything but passive. Specifically, deciphering complex royalty check stubs, verifying Division Orders, and tracking production volumes against payments can overwhelm even the most organized owner. However, without accurate records, you risk being underpaid or facing a tax […]

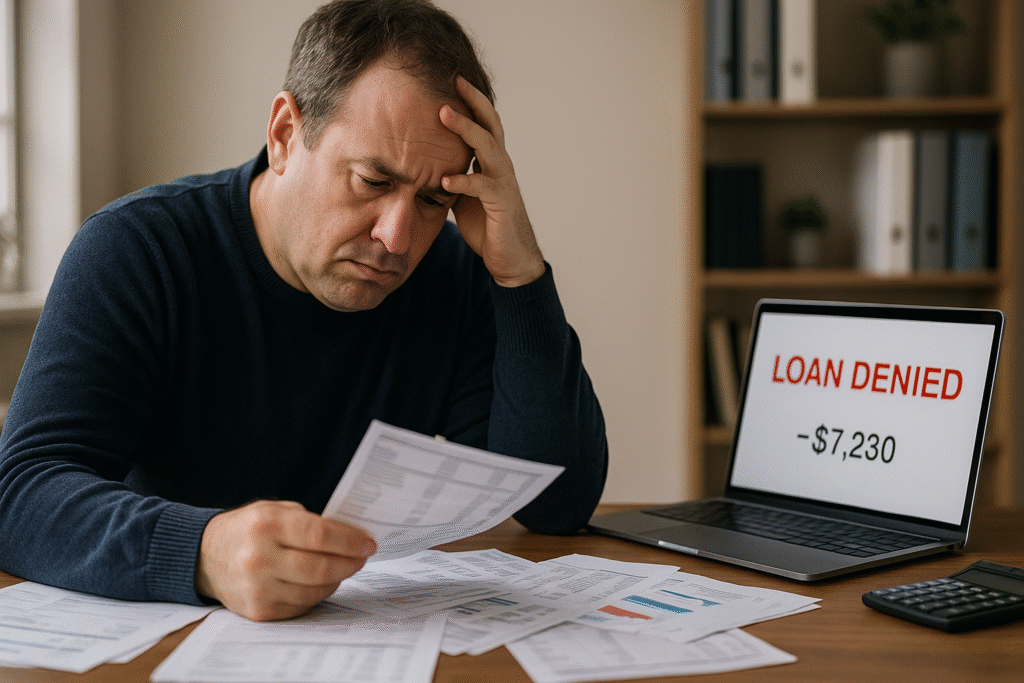

Bank Loan Denial: How Disorganized Books Kill Funding (and How to Fix it)

A bank loan denial is often the harsh wake-up call that forces a business owner to look closely at their financial records for the first time. Effectively, presenting disorganized books to a lender is the fastest way to get your loan application denied, regardless of how profitable your business might actually be. However, many business […]

Your CPA Looks Backward — We Look Forward: How Blind Loyalty Could Be Costing You Thousands.

Effectively, maintaining robust financial oversight is the difference between surviving tax season and thriving year-round. However, many business owners mistakenly believe that having a CPA equals having financial control. Specifically, while a CPA files your taxes, true financial oversight requires daily attention to cash flow, categorization, and strategy. Below, we explore why blind loyalty to […]