Shopify Bookkeeping Guide: How to Master E-Commerce Financials & Avoid Audits

Effectively, mastering Shopify bookkeeping is the difference between running a profitable e-commerce brand and merely churning cash. However, many store owners fall into the trap of assuming that their Shopify dashboard equals their financial reality. Specifically, ignoring the complexities of payment gateways, sales tax nexus, and inventory costs can lead to disastrous tax filings. Below, […]

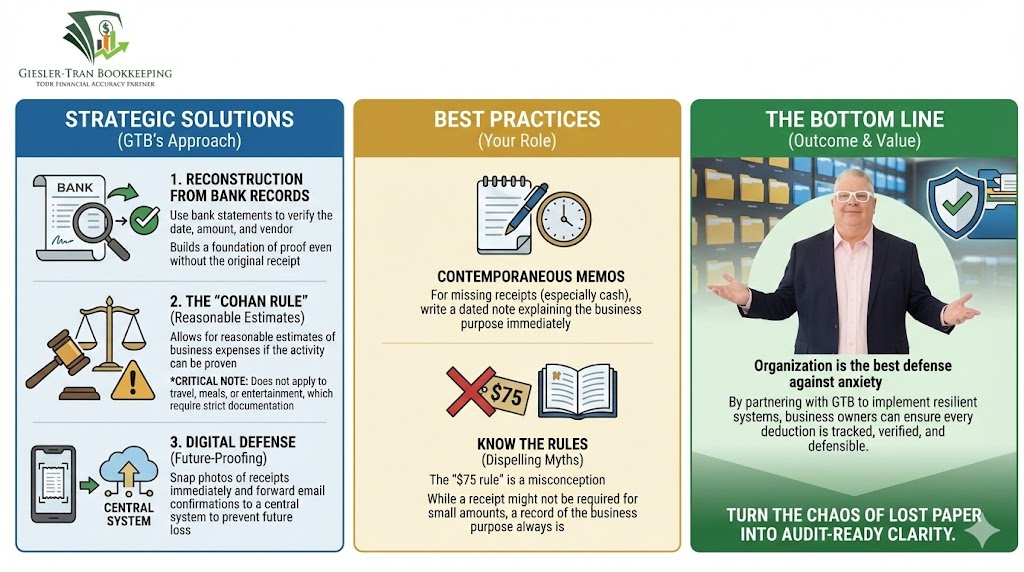

Missing Receipts & The Cohan Rule: What the IRS Really Accepts

Recently, a business owner asked if they could simply “estimate” their travel expenses because they lost the paperwork. Technically, a legal precedent exists for this, but relying on it is dangerous. In reality, dealing with missing receipts isn’t just about showing you paid; you must prove the expense was ordinary, necessary, and business-related. Below, we […]

Strategic Bookkeeping: Unlocking Growth and Stability for Entrepreneurs

Strategic Bookkeeping Gives You Clarity Early —Before Small Issues Become Expensive Problems From Technician to Entrepreneur: How Strategic Bookkeeping Unlocks Growth Stop working in your business so you can work on it. Strategic bookkeeping is the difference between running a business on guesswork and running it with clarity. Specifically, at GTB, we see three specific […]

Service Business Deductions: The Ultimate Guide to Stop Overpaying Taxes

Effectively, identifying valid service business deductions is the single most impactful way to lower your tax bill legitimately. However, running a service-based business—whether you’re a freelancer, consultant, or agency owner—means wearing many hats, often causing tax strategy to fall through the cracks. Specifically, nearly 60% of small businesses overpay taxes because they miss these critical […]

Why 60% of Small Businesses Overpay Taxes: The Hidden Cost of DIY Bookkeeping

Shockingly, industry statistics suggest that nearly 60% of small business owners overpay taxes every single year. Often, entrepreneurs assume this is because the tax code is rigged against them or because rates are simply too high. However, the real culprit is rarely the tax rate itself; rather, it is the quality of the financial data […]

Top Bookkeeping Mistakes That Trigger IRS Audits

Recently, I told a client something I genuinely believe: I surround myself with people smarter than I am so we can accomplish our mission at the highest level. In fact, successful business owners adopt this exact mindset when they stop trying to DIY their tax compliance and decide to hire a professional. Specifically, you need […]

Missing Receipts? The Ultimate Guide to Audit-Proofing Your Business Expenses

Missing receipts can feel like a ticking time bomb for business owners juggling client acquisition and employee management. Consequently, in the whirlwind of daily operations, administrative tasks often fall to the bottom of the priority list, leading to gaps in essential documentation. Recently, a client panicked during our year-end review because they discovered a significant […]

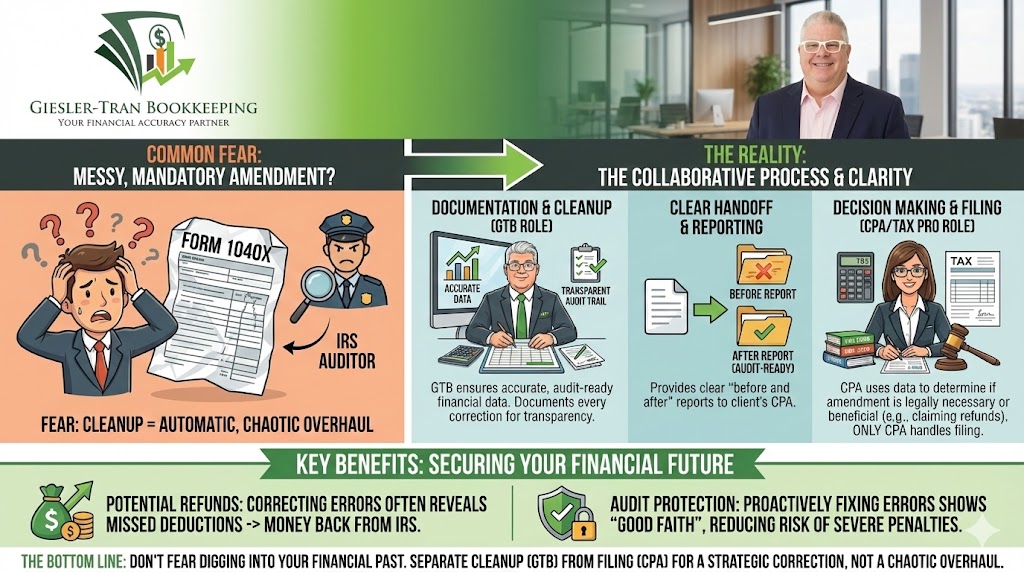

Past Tax Filings: Will Bookkeeping Cleanup Force You to Amend Returns?

Many business owners hesitate to fix their financial records because they fear the consequences with the IRS. Specifically, a common anxiety is that organizing historical data will automatically trigger a mandatory change to past tax filings, leading to penalties or audits. Consequently, this fear often paralyzes entrepreneurs, leaving them stuck with messy books for years. […]

Can a Bookkeeper Help During an IRS Audit? What to Expect

Effectively, receiving an audit notice is one of the most stressful moments a business owner can face. Naturally, your first question is likely: “Can my bookkeeper help me get through this?” The short answer is yes. Specifically, while a bookkeeper cannot legally represent you in tax court, they play a critical role in organizing records, […]

Stipend vs. Reimbursement: The Tax Truth Every Business Needs

Effectively, issuing a stipend seems like an easy way to reimburse employees for meals or travel. However, simply labeling a payment as a stipend does not automatically make it a tax-free loophole. Specifically, the IRS focuses on the substance of the transaction rather than its name. Therefore, understanding the strict tax rules surrounding every stipend […]