Payroll & 1099s: A Simple Guide to Contractor vs. Employee

Effectively, managing Payroll & 1099s is one of the most critical compliance tasks for any growing business. However, mixing up employee wages with contractor payments creates a bookkeeping nightmare and invites IRS scrutiny. Specifically, understanding the distinction ensures accurate tax filings and prevents costly penalties. Below, we break down exactly how to record Payroll & […]

Bookkeeping for Content Creators: Track Income, Fees & Taxes

Effectively, mastering bookkeeping for content creators is the secret to turning a creative passion into a sustainable business. However, tracking multiple income streams—like ads, sponsorships, and affiliate commissions—can quickly become overwhelming. Specifically, ignoring platform fees or failing to set aside taxes can lead to a financial nightmare. Below, we outline a simple system for bookkeeping […]

Sales Tax Guide: Nexus, Compliance & Audit Protection for Sellers

Effectively, navigating the complex web of state sales tax regulations is one of the biggest challenges for growing businesses. However, failure to register, collect, or file correctly often leads to aggressive assessments, penalties, and interest. Specifically, for ecommerce and multi-state sellers, understanding where you owe sales tax is critical to survival. Below, we outline a […]

The Ultimate Business Tax Season Checklist: Organize, Reconcile, and File with Confidence

Recently, I’ve noticed a recurring theme among business owners as January rolls around: a distinct sense of panic regarding their filings. In reality, tax season doesn’t have to be a chaotic fire drill if you have the right systems in place. For instance, many entrepreneurs scramble to find receipts from March or guess at the […]

Bookkeeping Services in Vancouver, WA: The Local Advantage for Growing Brands

Recently, I’ve had numerous conversations with Pacific Northwest business owners who are struggling to find reliable financial help. In reality, searching for competent bookkeeping services in Vancouver WA often feels like looking for a needle in a haystack. For instance, you might find a large national firm that treats you like a number, or a […]

Mastering Payroll Taxes and Filings: A Strategic Guide for Business Owners

I recently encountered a small business owner who was treating their payroll responsibilities as a simple administrative task, unaware of the severe risks involved. In reality, managing payroll taxes and filings is often the most dangerous compliance minefield a growing company faces. A single missed deposit deadline or a miscalculated withholding amount, for instance, can […]

Bookkeeping vs Accounting: Why Your Business Needs Both for Financial Health

Understanding the nuance between bookkeeping vs accounting is often the first step toward true financial maturity for any business owner. Initially, many entrepreneurs use these terms interchangeably, assuming that recording transactions is the same as analyzing them. In reality, while both functions deal with financial data, they serve distinct but equally vital roles in your […]

Bookkeeper or Accountant: What’s the Difference and Which Do You Need? | Giesler-Tran Bookkeeping

Deciding whether to hire a bookkeeper or accountant is one of the first major financial decisions a small business owner faces. Initially, the roles might seem interchangeable, but they serve vastly different functions in your company’s ecosystem. Specifically, a bookkeeper manages the daily pulse of your finances, while an accountant focuses on the long-term health […]

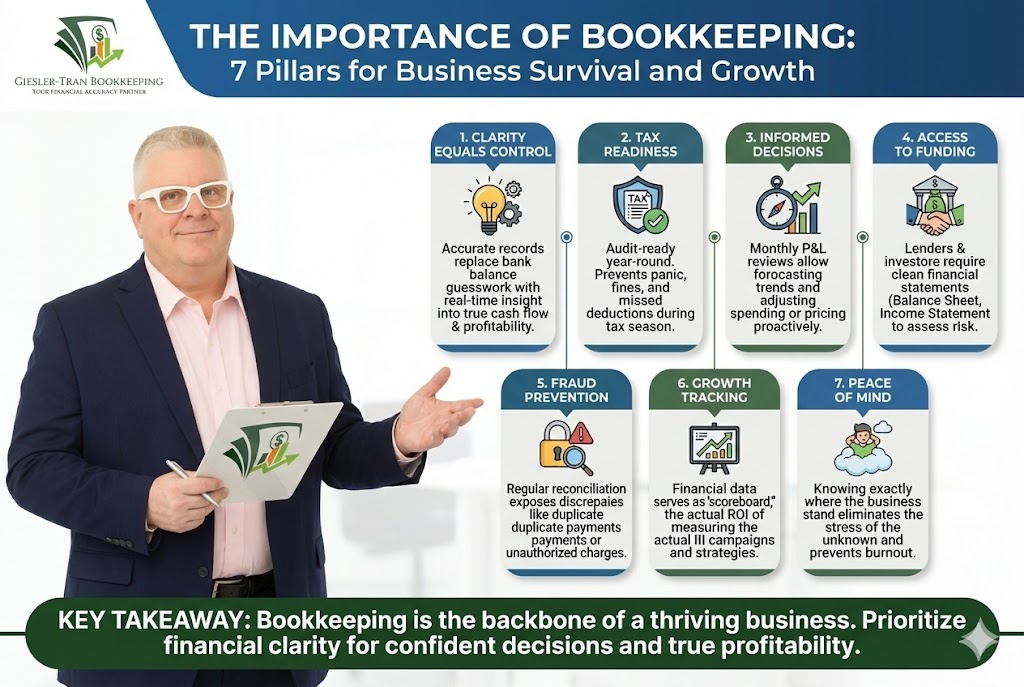

The Importance of Bookkeeping: 7 Pillars for Business Survival and Growth

The importance of bookkeeping is often underestimated by enthusiastic entrepreneurs who prefer to focus on product development rather than spreadsheets. In reality, neglecting your financial records is akin to driving a car with a painted-over windshield; you might be moving, but you will eventually crash. For instance, a recent study suggested that 82% of business […]