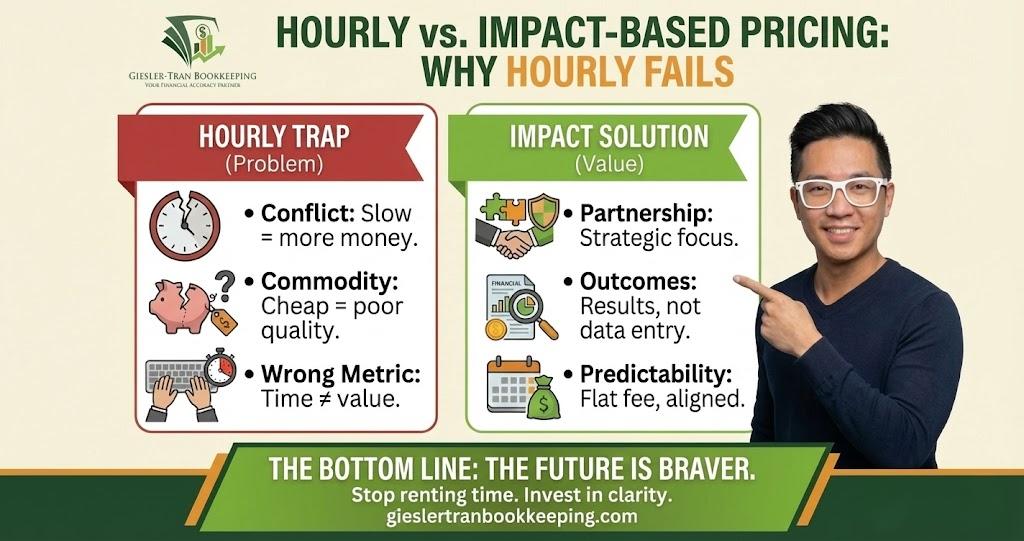

Bookkeeping Fees vs. Impact: Why Hourly Pricing Is Fails Your Business

Imagine if bookkeeping fees were charged based on impact—not on how long someone sat in a chair. Currently, most of the industry operates on an outdated model where value is measured by the tick of a clock. Specifically, business owners pay for how fast someone clicks, not for the clarity they bring to cash flow. […]

Bookkeeping Cleanup Costs: The Price of Fixing Messy Books

Determining the true bookkeeping cleanup cost is often the biggest source of anxiety for business owners who have fallen behind. It is also one of the most misunderstood expenses in the industry. Whether you are switching providers or scrambling for tax season, understanding the factors that drive your bookkeeping cleanup cost is the first step […]

