Historical Bookkeeping Cleanup Services | Giesler-Tran Bookkeeping

Historical bookkeeping cleanup is more than just data entry; it is a financial rescue mission. For many business owners, the initial goal is simple: survive the startup phase. However, the reality of running a growing company often means that back-office tasks, like reconciling bank feeds, get pushed to the bottom of the pile. Consequently, months […]

Is Your Business Bleeding Cash? The Critical Bookkeeping Health Check

Performing a comprehensive bookkeeping health check is the single most effective way to determine if your business is actually profitable or just moving money around. Most business owners erroneously believe their books are “fine” simply because their bank account balance remains positive. However, a positive bank balance often masks deep, systemic financial issues. Consequently, relying […]

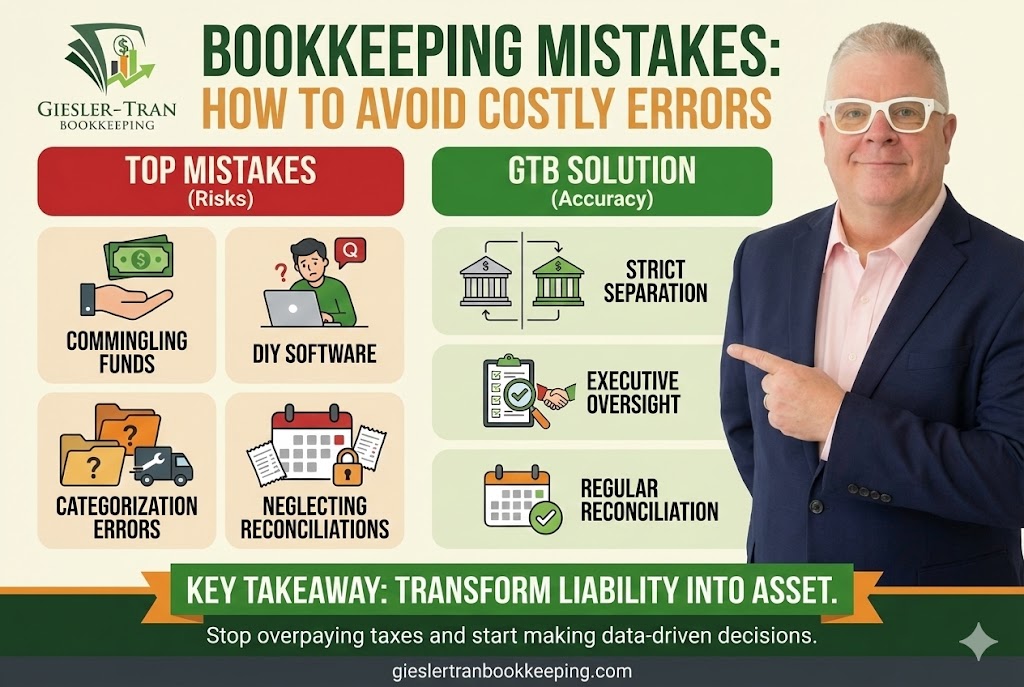

Bookkeeping Mistakes: How to Avoid Costly Financial Errors

Commonly, small business owners believe that as long as money is coming in, everything is fine. However, hidden bookkeeping mistakes can silently erode your profits, trigger aggressive IRS audits, and stunt your company’s growth potential. At Giesler-Tran Bookkeeping (GTB), we have seen it all—from shoeboxes full of faded receipts to QuickBooks files that look like […]

Nonprofit Internal Controls: The Essential Guide to Fraud Prevention

Nonprofit internal controls were the missing piece that led to a significant loss of funds for a beloved community organization we recently reviewed. Sadly, the cause wasn’t a sophisticated cyber-attack but a simple lack of oversight in their accounts payable process. Consequently, this vulnerability allowed a trusted volunteer to divert small amounts of cash over […]

Top Bookkeeping Mistakes: How to Spot and Fix Them Fast

Effectively, avoiding top bookkeeping mistakes is the fastest way to protect your business’s cash flow. Unfortunately, many owners unknowingly commit errors like commingling funds or ignoring reconciliations until tax season arrives. Specifically, these slip-ups compound into cash surprises, tax exposure, and bad management decisions. Below, we highlight the top bookkeeping mistakes we see most often […]

