10 Deducciones Fiscales Ocultas Que Ahorran Miles a las Empresas de Servicios

Deje de perder dinero pasando por alto las críticas deducciones fiscales para empresas de servicios. En realidad, para consultores, agencias y firmas profesionales, la diferencia entre una factura de impuestos masiva y una justa a menudo se reduce al conocimiento. Específicamente, entender la gama completa de deducciones fiscales para empresas de servicios disponibles para usted […]

Fuel Delivery Bookkeeping Guide: Scale Your Fleet & Master IRS Tax Rules

Effectively, mastering fuel delivery bookkeeping is the operational backbone of modern mobile energy providers like Juiced Fuel. However, simply delivering gas to North Dallas fleets isn’t enough if your back office is a mess. Specifically, the unique combination of volatile commodity pricing, complex excise taxes, and fleet depreciation makes standard accounting methods obsolete. Below, we […]

Service Business Deductions: The Ultimate Guide to Stop Overpaying Taxes

Effectively, identifying valid service business deductions is the single most impactful way to lower your tax bill legitimately. However, running a service-based business—whether you’re a freelancer, consultant, or agency owner—means wearing many hats, often causing tax strategy to fall through the cracks. Specifically, nearly 60% of small businesses overpay taxes because they miss these critical […]

Bookkeeping Cleanup: How to Fix a Year of Messy Books in 30 Days

Overwhelmingly, fixing a full year of bad accounting can feel like an impossible task, but the right bookkeeping cleanup process can turn chaos into clarity faster than most business owners realize. Often, one missed month quietly becomes three, three roll into twelve, and suddenly you’re staring at financial reports that don’t match reality. Consequently, ignoring […]

Top Bookkeeping Mistakes That Trigger IRS Audits

Recently, I told a client something I genuinely believe: I surround myself with people smarter than I am so we can accomplish our mission at the highest level. In fact, successful business owners adopt this exact mindset when they stop trying to DIY their tax compliance and decide to hire a professional. Specifically, you need […]

The Audit-Ready Chart of Accounts: Structure Your Books for Compliance

Fundamentally, your Chart of Accounts (COA) is the backbone of your entire bookkeeping system. If it is messy, overly generic, or missing essential categories, your financials will always be wrong—no matter how diligently you reconcile. Unfortunately, most business owners do not realize that errors in their COA create massive IRS exposure and missed deductions. Consequently, […]

10 Hidden Tax Deductions That Save Service Businesses Thousands

Stop leaving money on the table by overlooking critical service-based business tax deductions. In reality, for consultants, agencies, and professional firms, the difference between a massive tax bill and a fair one often comes down to awareness. Specifically, understanding the full range of service-based business tax deductions available to you is the fastest way to […]

Bookkeeping Services in Vancouver, WA: The Local Advantage for Growing Brands

Recently, I’ve had numerous conversations with Pacific Northwest business owners who are struggling to find reliable financial help. In reality, searching for competent bookkeeping services in Vancouver WA often feels like looking for a needle in a haystack. For instance, you might find a large national firm that treats you like a number, or a […]

Portland Bookkeeping Services: The Strategic Advantage for Local Business Growth

Recently, I’ve had numerous conversations with Oregon business owners who are struggling to find reliable financial help. In reality, searching for competent Portland bookkeeping services often feels like looking for a needle in a haystack. For instance, you might find a large national firm that treats you like a number, or a solo freelancer who […]

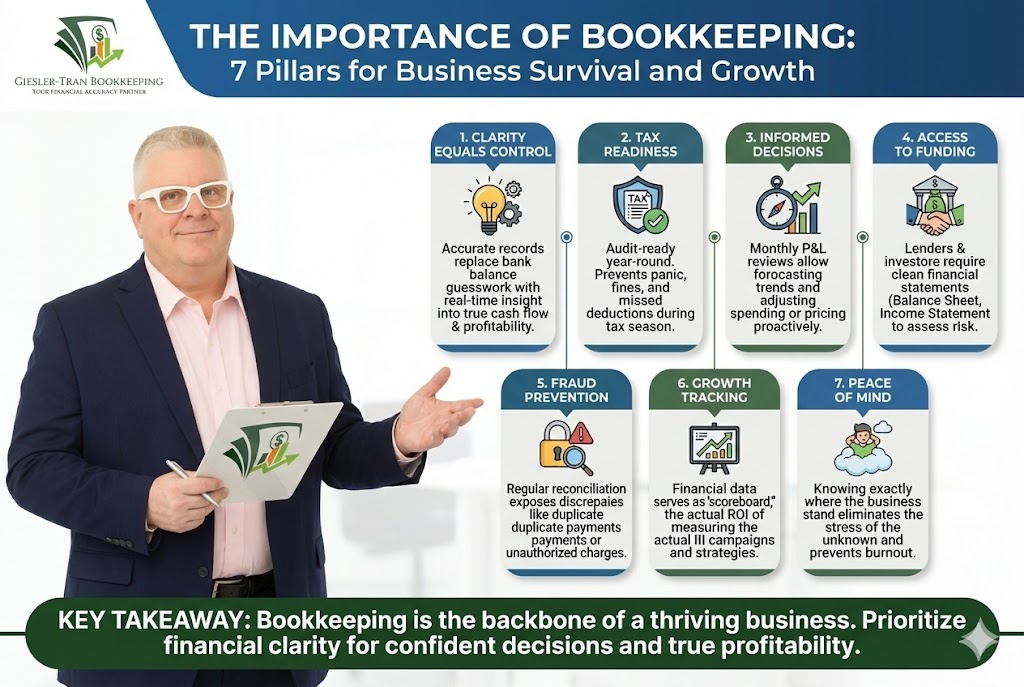

The Importance of Bookkeeping: 7 Pillars for Business Survival and Growth

The importance of bookkeeping is often underestimated by enthusiastic entrepreneurs who prefer to focus on product development rather than spreadsheets. In reality, neglecting your financial records is akin to driving a car with a painted-over windshield; you might be moving, but you will eventually crash. For instance, a recent study suggested that 82% of business […]