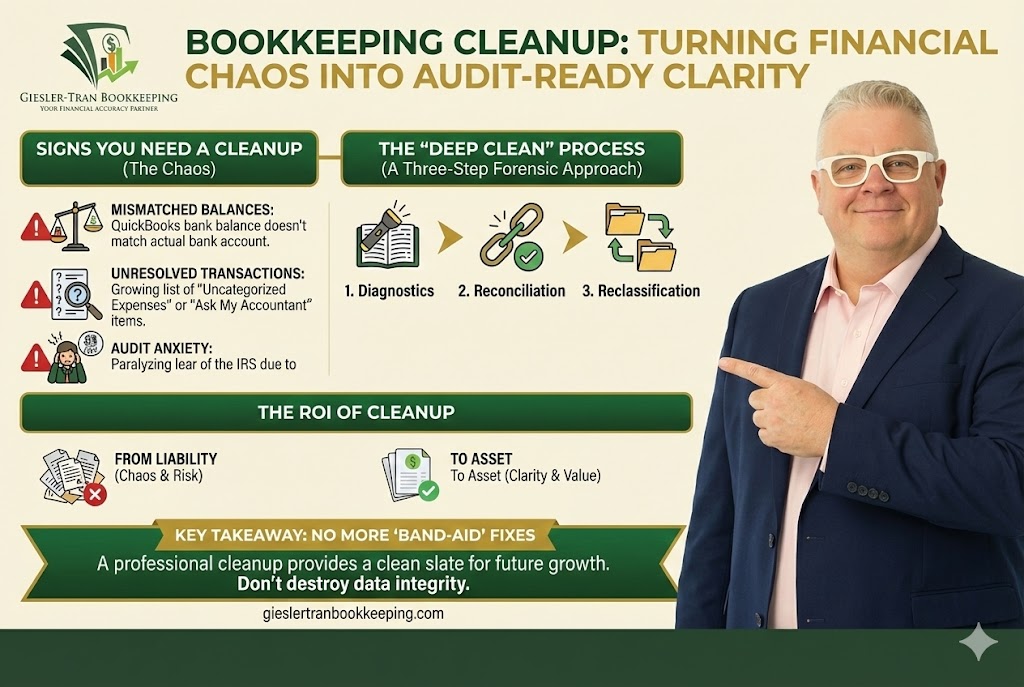

Bookkeeping Cleanup: Turning Financial Chaos Into Audit-Ready Clarity

Eventually, every growing business hits a period of chaotic expansion where the administrative tasks simply cannot keep up with the revenue. Consequently, the monthly reconciliation gets pushed to “next weekend,” and then to “next month.” Before you know it, you are six months behind, tax season is looming, and your financial data is a black […]

Why 60% of Small Businesses Overpay Taxes: The Hidden Cost of DIY Bookkeeping

Shockingly, industry statistics suggest that nearly 60% of small business owners overpay taxes every single year. Often, entrepreneurs assume this is because the tax code is rigged against them or because rates are simply too high. However, the real culprit is rarely the tax rate itself; rather, it is the quality of the financial data […]

Bookkeeping Cleanup: How to Fix a Year of Messy Books in 30 Days

Overwhelmingly, fixing a full year of bad accounting can feel like an impossible task, but the right bookkeeping cleanup process can turn chaos into clarity faster than most business owners realize. Often, one missed month quietly becomes three, three roll into twelve, and suddenly you’re staring at financial reports that don’t match reality. Consequently, ignoring […]

Medical Office Tax Deductions: 10 Commonly Missed Write-Offs

Every year, thriving practices across the country overlook valuable medical office tax deductions—not because they are evading taxes, but simply because their bookkeeping isn’t structured to capture them. Unfortunately, clean patient files do not equal clean financial records. After completing hundreds of cleanups for chiropractors, dentists, PT clinics, and wellness centers, one hard truth has […]

Top Bookkeeping Mistakes That Trigger IRS Audits

Recently, I told a client something I genuinely believe: I surround myself with people smarter than I am so we can accomplish our mission at the highest level. In fact, successful business owners adopt this exact mindset when they stop trying to DIY their tax compliance and decide to hire a professional. Specifically, you need […]

The Audit-Ready Chart of Accounts: Structure Your Books for Compliance

Fundamentally, your Chart of Accounts (COA) is the backbone of your entire bookkeeping system. If it is messy, overly generic, or missing essential categories, your financials will always be wrong—no matter how diligently you reconcile. Unfortunately, most business owners do not realize that errors in their COA create massive IRS exposure and missed deductions. Consequently, […]

10 Hidden Tax Deductions That Save Service Businesses Thousands

Stop leaving money on the table by overlooking critical service-based business tax deductions. In reality, for consultants, agencies, and professional firms, the difference between a massive tax bill and a fair one often comes down to awareness. Specifically, understanding the full range of service-based business tax deductions available to you is the fastest way to […]

Key Bookkeeping Mistakes to Watch For: Are Your Books Lying to You?

Identifying key bookkeeping mistakes early is critical, yet most business owners assume their books are “fine”—until something breaks. If your reports look “off,” you are likely already suffering from skipped or sloppy bank reconciliation. Typically, these errors manifest as a tax bill that looks too high, tight cash flow for no reason, or revenue that […]