Embezzlement Prevention: How to Detect and Stop Employee Theft

Effectively, preventing embezzlement is one of the most uncomfortable but necessary responsibilities of a business owner. Sadly, employee theft often starts small—a disguised invoice here, a personal charge there. Specifically, without proper controls, these small leaks compound into devastating losses. Below, we outline exactly how to detect red flags, implement segregation of duties, and stop […]

The Hidden Cost of “Good Enough Books”: Why Accurate Financials Matter

Effectively, relying on good enough books creates a false sense of security that can quietly undermine your entire business. Unfortunately, many owners believe that “close enough” is acceptable until a payroll error, a missed vendor credit, or a rejected loan application costs them thousands. Specifically, good enough books hide cash leaks, increase audit risk, and […]

Why you should treat ScamAdvisor with extreme caution — and how to verify a site the right way

Effectively, relying on a single automated score from ScamAdvisor to judge a business is a dangerous gamble. However, many consumers and business owners treat these “trust scores” as gospel without understanding the flawed algorithms behind them. Specifically, valid businesses often face sudden reputational damage due to opaque ratings that offer little explanation. Below, we explore […]

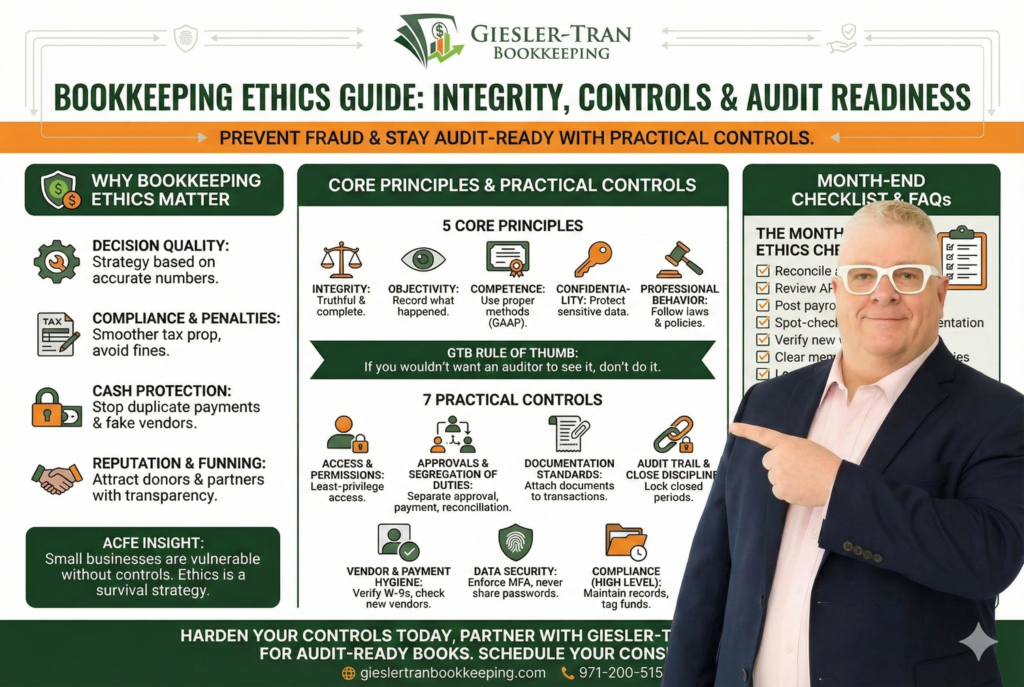

Bookkeeping Ethics Guide: Integrity, Controls & Audit Readiness

Effectively, maintaining high bookkeeping ethics is not just an abstract concept; it is the set of everyday behaviors that keep your numbers trustworthy. However, many business owners view ethical controls as optional “red tape” rather than essential protection. Specifically, without these standards, you invite errors, penalties, and significant fraud risk. Below, we provide a practical, […]

Bank Reconciliation: The Hidden Control That Stops Fraud and Saves Your Cash Flow

Recently, I reviewed a client’s books who believed their cash flow was tight due to low sales. In reality, their sales were fine, but they were leaking money through duplicate payments and uncancelled subscriptions that no one had noticed for months. For instance, without regular checks, a $50 recurring charge or a double-paid invoice can […]