Messy Books Cleanup Portland: A Real-World Financial Rescue Case Study

Messy books cleanup Portland is one of the most requested services we offer, yet it is also the one business owners are most afraid to ask for. For many entrepreneurs in the Rose City, the rain isn’t the only thing causing gloom; the looming shadow of unfiled taxes and disorganized ledgers creates a constant state […]

Scaling a Private Practice in WA: How ShillMed Balances Patient Care with Financial Health.

For most owners, the mission is deceptively simple: heal patients. But the reality of scaling a private practice in Washington State—from Vancouver to Spokane—involves a level of complexity that goes far beyond the exam room. Between insurance compliance, inventory management for supplements, and the overhead of a physical office, the “business” side of medicine can […]

10 Deducciones Fiscales Ocultas Que Ahorran Miles a las Empresas de Servicios

Deje de perder dinero pasando por alto las críticas deducciones fiscales para empresas de servicios. En realidad, para consultores, agencias y firmas profesionales, la diferencia entre una factura de impuestos masiva y una justa a menudo se reduce al conocimiento. Específicamente, entender la gama completa de deducciones fiscales para empresas de servicios disponibles para usted […]

Conference Expense Deductions: Turn Your Business Travel Into Tax Savings

Maximizing conference expense deductions should be a priority for every growth-minded business owner this year. While many entrepreneurs view industry events solely as a cost, they are actually a powerful investment vehicle. Specifically, attending these events is one of the fastest ways to uncover real growth opportunities—not just from the keynote sessions, but from the […]

Hiring a Tax Professional: Filtering the Noise During Tax Season

Right now, your email inbox likely resembles a war zone. Specifically, between January and April, every CPA, franchise tax firm, and “instant refund” service comes out of the woodwork, flooding business owners with desperate marketing. Consequently, the process of hiring a tax professional feels less like a strategic decision and more like a game of […]

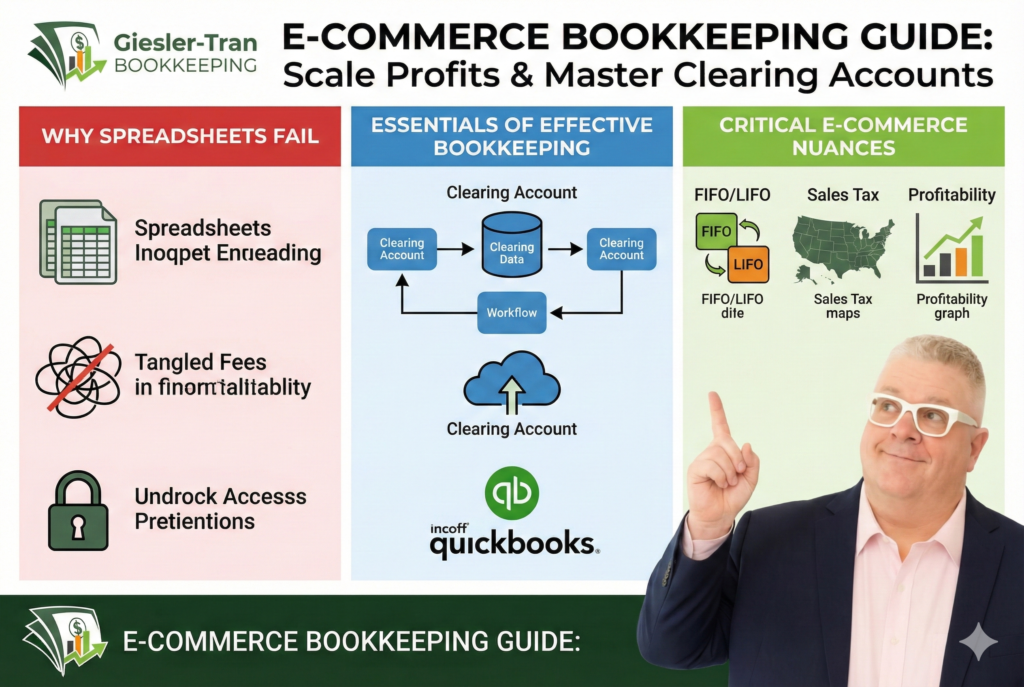

E-Commerce Bookkeeping Guide: Scale Profits & Master Clearing Accounts

Effectively, proper e-commerce bookkeeping is the difference between a thriving online store and a tax nightmare. However, running a digital business often feels like juggling flaming swords. Specifically, between managing inventory, tracking shipping costs, and reconciling payment processors like Stripe, financial clarity often gets lost. Unfortunately, many entrepreneurs rely on spreadsheets until the revenue grows […]

The Defensible Audit Trail: Why Spreadsheets Fail & How QBO Protects You

Effectively, creating a defensible audit trail is the single most important step you can take to protect your growing business from IRS scrutiny. However, many small business owners start with spreadsheets because they are flexible, familiar, and “free.” Unfortunately, what works for a hobbyist fails when revenue streams become complex. Specifically, spreadsheets lack the ability […]

Fuel Delivery Bookkeeping Guide: Scale Your Fleet & Master IRS Tax Rules

Effectively, mastering fuel delivery bookkeeping is the operational backbone of modern mobile energy providers like Juiced Fuel. However, simply delivering gas to North Dallas fleets isn’t enough if your back office is a mess. Specifically, the unique combination of volatile commodity pricing, complex excise taxes, and fleet depreciation makes standard accounting methods obsolete. Below, we […]

