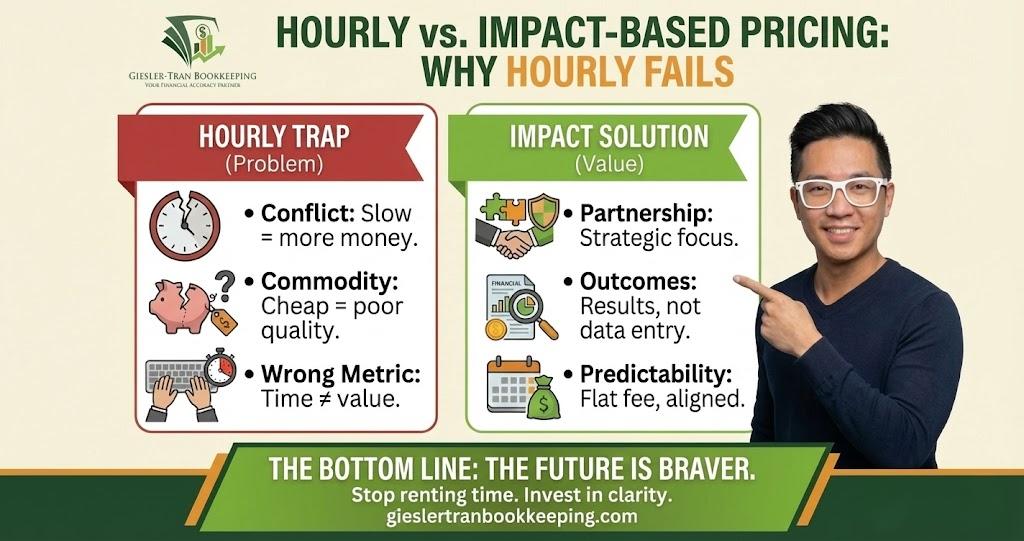

Bookkeeping Fees vs. Impact: Why Hourly Pricing Is Fails Your Business

Imagine if bookkeeping fees were charged based on impact—not on how long someone sat in a chair. Currently, most of the industry operates on an outdated model where value is measured by the tick of a clock. Specifically, business owners pay for how fast someone clicks, not for the clarity they bring to cash flow. […]

Reconciliation Services Camas: The First Line of Defense for Your Business

If you are a business owner searching for reconciliation services Camas, you likely already suspect that your books are not telling you the whole truth. Messy or unreconciled books aren’t just a minor administrative inconvenience; they are a significant liability. Consequently, bank reconciliation serves as the absolute foundation of trustworthy financials, yet it remains one […]

Beyond Tax Compliance: How Monthly Financial Statements Drive Growth

Historically, many small business owners treat their bookkeeping as a compliance chore—something to be endured once a year to keep the IRS happy. Consequently, they only see their Profit & Loss statement when their accountant hands it to them in March. By then, the data is 14 months old and useless for decision-making. However, high-growth […]

Hiring a Tax Professional: Filtering the Noise During Tax Season

Right now, your email inbox likely resembles a war zone. Specifically, between January and April, every CPA, franchise tax firm, and “instant refund” service comes out of the woodwork, flooding business owners with desperate marketing. Consequently, the process of hiring a tax professional feels less like a strategic decision and more like a game of […]

Why “Fast & Clean” Bookkeeping Services Are Gambling With Your Business

Many business owners, drowning in receipts and spreadsheets, are understandably tempted by the promise of fast & clean bookkeeping services. Initially, the idea of handing over a messy shoebox of data and receiving polished reports 48 hours later feels like a miracle. However, most business owners think bookkeeping is boring, while most volume-based firms think […]

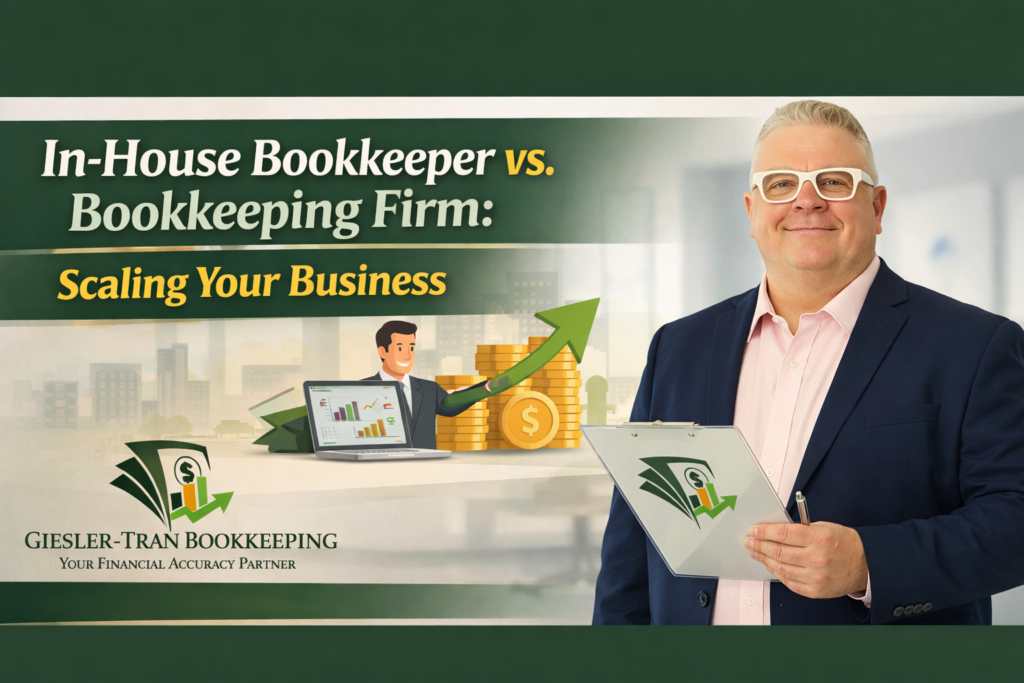

The Scale Factor: Why Specialized Bookkeeping Firms Outpace In-House Teams

Recently, I’ve observed a recurring struggle among high-growth business owners who try to manage their expanding finances with a single employee. In reality, when a business starts growing, the numbers get more complicated—fast. For instance, you suddenly face more transactions, more accounts, and more platforms, with every decision riding on whether your books are accurate. […]

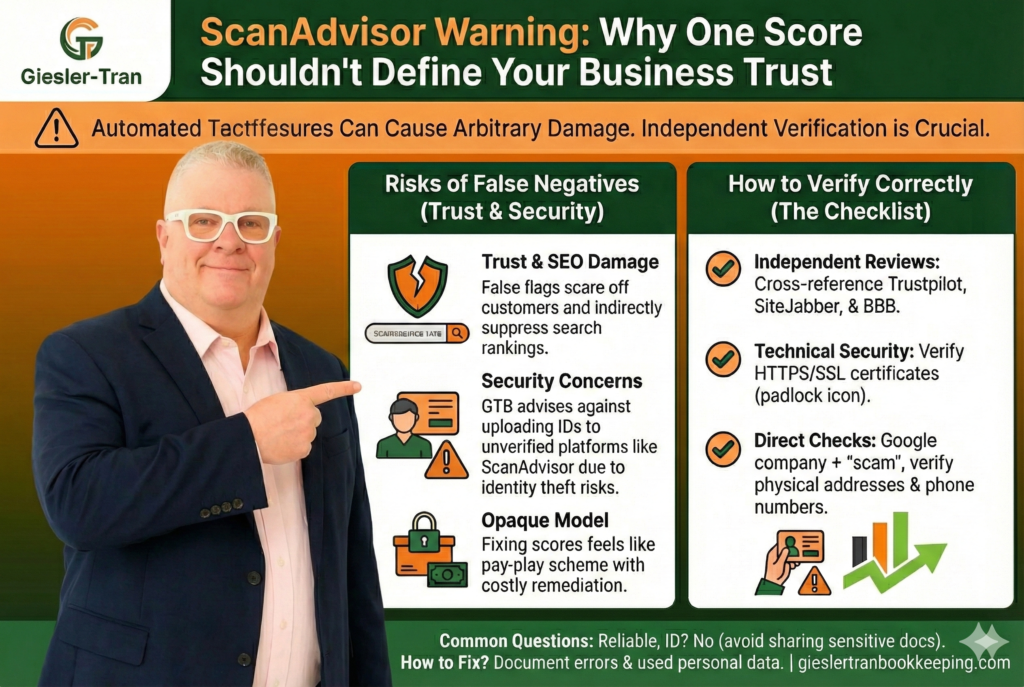

Small Business Website Verification Guide: Protect Financial Data from Fraud

Effectively, mastering small business website verification is the first line of defense against modern financial fraud. However, many entrepreneurs still rely on automated tools like ScanAdvisor to determine if a vendor is safe. Unfortunately, for businesses handling sensitive banking data, this passive approach is risky. Specifically, automated scores often overlook the subtle red flags that […]

Bookkeeping Services Near Me: Why the Best Local Solution is Virtual

Effectively, finding reliable bookkeeping services near me is the top priority for countless small business owners who feel overwhelmed by their financial data. However, in today’s digital-first economy, the concept of “local” has evolved significantly. Specifically, you no longer need to drive across town to hand over a shoebox of receipts to get expert support. […]

Strategic Bookkeeping: Unlocking Growth and Stability for Entrepreneurs

Strategic Bookkeeping Gives You Clarity Early —Before Small Issues Become Expensive Problems From Technician to Entrepreneur: How Strategic Bookkeeping Unlocks Growth Stop working in your business so you can work on it. Strategic bookkeeping is the difference between running a business on guesswork and running it with clarity. Specifically, at GTB, we see three specific […]

Cheap Bookkeeping: The Hidden Costs Affordably Avoided

Cheap bookkeeping convinces many business owners that hiring a professional firm is something you do only after hitting a certain revenue number. They tell themselves, “Once I hit $1 million, I’ll hire a real firm.” But focusing solely on finding a cheap bookkeeping solution often backfires. The Hidden Bill: Why Cheap Bookkeeping Alternatives Often […]