QBO Setup for Realtors: Why Customization Beats Spreadsheets

Effectively, a professional QBO setup for realtors is the difference between a tax-time nightmare and a profitable year. However, if you are like most busy agents, you have probably lived inside Google Docs and spreadsheets longer than you care to admit. Initially, these manual methods work; yet, they inevitably fail when volume increases. Specifically, when […]

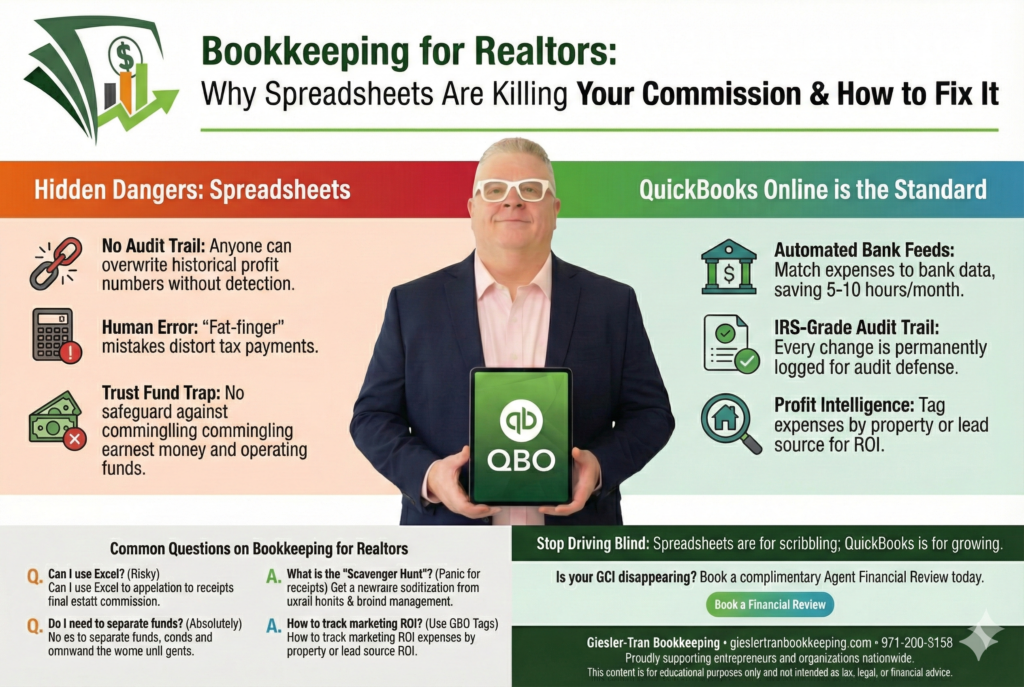

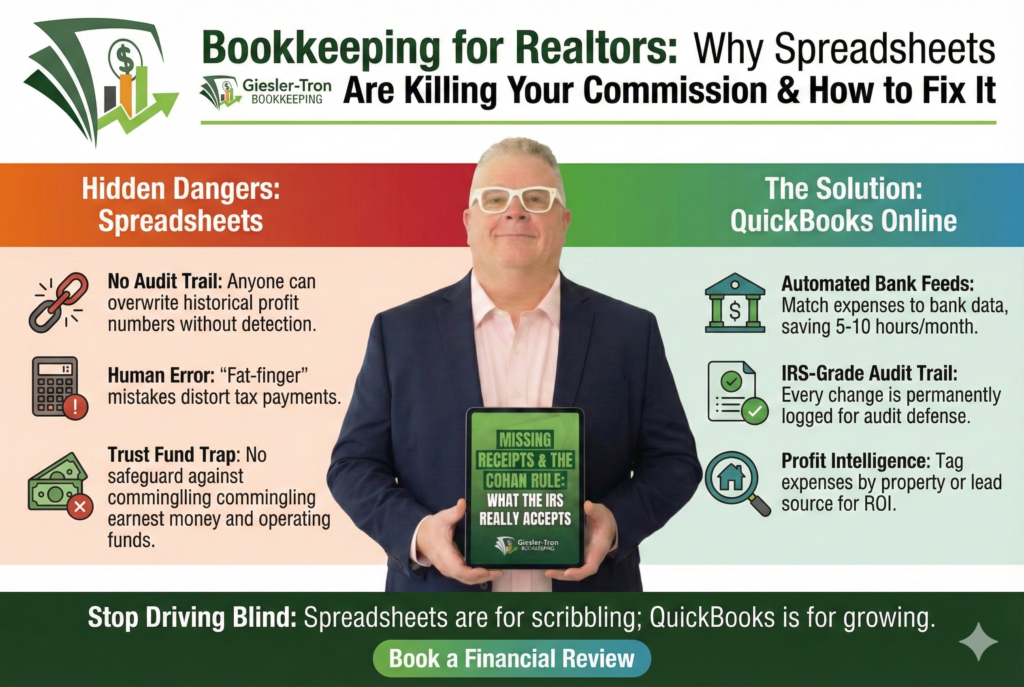

Bookkeeping for Realtors: Why Spreadsheets Are Killing Your Commission & How to Fix It

Effectively, professional bookkeeping for realtors is the foundation of a scalable real estate business. However, many agents still rely on “digital napkins”—otherwise known as spreadsheets—to track their financial lives. Specifically, while Excel or Google Sheets might feel convenient for scribbling down expenses, they are dangerous tools for managing business records. Below, we explore why relying […]